The National Association of Home Builders (NAHB) has taken a look at the differences between homes constructed within metropolitan statistical areas (MSAs) and those constructed outside of them. For starters, there are not many of the latter.

As explained by Paul Emrath in NAHB's Eye on Housing blog, non-MSA areas are "aggregations of counties defined by the Federal Government based largely on commuting patterns." Of the 848,000 single-family homes for which construction was started in 2017, only about 79,000 were built outside of the areas officially-defined (by the Census Bureau and the Department of Housing and Urban Development) as MSAs. This is up 40 percent from the construction trough in 2011 whereas construction inside MSAs is up 97 percent.

Emrath says one feature that differentiates home building in nonmetropolitan America is the relatively high percentage of custom homes - single units built on the owner's land. More than half of the non-MSA homes fall into that category. The Census bureau breaks the custom category into contractor built if the owner employs a builder and owner built where the property owner acts as general contractor.

Seventeen percent of non-MSA homes were owner-built in 2017 and 36 percent were built by builders. The remaining 47 percent were built for sale or occasionally for rent. In metropolitan areas only a sliver of the residential building was custom; 5.4 percent built by the owner, 11.5 percent employing a contractor. The vast majority (over 80 percent) were built on spec, usually in tracts or subdivisions.

There are also MSA/non-MSA differences in the size and the price of homes. The average size of a home built within an MSA is significantly larger, 2,639 square feet compared 2,148 square feet. The average price of a single-family home outside the MSA was $245,552, about one-third less than the MSA counterpart. Emrath says the lower price is partly due to lower building costs but mostly to the smaller home size.

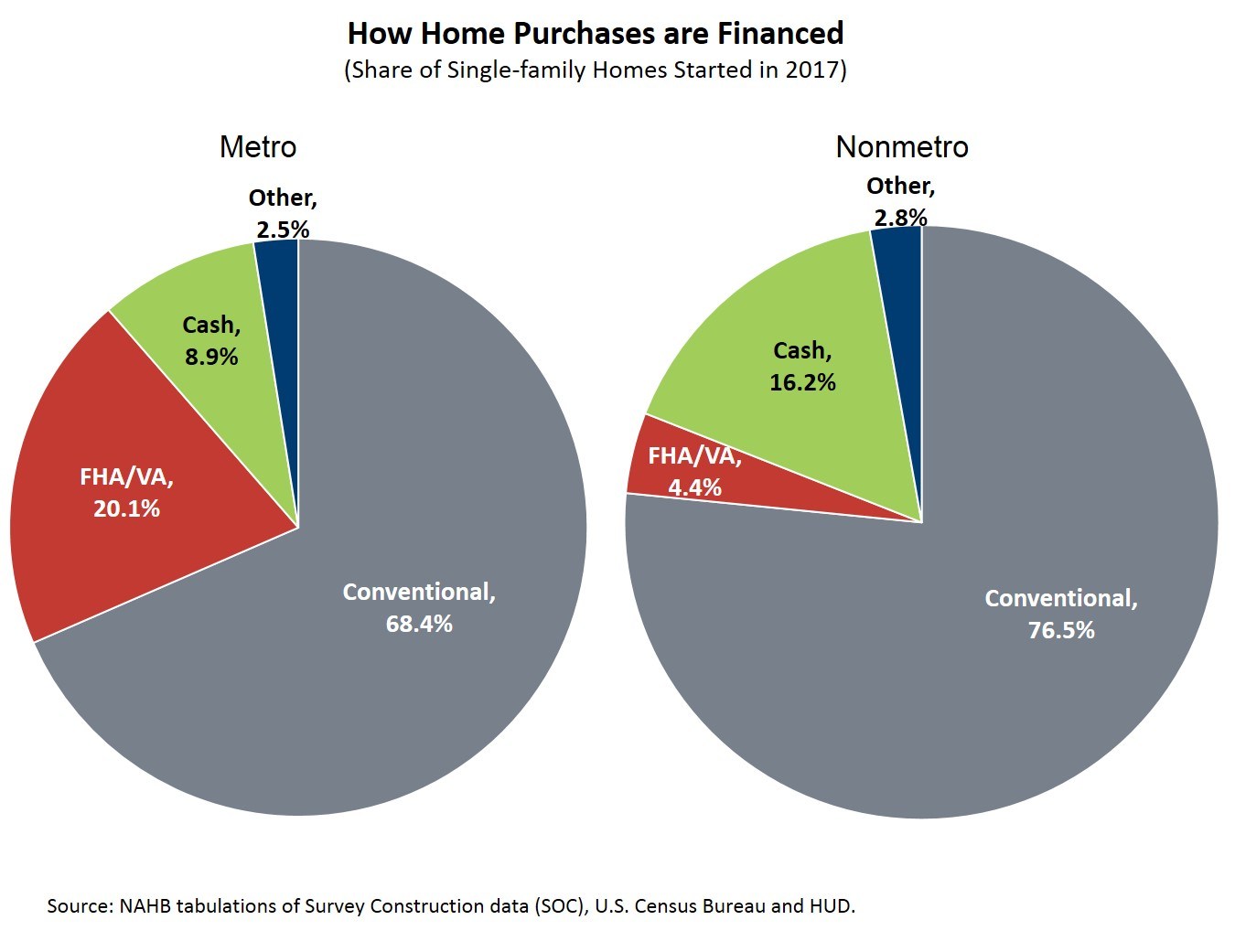

The financing of these homes also differs somewhat. In both locations a strong majority of buyers use a conventional mortgage. However, MSA buyers use FHA and VA loans to a greater extent than non-MSA buyers and the latter are twice as likely to use cash to purchase/build their homes.

Emrath says the reliance on cash may in part be a result of more limited financing options. This, along with the slower post-recession recovery of building in non-metro areas and the smaller size of the homes suggests that these areas face particular challenges. They may need more targeted support from programs like those of the Department of Agriculture. USDA loans typically represent less than 1 percent of all originations nationwide.