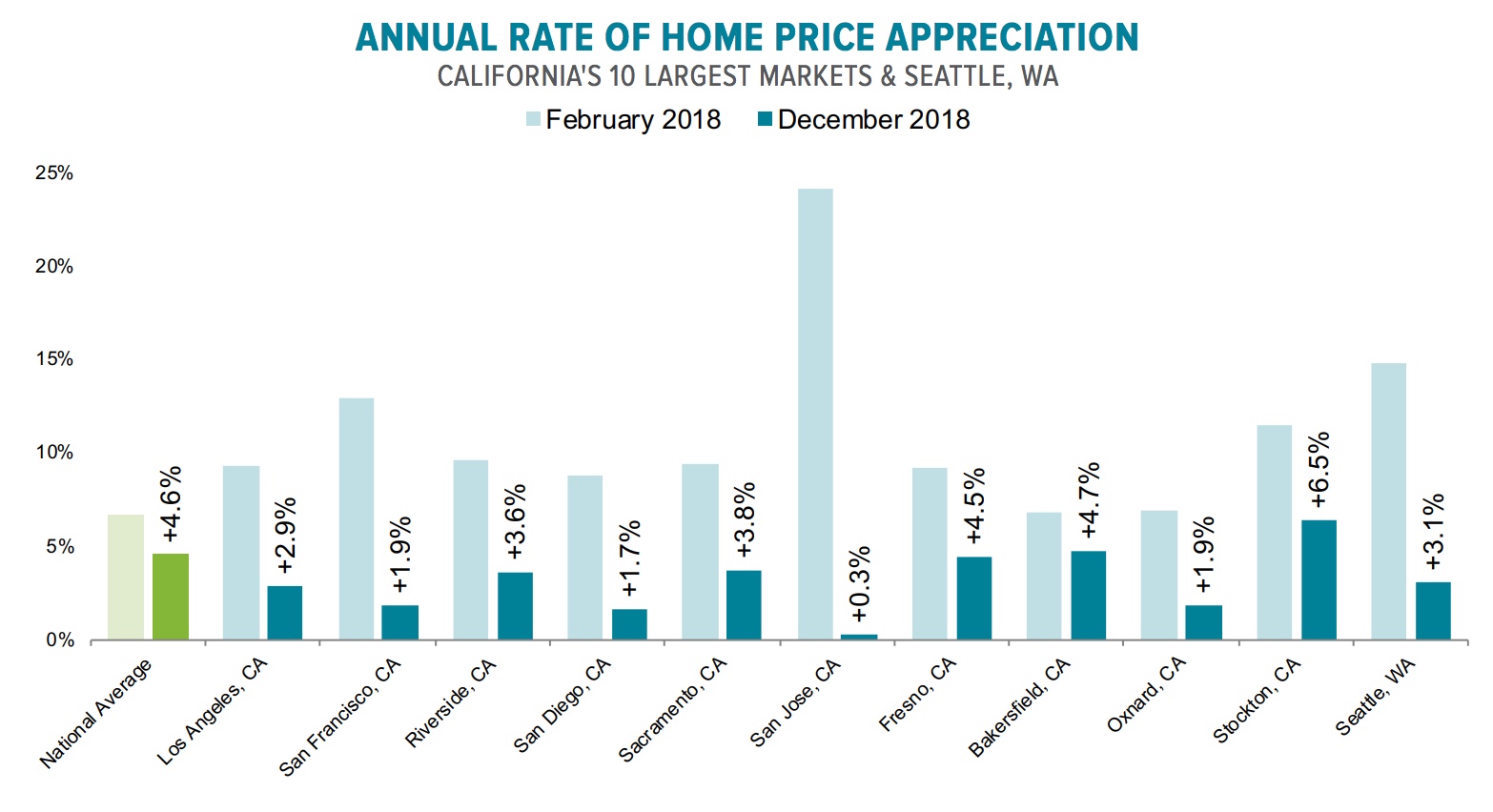

Earlier this week CoreLogic reported that the annual rate of appreciation in January, 4.2 percent, was exactly two-thirds the rate in January 2018. The Black Knight Mortgage Monitor essentially confirms that deceleration, reporting price increases dropping from 6.8 percent last February to 4.6 percent at year end.

