Garrett Watts Report Newsletter: January 25, 2010

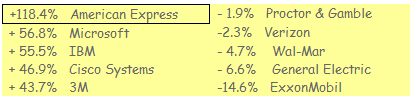

The Dow Jones industrial Index had a good year last year, but how did the individual stocks do?

Here’s how the top five and bottom five did.

There are only two banks in the Dow: JPMorgan Chase, which was up 32.2% and BofA, which was up 7.0%.

When banks fail, you know how a healthy bank will take over their deposits at ridiculously low prices? We’re on a list to get press releases from the FDIC, most of which we just skim, but we’re starting to see more and more bank failures where no one wants to take over the deposits. We just saw this with Barnes Bank in Utah. Other than because the deposits are unattractive for all the obvious reasons, we wonder what other dynamics might be in play such that the FDIC can’t find a single bank to take them over.

Taylor, Bean’s wholly-owned thrift Platinum Community Bank was seized when Taylor, Bean transferred $220 million in impound accounts to Platinum and then onto their warehouse lender (Colonial Bank) to clean up stale loans. This ballooned the thrifts balance sheet in round numbers from $100 million to $300 million, a huge no-no. The money was transferred on July 2nd last year. Does that date sound suspicious? Did you notice that it was two days after the June 30 Call Report? It looks like “someone” at Taylor, Bean chose that date on purpose to avoid disclosing to the OTS. The word is that they hoped to have the stale loans cleared up by time they had to file their September 30 Call Report, return the impound money, and go about their business. Can you believe their chutzpah? And their stupidity?

We were surprised to read that 56 institutions failed to make their TARP dividend payments that were due on November 15. AIG was probably the most prominent one.

Once a year the Heritage Foundation issues an Index of Economic Freedom, ranking countries based on economic openness, trade, property rights, the rule of law and the amount of regulation. Hong Kong was #1, followed by Singapore, Australia and New Zealand. The U.S. ranked #6. Out of 183 countries looked at, China ranked #140, and this should send a message to those doomsayers who think China will rule the world. The three worst countries were Cuba, Zimbabwe and North Korea. No surprise here on the last three: Free minds are inextricable linked to free markets, and you can’t have one without the other.

Remember how we wrote recently that accepting 99% perfection is not good enough, that if you do 300 loans a month and you accept a 1% error rate, you’ll make three bad loans a month or 36 a year? We got lots of e-mail on this, almost entirely from people who seem fed up with people who don’t care enough to do things the right way. One woman wrote “Our culture seems to make sloppiness acceptable. Don’t people take pride in their work anymore?”

We wrote a letter to Phil Angelides, the lawyer running the hearings in Washington on the financial crisis. Our suggestion: Don’t just question executives, but question the Board members as well. They’re the ones who had the final say in what their institutions did and what kind of risk they were willing to take. They, too, could have been victims of a bull market optimism, but taxpayers still deserve to know what oversight and due diligence steps these Directors took.

Google is sitting on $22 billion of cash, and Apple holds $23 billion of cash. Could there be a stronger statement about the power of the New Economy companies? Why did we bail out Old Economy losers like GM and Chrysler when it’s the New Economy which is creating such big winners?

President Obama just celebrated the one year anniversary of his inauguration, and when we hear people criticize him, it makes us think of one his greatest accomplishments: It is that people can like him or dislike him, not because of his race but because of his policies. We like that he’s no longer our first African-American President but simply our President.

Some of the smaller banks getting into warehouse lending aren’t doing monthly curtailments for loans in warehouse after 45 days. They’re just making the lender buy the loan out, all 100% of it, after the 45th day. We like it. It’s pretty tough, but it does get people focused on the problem. We’re also seeing newer warehouse lenders raise the spread over the index as well as the floor after the 15th or 20th day.

Not all is bad in Bank Land. Westamerica Bank just reported a 5.48% net interest margin, a 44% efficiency ratio, and reserves equal to 198% of NPA’s. They repaid their TARP money, and for the past two quarters they reported an ROA of 1.93% and 1.97%, with an ROE of 19.1% and 19.8%. This $4 billion bank has about 90 branches and is headquartered in Marin County, a few minutes north of San Francisco and just across the Golden Gate Bridge.