Hurricane Florence, the storm that tore up much of eastern North and South Caroline in September, may be especially disastrous in terms of VA loans. Black Knight looks at the possible impact of the storm in its current issue of Mortgage Monitor.

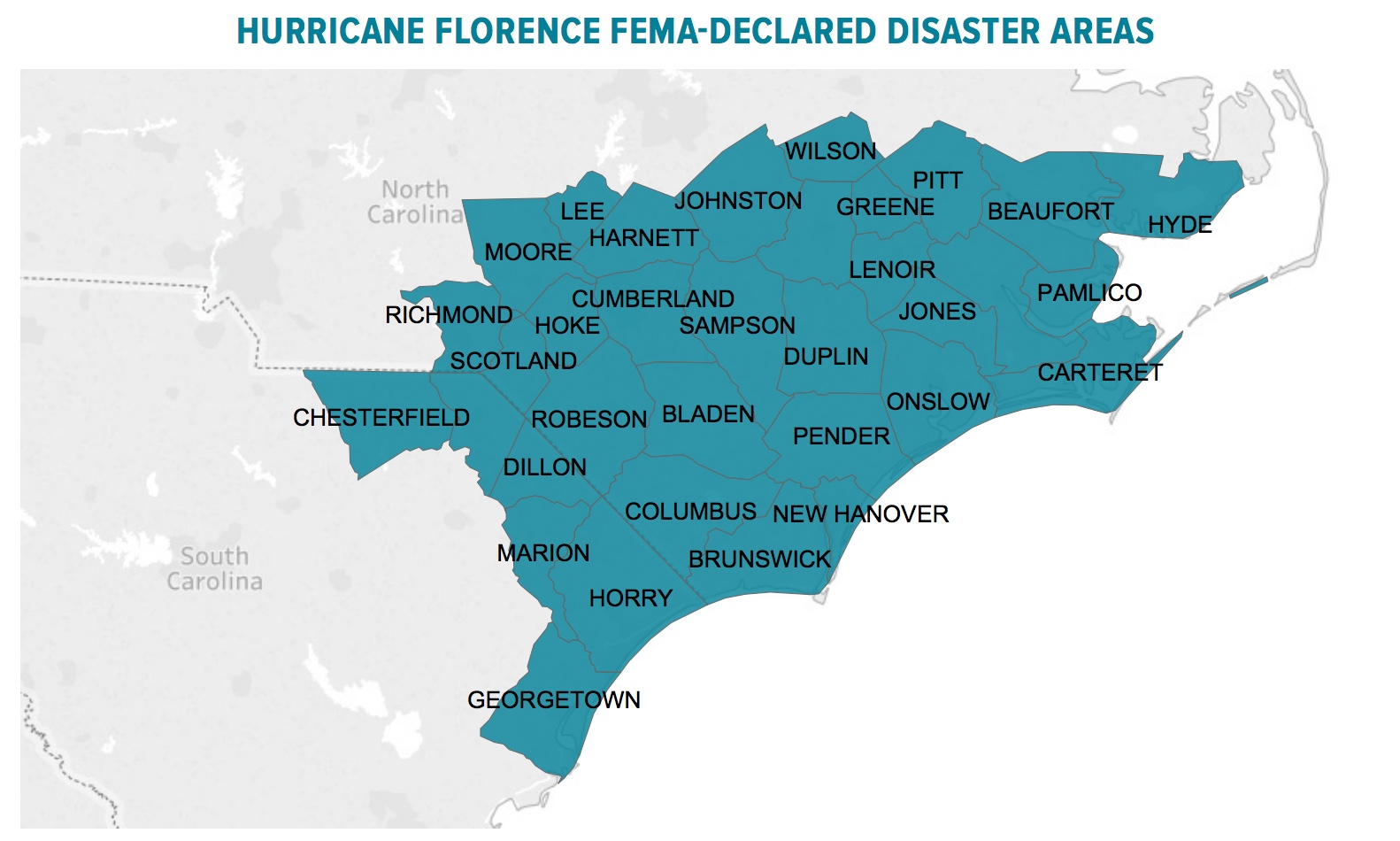

In the 34 localities declared as Hurricane Florence disaster areas the Monitor found there were a total of 1.17 million properties, 474,000 of which carry at least one mortgage. North Carolina bore the brunt of the storm, and 80 percent of the affected mortgages, an estimated 385,000, representing more than 20 percent of both total properties and mortgaged homes, are in that state. In South Caroline an estimated 90,000 mortgaged homes are located in FEMA declared counties, about 10 percent of all homes in the state.