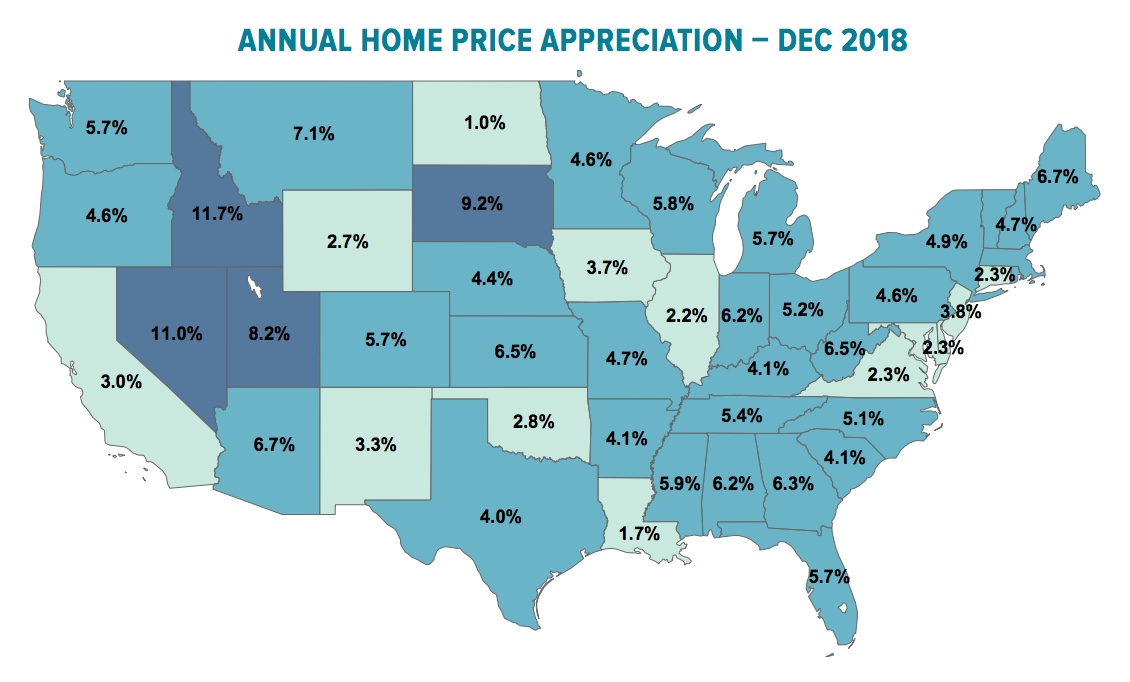

Ben Graboske, president of Black Knight's Data & Analytics division, explained that while home prices are still up year-over-year in all 50 states and the nation's 100 largest markets, slowing is noticeable nationwide and - combined with recent interest rate reductions - is helping to improve the overall affordability outlook.

"At the end of December, home prices at the national level had fallen 0.3 percent from November for their fourth consecutive monthly decline," he said. "As a result, the average home has lost more than $2,400 in value since the summer of 2018. And while home prices are still up on an annual basis, the slowdown continues nationwide and, importantly, is not being driven by seasonal effects. December marked the 10th straight month of slowing annual home price appreciation."

He added, "With more than 50 percent of areas reporting, early numbers for January suggest we're likely to see more of the same. That said, it's important to keep in mind that annual growth is still outpacing the 25-year average of 3.9 percent - although the gap is closing quickly. Also, it's yet to be seen what impact the recent pullback in interest rates may have on the national home price growth rate.

The slowdown has been especially apparent in the West. While some interior states are still seeing large gains - Nevada, Idaho, and Utah saw the greatest increases in the nation with Nevada still in the double digits - large metro areas on the coast have seen appreciation rates plummet.

Black Knight looked at the 10 largest markets in California and at Seattle and found that eight of them had seen their appreciation rate cut in half over the previous 10 months and by 70 percent in five of them. While prices in Washington State as a whole are still increasing by 5.7 percent, Seattle's several year double digit run has evaporated. The annual rate is now 3.1 percent.

