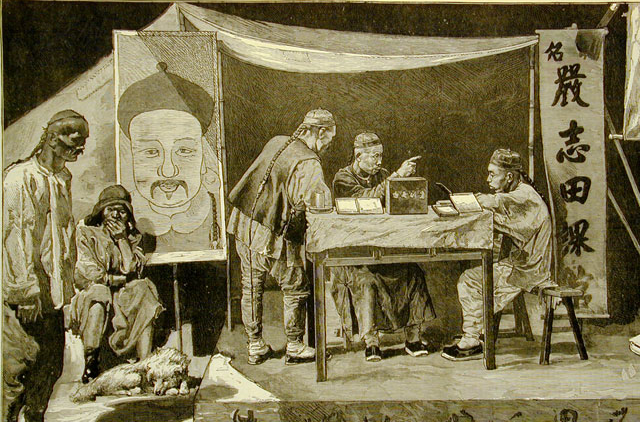

I have visited China twice in the last 4 years. During my last trip to China, two of my travel partners were intrigued and perhaps even obsessed with Chinese fortune tellers. They made several visits to various fortune tellers to get a glimpse into their futures. One wanted to know about a relationship while the other needed some insight on a business deal. In every city we visited, my friends found a local fortune teller to forecast their future.

There were two types of fortune telling these guys gravitated to:

- Ziping Bazi which uses four components of time, hour of birth, day, month and year to help predict the future.

- Palm Reading. The fortune tellier analyzed the position of palm lines.

After visiting several fortune tellers, they finally found someone who told them what they wanted to hear.

It would be nice if we could visit a fortune teller to help us predict the future of interest rates, mortgage application activity and other economic drivers that impact our industry. Sometimes I listen to the “talking heads” on the business news networks predicting contrary conclusions based on analyzing the same economic data. They’re all reading the same data but come up with completely different views on the future. Just like my travel friends, if you listened to enough “talking heads”, you’ll eventually find a forecast that meets your expectation.

I am critical of the “talking heads”, but there is value in reviewing economic data and corresponding commentary prepared by smart people. I recently read a special piece on the housing and mortgage activity of 2010 prepared by the Well Fargo Economic Group. This is a really smart group of economists and analysts.

Some of the key observations are:

- Home building will grind higher in 2010 after the stimulus ends. Tax credits for home purchase may be extended again

- Affordability is at its highest level ever, which should help new and existing home sales. However, affordability is expected to stay high for some time and would be buyers may delay home purchase over employment concerns

- Mortgage rates should rise ½% as the Federal Reserve’s program of buying mortgage backed securities ends March 31, 2010

- The median existing home prices in 2010 are expected to be around $171K, down from a 2006 level of $221.9K

- The GDP is expected to grow at 2.9% in 2010 and 2.4% in 2011

- The 10-year note yield is expected hover in the 3.30 in 2010 and rise to 5.30 in 2011.

- Conventional 30-year fixed commitment rate is expected to rise to 5.60% in 2010 and 6.00 in 2011. The level predicted is still historically low.

Economic forecasting can be both art and science. Reviewing accurate data and reading/listening to legitimate commentary can be valuable in preparing for the future. Owners of businesses need to review macroeconomic drivers to help make business decisions. If the drivers appear to be favorable, a business expansion strategy may make sense. However, if the drivers are negative and the overall market is expected to contract, cost cutting may be more appropriate. The key is to be as objective as you can about the data and read commentary from smart and experienced people. Don’t make business decisions based on emotions or be influenced by economic fortune tellers.