Black Knight says that only one-ninth as many homeowners were affected by Florence as were hit by Hurricanes Harvey and Irma last year, but there are several reasons the storm has the potential to inflict considerable financial damage to the mortgage industry; the leverage prevalent in the area, the distribution of loan types, and an elevated delinquency rate in the area even before Florence struck.

While home values are about $100,000 below the national average, homes with mortgages tend to be more heavily leveraged, a combined loan-to-value (CLTV) ratio of 63 percent compared to the national average of 51 percent. On the plus side, the area has only a 3 percent negative equity rate.

The presence of Fort Bragg and Camp Lejeune in the area and a significant population of retired military personnel means a high concentration of VA loans. Where these loans have a 5 percent share of total mortgages nationwide, in that section of the South the average is more than 20 percent. They actually make up more than 40 percent of all mortgages in the North Carolina counties of Cumberland, Harnett, Hoke and Onslow. The numbers of these loans, which allow LTVs of up to 100 percent, could be a factor in the higher average CLTV ratios as well.

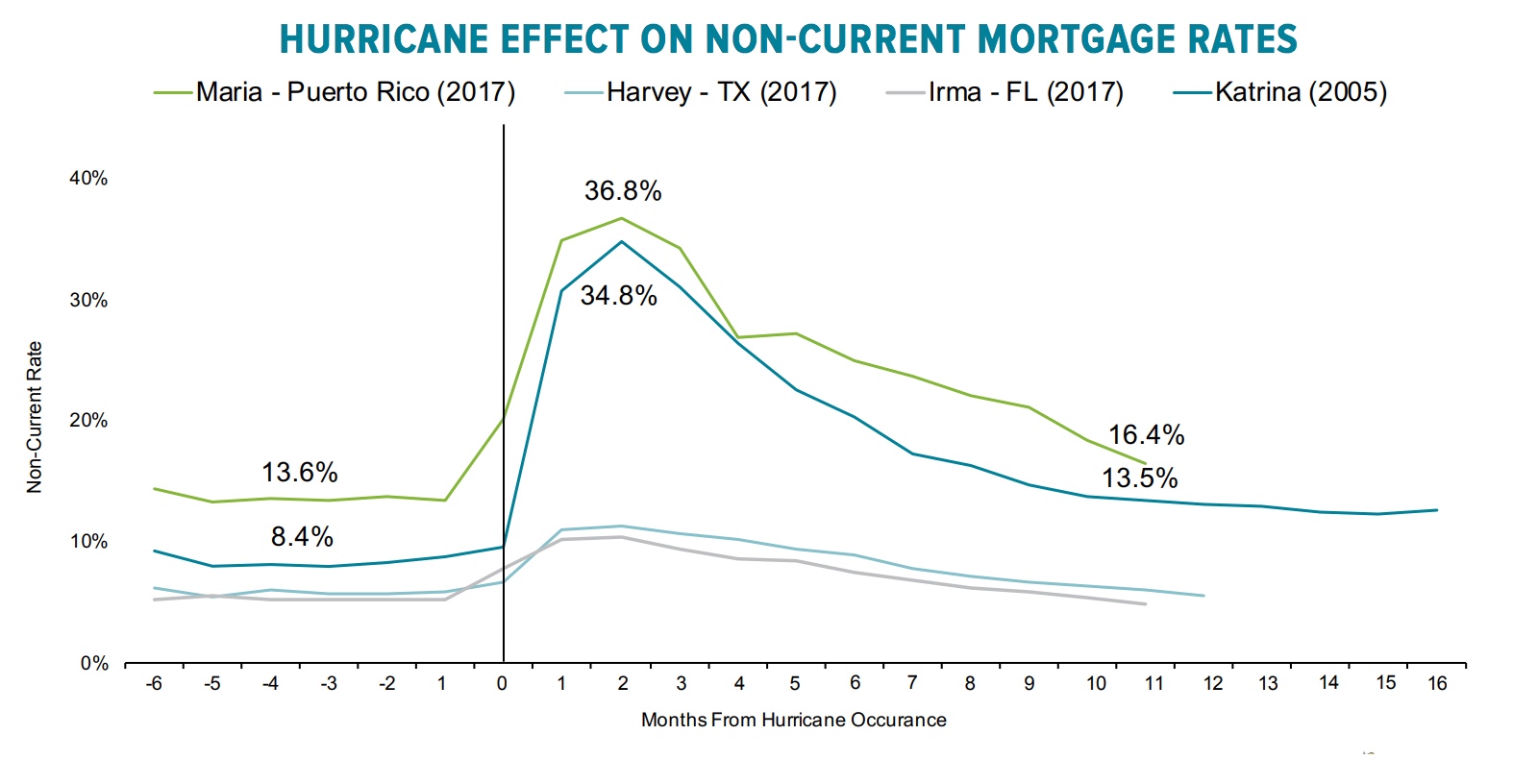

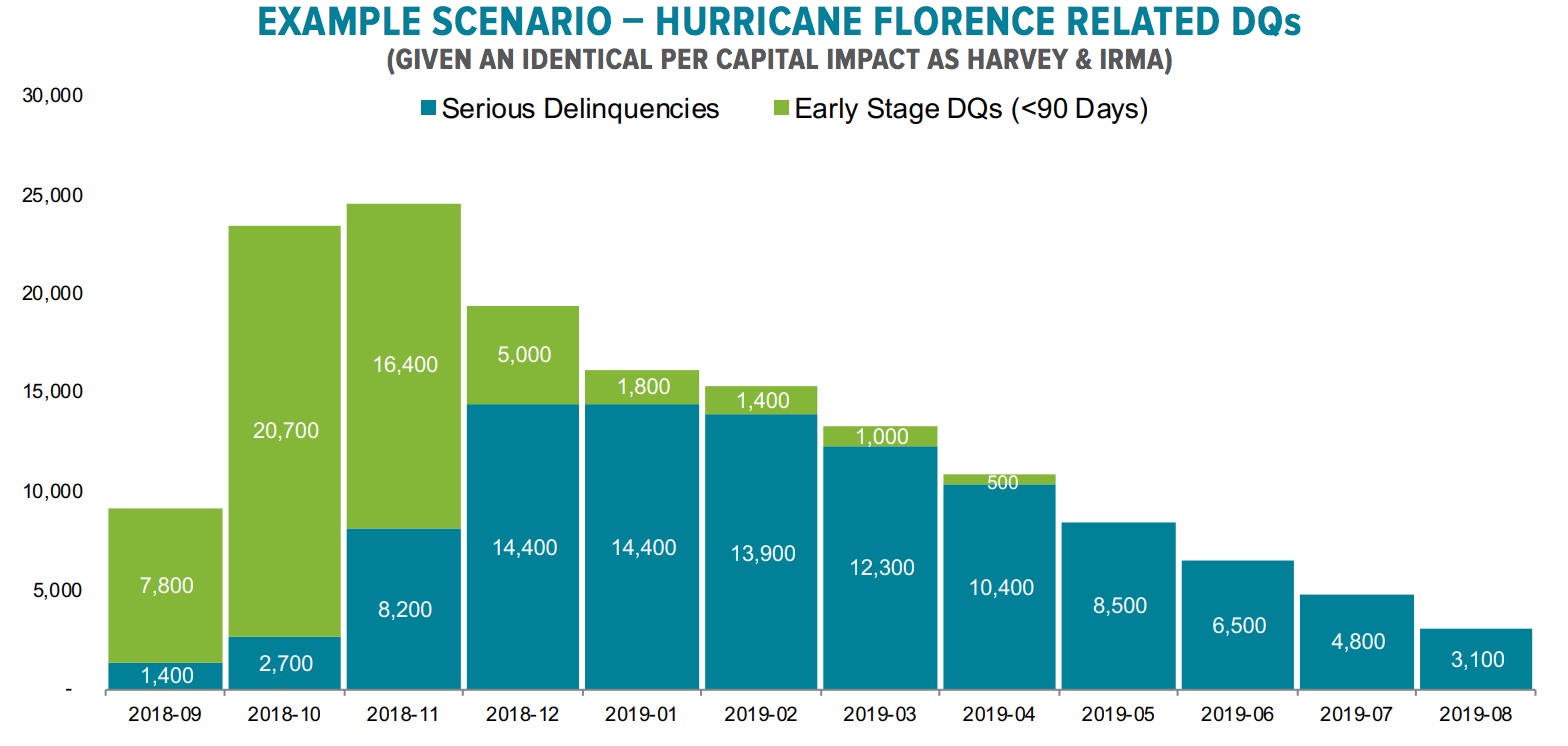