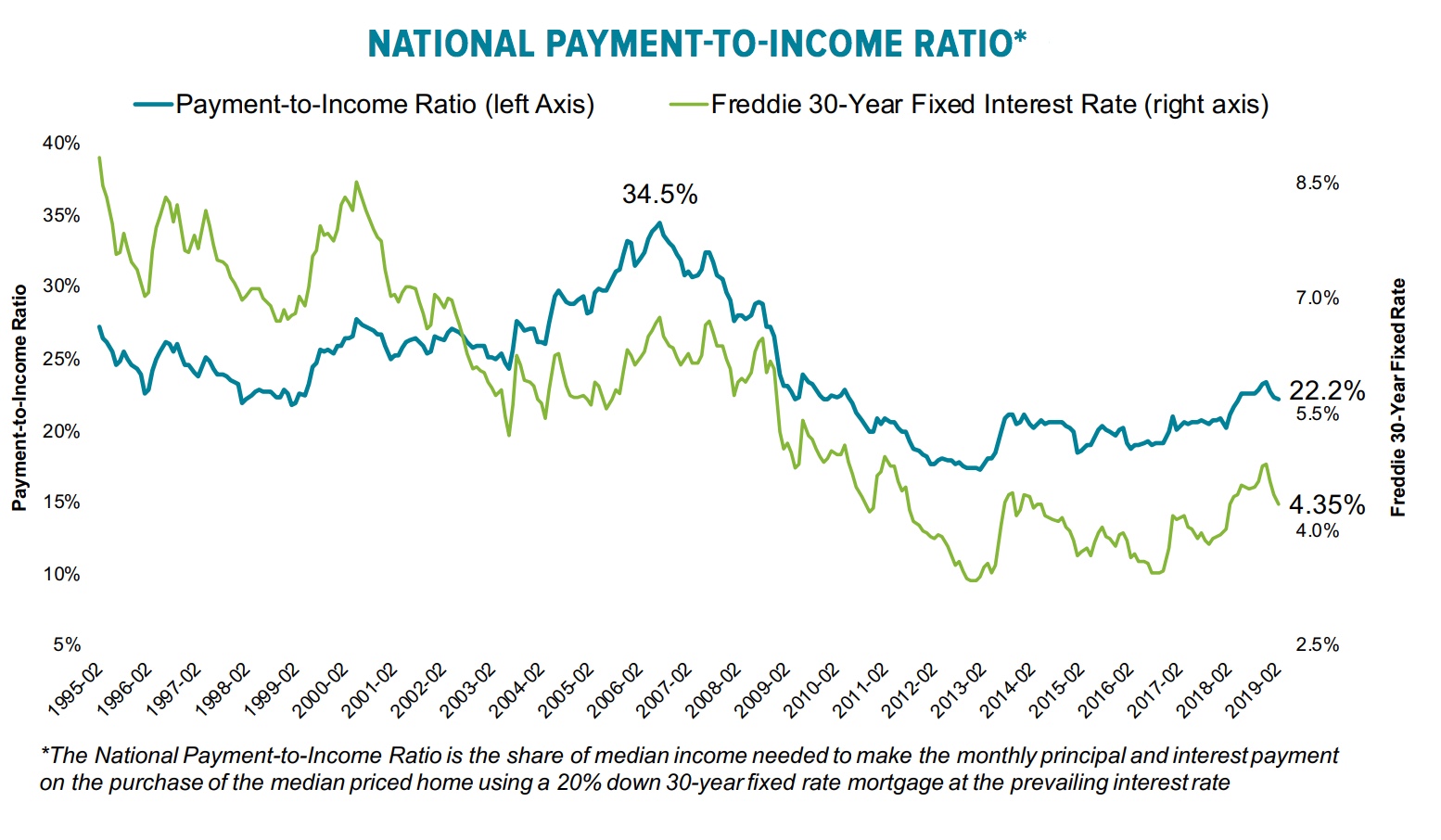

While California is still the least affordable state in the country, it currently requires 36 percent of the median household income to make principal and interest payments on the average home purchase, the affordability picture is brightening in many areas.

Black Knight says moderating prices, coupled with falling interest rates, have made housing the most affordable it's been since early last year. Lower interest rates alone have translated into 6 percent more buying power while keeping monthly payments the same. It now takes 22.2 percent of median income to purchase the average home with 20 percent down and a 30-year loan compared to the post-recession high of 23.4 percent just a few months ago. It is also well below the long-term average of 25 percent in the last 1990s and early 2000s and certainly lower than the peak of 45 percent just prior to the housing crisis.

