What happens when governments run massive deficits and then create/print too much money to fund them?

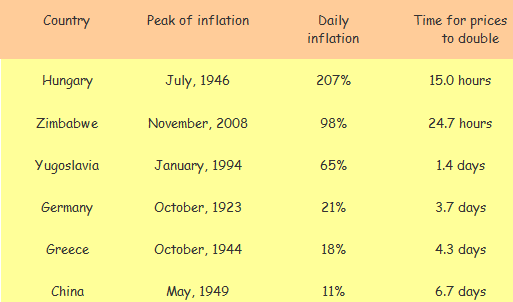

Below is a table summarizing some of the world’s worst bouts of inflation. Note, in the third column, this is the daily rate. If we were to look at inflation rate on a annual basis, there would be too many zeroes for this page. Germany's famous battle with inflation in 1923 inflation had prices rising 29,500% in one month, but if you look at the monthly rate for Hungary, the number comes to 4.19 x 1016. That’s 4.19 times 10 to the 16th power.

Isn’t it interesting that inflation so often goes hand-in-hand with disruption of civil society and personal freedom? Hungary and China had inflation concurrent with takeovers by Communist thugs, and in Zimbabwe, the inflation left something like 90% of the population unemployed. Let’s not forget that Germany’s 1923 inflation is widely credited with giving rise to Hitler. With enough inflation, governments can pay off their debts for pennies on the dollar, but they will destroy the country. Look no further than Yugoslavia. The time of their great inflation was when the country came apart, and today there is no more Yugoslavia.

Last week we mentioned that almost $42 out

of every $100 of the federal budget goes to service the debt. Maybe

we’re being simplistic, but isn’t that a bit like a family spending 42%

of its money on credit card bills? Yes, a government can print money

the way a family can’t, but printing too much money almost always leads

to disaster.

Zimbabwe went crazy the last few years printing

new money, and the result was inflation last year of 231,000,000%.

Yes, that 231 million! If that happened here, that $4 bag of popcorn

at the movies would cost $920 million.

You say it can’t happen here? Going back only 150 years to our Civil War, inflation in the confederate states was 9,000% by the end of hostilities. In the North, inflation peaked at “only” 80%.

Will the mortgage broker ever go away? We know some smart people who’ve started up broker shops recently, and we think they’ll find good niches where they add value and make a good living. Scott Van Dellen and Preston James are two such people, both of whom we helped make the move. The days of mortgage brokers making bazillions of dollars are gone, but you can make decent money and be your own boss.

Do you want to acquire a failed bank with those great terms from the FDIC? Fine, but in order to qualify, you must have at least 10% total risk-based capital, Tier 1 risk-based capital of at least 6%, a Tier 1 leveraged capital ratio of at least 4%, and a CAMEL rating of 2 or better. The management component of your rating must also be a 1 or a 2.

The last requirement reminds us of a friend who was CFO of a San

Diego bank that got a CAMEL 1 but a 2 for management. Their argument

to the Examiner-in-Charge was essentially, “How can you give us an

overall rating of 1 and then give us a 2 for management? Who do you

think did all the things that got us the CAMEL 1 if it wasn’t

management? Was it little fairies that came in during the night?” A

hilarious and true story, but we forget the outcome. If they appealed

it to the Ombudsman, we doubt he changed it. The Ombudsman always

rules in favor of the regulators.

We

mentioned the movie Valentine’s Day, and we forgot to mention that

Taylor Swift can really act. Her portrayal of an airhead cheerleader is

hilarious.

Remember National Bank of Detroit (NYSE: NDB), Nice

But Dull? Mike McMahon reminds us that they never did big deals, just

lots of small ones, and hence their other nickname for NBD, No Big

Deals.