Finally, the delinquency rate in the area was higher than the national rate even before the hurricane struck; 4.4 percent as compared to 3.5 percent. After Harvey and Irma, the VA delinquency rate rose by 5.8 percent, which was a 40 percent greater increase than was the case with conventional loans. Black Knight says an identical per-capita impact as was seen following Harvey and Irma would means that delinquencies would begin to creep up in September, with nearly 25K borrowers becoming past due over the next three months, with the peak occurring in November. Of these, about 14,000 would become seriously delinquent, that is more than 90 days past due. An estimated 5,400 veterans would be among those non-current borrowers.

Ben Graboske, executive vice president of Black Knight's Data & Analytics division explained, "Although the situation in the Carolinas continues to evolve as we speak, we are beginning to get a sense of the potential scope of the storm's impact from a mortgage performance aspect. If the post-storm trajectory follows that of Hurricanes Harvey and Irma, thousands of Americans affected by Hurricane Florence could become past-due in the coming months.

If those past disasters are any clue, the damage to mortgage performance peaks about four months later, but while the impacts shrink they do linger. By August of this year hurricane related delinquencies had declined by 84 percent in Florida and 78 percent in Texas. Improvement continues in Puerto Rica, which was hit by both Irma and subsequently by Maria, but at a slower pace with serious delinquencies down there by 74 percent. The company estimates that about 18,000 storm related delinquencies remain in Puerto Rico and just over 25,000 on the mainland. Given that history, Black Knight projects the scenario below for post-Florence performance.

The Monitor also looked what appears to be a continuing slowdown in the rate of home price increases. In July 22 of the 100 largest markets saw home prices decline, the largest such population experiencing July losses in five years. The national Home Price Appreciation (HPA) month-over-month was 0.22 percent, the lowest for any July in seven years and roughly half of the average increase during that month in the last five years. The annual increase in July was 5.9 percent, down from its recent peak of 6.7 percent in February. Still, it was an increase and marked the 19th straight month the Black Knight's national Home Price Index has increased on a monthly basis.

The top ten single month declines were all on the West Coast or in Florida and some were staggering. San Jose, where prices have moved up by 35 percent over 20 straight months of appreciation, has now seen them decline for two consecutive months and the annual rate of appreciation has fallen from 24 percent in February to 18 percent in July. Of course, that rate is still triple the national average. Seattle also had two monthly declines, ending 44 months of increases and slowing annual appreciation from just under 15 percent five months ago to under 10% in July. San Francisco saw the first decline in 22 months and its annual appreciation has ticked down more than two percentage points.