Falling rates have continued to increase refinancing incentives as well. With the 30-year fixed rate at 4.35 percent as of late February, the number of homeowners who could qualify for a refinance and reduce their interest rate by at least 75 basis points had risen to 3.27 million. This is up 75 percent from the 10-year low in the refinance pool in November.

The vast majority, more than 85 percent, of the homeowners who could benefit from refinancing are those who took out their mortgages more than seven years ago and have not chosen to refinance during periods of even lower rates. Still, Black Knight notes that there are more than 250,000 homeowners who took out mortgages last year and could likely reduce their interest rate significantly by refinancing.

But if refinancing opportunities are up, prepayments are not. Black Knight said January saw the fewest repays, usually an indication of refinancing activity, since November 2000. The rate declined 10.15 percent year-over-year as seasonally low home sales outweighed any rise in refinancing incentive.

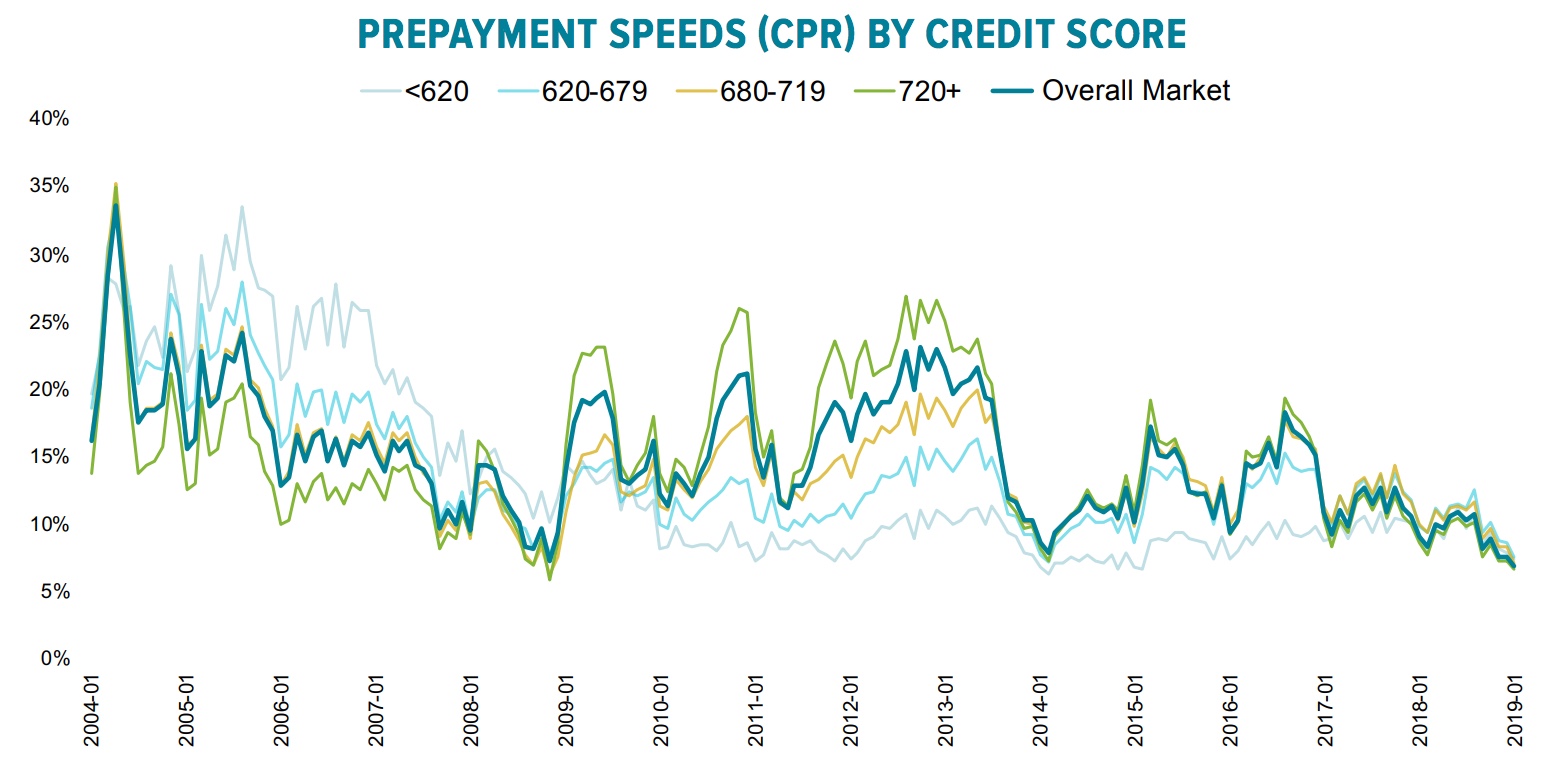

High credit score borrowers are generally more reactive to falling interest rates, but Black Knight says the current prepays are noticeably uniform across credit buckets. Less than 1 percent separates