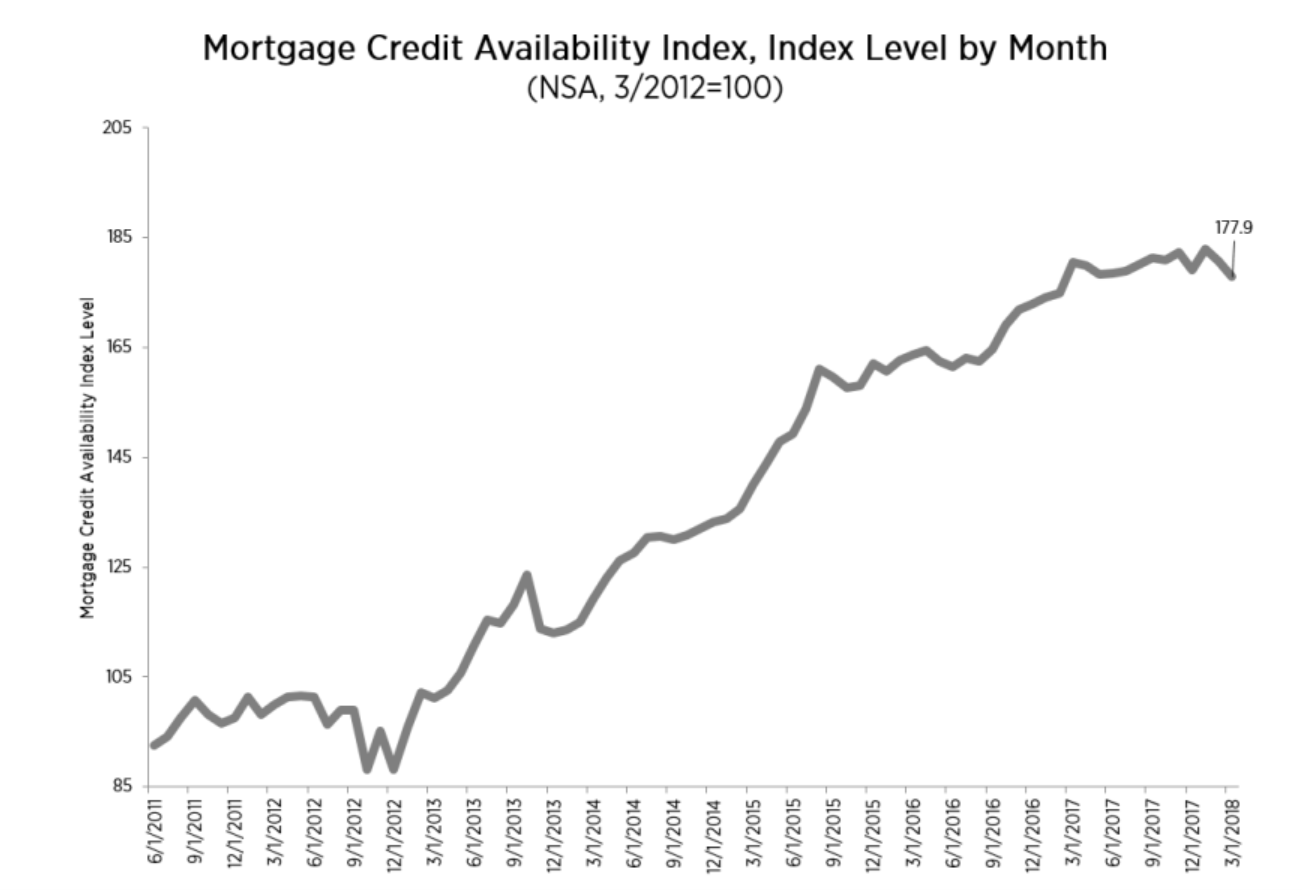

Mortgage credit access tightened for the second straight month in March. The Mortgage Bankers Association (MBA) said its Mortgage Credit Availability Index (MCAI) declined 1.5 percent to 177.9 compared to February and has lost 5.0 points since January. The Index was benchmarked at 100 in March 2012.

All four of the component indices were down, with the Government MCAI taking the biggest hit, down 2.1 percent. The Conventional MCAI was down 0.8 percent as was one of its sub-indices, the Conforming index. The second component of the Conventional MCAI, the Jumbo index, was down 0.7 percent.

Joel Kan, MBA's Association Vice President of Research and Economics said, "Mortgage credit availability decreased in March driven by both conventional and government loan programs. The government MCAI saw the largest decrease which was driven by investors making adjustments to their interest rate reduction offerings for FHA and VA loans."

The MCAI is calculated using several underwriting factors including credit score, loan type, and loan-to-value ratio. The four components are constructed in the same way as the composite index and are designed to show relative risk and credit availability for their respective borrower populations. The Conforming and Jumbo indices have the same index date and base as the MCAI, March 2012=100. The Conventional and Government indices have adjusted "base levels" to better represent where each index might fall in March 2012 relative to the 100 benchmark.