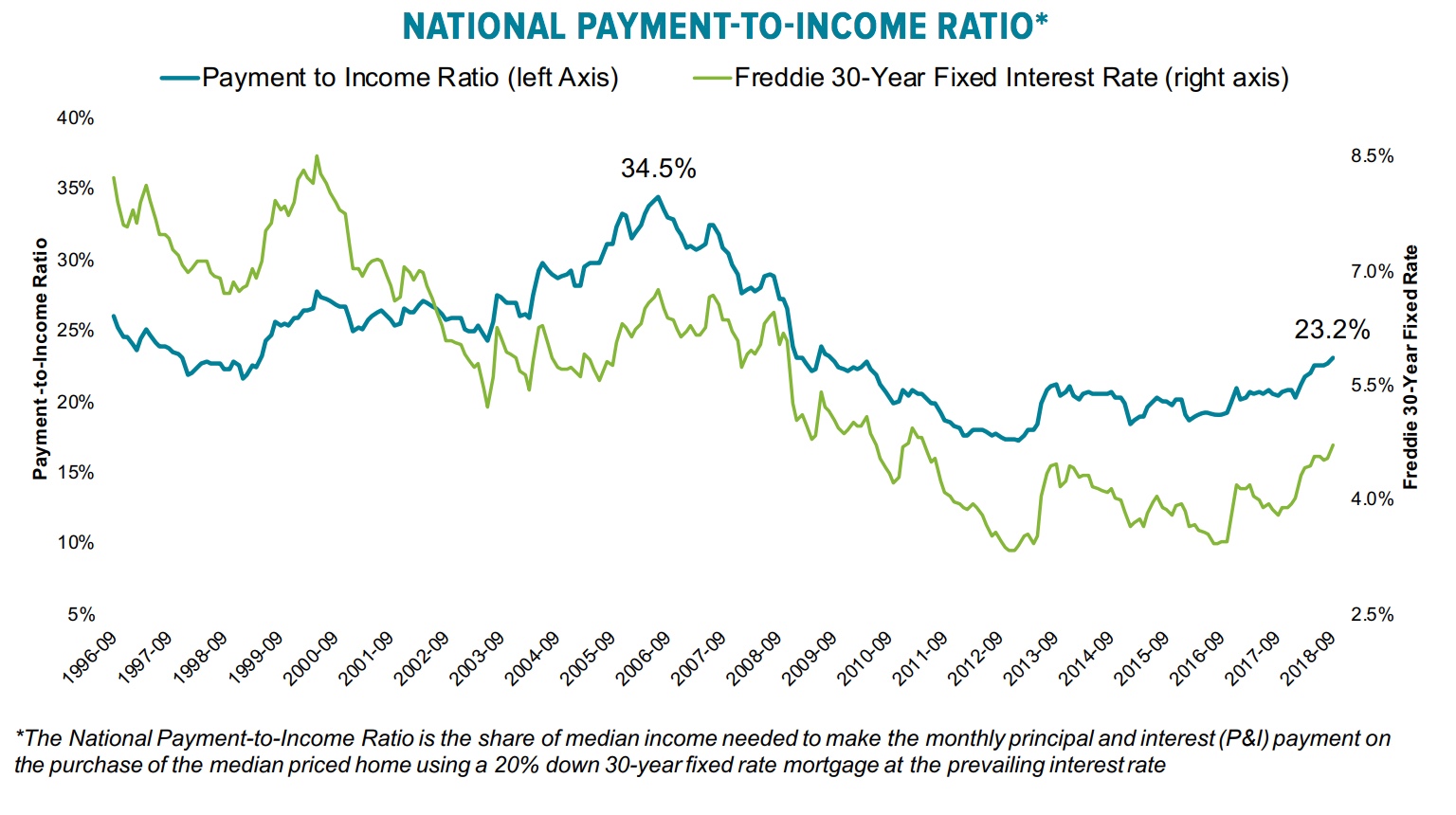

But even as appreciation decelerates, interest rates are impacting home affordability; rates during the week ended September 30 hit a 7-year high. As of September, it takes a $1,238 monthly P&I payment to purchase the average-priced home with 20% down. That's up $168 since the start of the year or a 16 percent year-to-date increase compared to only a 3 percent increase for all of 2017. It now takes 23.2% of median income to make the P&I payment on the average home. This is the first time that measure has exceeded 23 percent since 2009 although it is still slightly below the long-term average of 25 percent.

The Monitor also notes that the share of prepayments being driven by rate-term refinancing hit a record low in the 2nd quarter of the year, 8 percent. The previous low of 12 percent was in 2006 (Black Knight's records go back to 2005) when, as now, the refinancing was primarily for the purpose of cash-out.

Home sales are now the dominant reason behind pre-payments, accounting for 57 percent of the total, the largest share ever recorded. As home sales become the dominant factor, prepayments also tend to become more seasonal. Black Knight projects that, if the interest rate incentive for refinancing remains steady, prepays could drop by 30 percent at the beginning of next year when home sales activity hits its seasonal bottom.