the conditional prepayment rate of those with scores below 620 and those above 720, the smallest spread in 18 years. Over 60 percent of active mortgages today have credit scores over 720 compared to 50 percent at the previous low point in 2008.

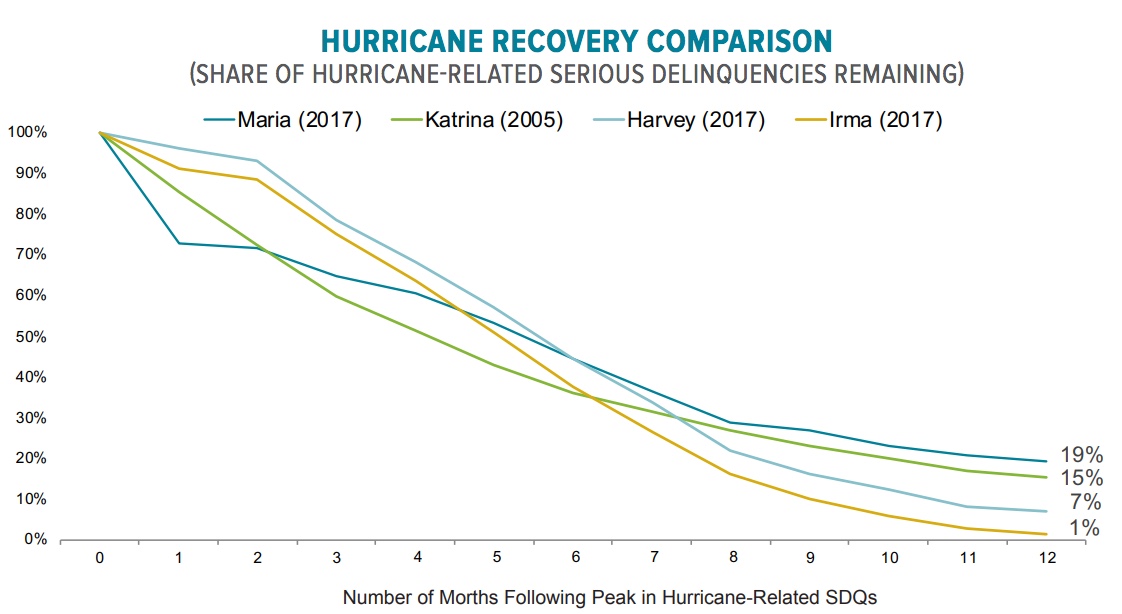

While there has been a lot of attention paid to delinquency rates following hurricanes Harvey, Irma, and Florence that hit Texas, Florida, and North Carolina in 2017 and 2018, not much has been said about those in the aftermath of Hurricane Maria in Puerto Rico. While the territory is not counted in national delinquency statistics, high defaults and foreclosures are an economic factor for lenders and investors.

Black Knight now reports that mortgage performance on the island has continuously improved during 2018. At the peak the total non-current rate hit 36.8 percent, but has now fallen to 14.4 percent, only slightly above the pre-storm rate. Other measures of delinquency have improved dramatically as well.

First lien performance (bar graph) p 7

The company says delinquencies have probably not yet peaked following the two 2018 storms, Michael and Florence, but looking at the 2017 disasters as well at Hurricane Katrina in 2005, the recovery from Irma was the fastest during the first 12 months after landfall.