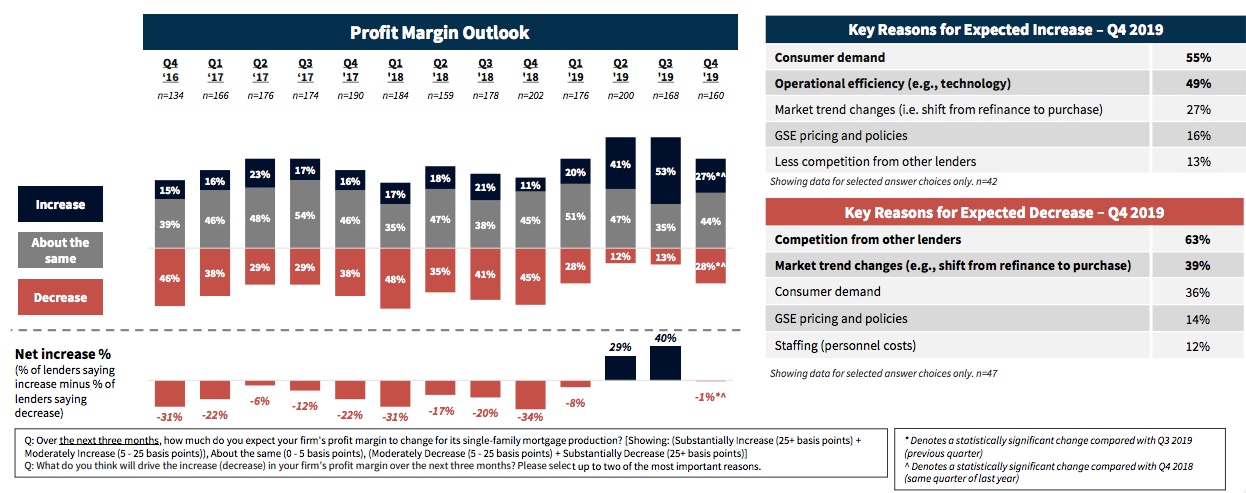

Lenders responding to Fannie Mae's Q4 2019 Mortgage Lender Sentiment Survey® didn't have as bright an outlook for their future profit margins as in the previous survey when their expectations were at a high for the survey which dates back to 2014. However, 44 percent of the 188 senior lending executives completing the survey believe their profit margins will remain about the same compared to the prior quarter, while the remainder are almost evenly divided among those who expect profits will fall (28 percent) and those who expect them to rise, 27 percent.

Fannie Mae cites the Mortgage Bankers Association's (MBA's) recent Quarterly Mortgage Bankers Performance Report which showed lender's per loan net production income has been on the rise over the first three quarters of 2019. Lenders reported Q3 2019 earnings of $1,924 per loan, versus a third quarter average of $1,061 over the last three years. Adding to lender optimism is the elevated mortgage spread. The average spread (30-year fixed-rate mortgage versus 10-year Treasury note was 189 basis points in November. The long-run average is 168 basis points.

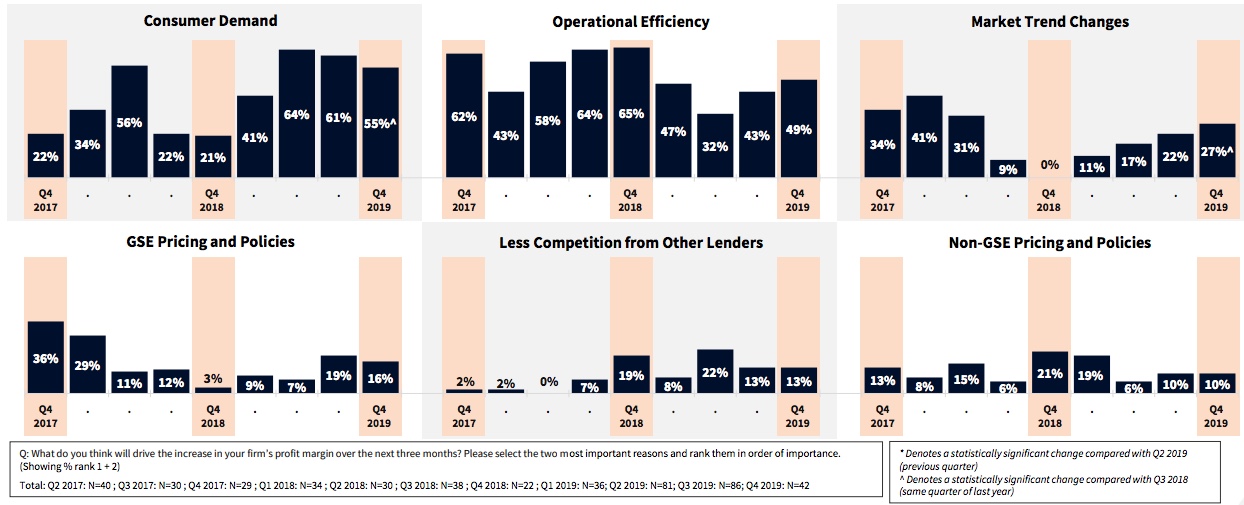

Consumer demand was cited by 55 percent of those who expect margins to increase while "Competition from other lenders" continues to be the main reason for negative outlooks. "Market trend changes" was the second negative reason. It hit its highest point since the first quarter of 2017.

