An analysis published on Black Knight's blog indicates that rents and home prices don't always rise or fall in tandem. The company says comparing trends between the two can sometimes be an apple and oranges situation; they are similar in some respect but vastly different in others.

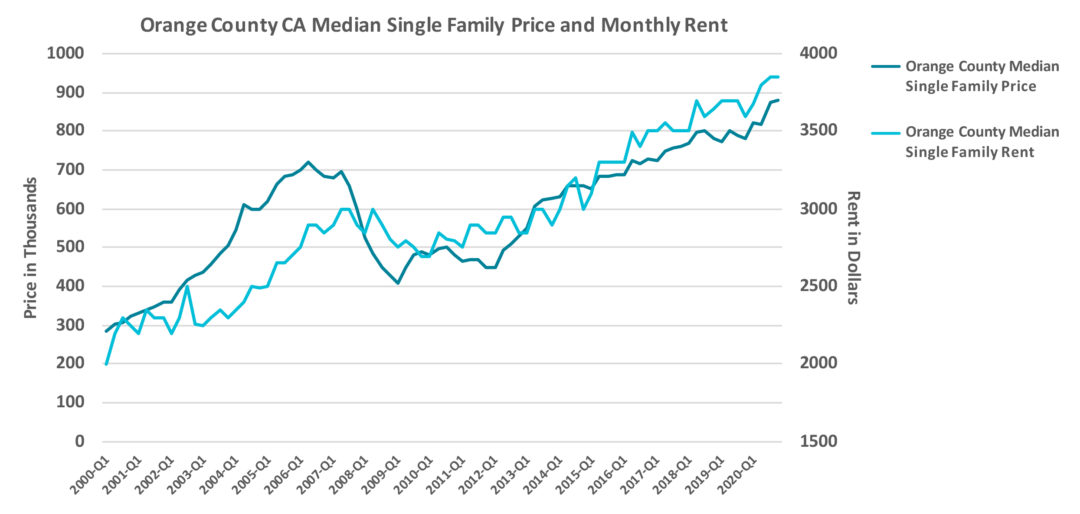

In Orange County, California for example, median sale prices for single-family home prices and monthly rent for them in Orange County California, look, at first glance, to be on the same trajectory, which is a fair long-term conclusion. However, a closer examination of the graph below shows larger divergences between them in short-term bursts.

During the housing bubble home prices moved higher almost without interruption while rents for single-family houses trended higher at a slower rate and with some volatility. Then the difference between the two reversed at the end of the boom and into the Great Recession. Since then, Black Knight says, the median rental price has increased at a fairly steady pace while sales prices are much more volatile, "with more pronounced peaks and valleys in reaction to larger market forces."

The pandemic has exacerbated some real estate trends, such as low inventories and record low interest rates and median home prices in Orange County have increased steadily throughout 2020 except for a small dip in the second quarter. The median price in the fourth quarter is up $100,000 year-over-year to $880,000. Single-family rents have also steadily increased, rising from a median of $3,600 to $3,850 over the same period.

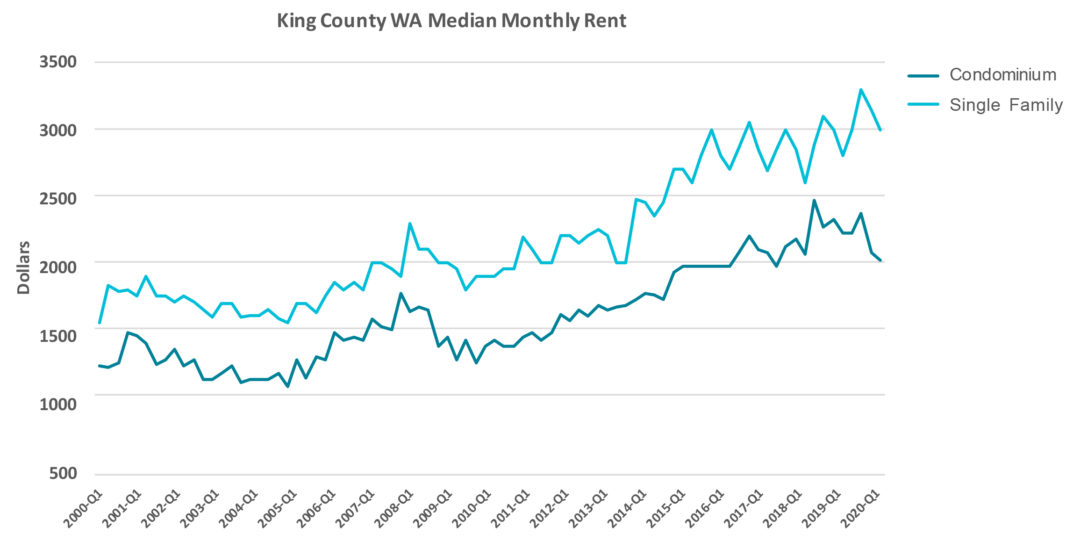

Black Knight points to King County, home to Seattle, as an example of the differences in rent prices of single-family homes and of condos. As people seek "social distance" during the pandemic they are migrating away from crowded urban areas and from the multifamily housing found there. Consequently, condo rents are dropping. In King County the median condo rent was around $2,250 per month at the beginning of the year but is now at a median of $2,050, a 9 percent decline. The county was also site of the first coronavirus death in March and an early virus hotspot, marking the start of the large drop in condo prices on the graph.

Finally, the company found the pandemic has somewhat leveled the field location-wise for renters. While there will always be a difference in prices for similar units in Manhattan versus other large cities, the gap among major markets has been closing.

While rents in areas that are traditionally on the low end have remained steady, expensive areas such as New York have seen drops, in some cases sharp ones. The median New York City rent for a two-bedroom condo is down about 30 percent, from $8,000 at the first of the year to $5,500 in just a few months. Prices in smaller cities such as Charlotte and Houston have seen only small changes; from $1,300 in Q1 to $1,375 in Q4 in Charlotte, $1,395 to $1,400 in Houston.