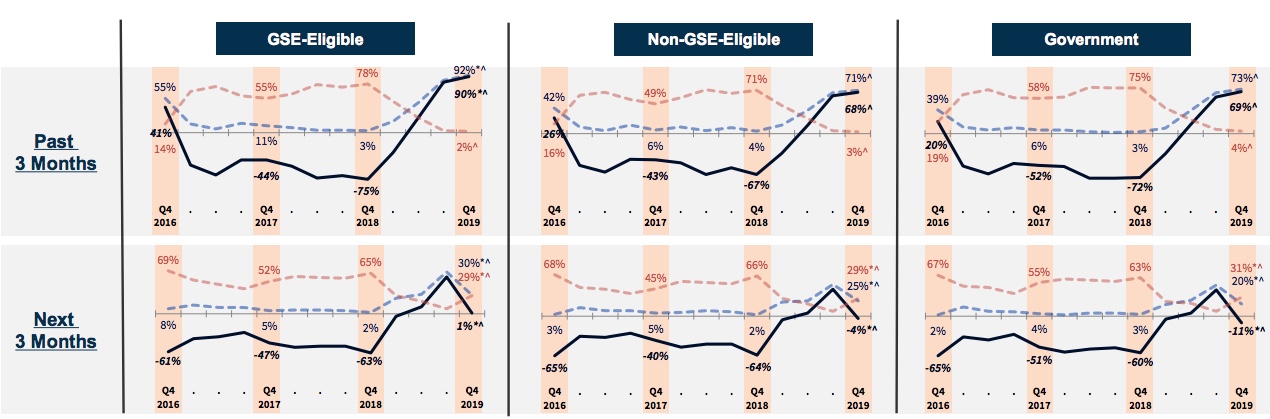

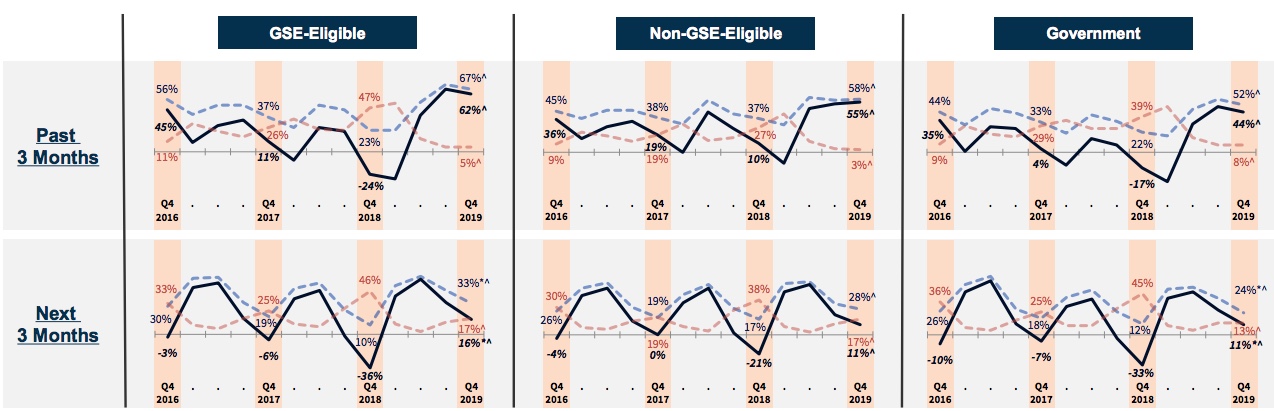

Reports of demand growth for both purchase and refinance mortgages over the previous three months reached survey highs, but lenders expect refinancing demand to tail off going forward, declining to levels seen in the first quarter, while purchase demand expectations remain at record high levels.

Purchases...

... and Refis

Most lenders reported no major changes in their underwriting credit standards for the prior three months and expected no major changes for the next three months. The results were similar to those reported from the third quarter survey.

"Mortgage lenders' profit margin outlook remains steady following gains in the first three quarters of 2019," said Fannie Mae Senior Vice President and Chief Economist Doug Duncan. "Credit standard trends also continue to hold steady amid the largely unchanged profitability outlook. Lower interest rates, which drove the refinance boom, have been the engine driving mortgage demand growth this year. Lenders' purchase and refinance demand expectations align with our own forecast: With interest rates stabilizing in 2020, we expect a decline in refinance activity and slightly higher purchase activity."

The 188 respondents to the fourth quarter survey represented 168 lending institutions; 76 mortgage banks, 60 depository institutions, and 30 credit unions. Sixty institutions were large, in the top 15 percent based on 2018 mortgage originations, 38 were in the next highest 20 percent, and 38 were in the bottom 65 percent. The survey was conducted between October 30 and November 10.