Fannie Mae is predicting a notable slowdown in the growth of the U.S. economy in the first quarter of 2019. They have downgraded their earlier forecast by 0.1 percent to an annualized rate of 1.7 percent, compared to 2.8 percent in the fourth quarter of 2018. For the full year they are looking for growth of 2.2 percent, down from what is expected to be a final rate of 3.1 percent last year.

The first quarter forecast from the company's economists reflects expectations that consumer spending has slowed as their confidence in future economic conditions has deteriorated. The economists do think that most of the impact of the partial government shutdown will dissipate by the end of the quarter and the government debt ceiling will be raised in a way that doesn't unduly undermine investor, business, or consumer confidence.

As to the full year outlook, the economists say they expect a shrinking benefit from federal fiscal policies, a widening of the trade deficit, and a deceleration in the pace of business investment. Key downside risks to the forecast include the slowdown in global economic growth and trade uncertainty while they may be underestimating the impact of the dovish shift by the Federal Reserve, easing financial conditions, and an expanding labor pool. With this in mind, they say the balance of risks have shifted from predominantly downside to closer to neutral.

Fannie Mae lowered its forecast for home sales in the fourth quarter as sales of existing homes in December fell 6.4 percent to an annualized 4.99 million units. It was the first time since November 2015 that sales were below the 5.0 million level. In November, new home sales rose by 16.9 percent to 657,000. December new home sales data has been delayed by the shutdown.

Pending home sales fell 2.2 percent in December, the third straight decline, suggesting that weakness in existing home sales will continue early in 2019 in spite of favorable home buying conditions. However, a 12.8 percent increase in average purchase mortgage applications in January offers some hope for home sales entering the spring buying season. In recent weeks, purchase mortgage applications have returned a portion of these gains, suggesting that any jump in home sales may be short-lived.

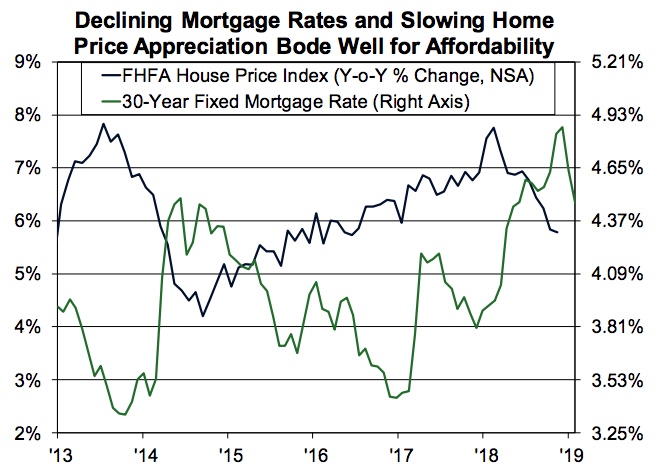

The revised projections for home sales has led to lower expectations for purchase mortgage originations in 2018 and 2019 as well. They have been revised to $1.147 trillion in 2018 and $1.181 trillion this year. Projected refinance originations were raised to $431 billion in 2019 in response to the modestly lower interest rate forecast. The 30-year fixed mortgage rate in 2019 is now expected to average 4.4 percent, one-tenth below the January forecast. On net, projections for total single-family mortgage originations have been lowered by approximately $3 billion to $1.611 trillion, which is 0.2 percent above the $1.608 trillion in total single-family originations in 2018.

Fannie Mae's February Economic Development report still maintains that a strong labor market supports housing demand and an 18-basis point decline in mortgage rates over January and slower house price appreciation suggest that home-buying conditions are still trending in a favorable direction as the spring buying season approaches.

Annual growth in the Federal Housing Finance Agency's Purchase-Only House Price Index remained at 5.8 percent in November, staying below 6.0 percent for the second consecutive month after exceeding or equaling 6.0 percent for the prior two years. Fannie Mae's Home Purchase Sentiment Index (HPSI) increased 1.2 points in January to 84.7, suggesting potential buyers are a bit more optimistic. However, the HPSI remains 4.8 points below its level from a year ago.

Consistent with slower annual house price appreciation, the inventory of existing homes for sale rose from a year ago for the fifth consecutive month in December to the fastest annual growth rate since October 2014. The months' supply of homes rose to 3.7 months in December from 3.2 months in December 2017. This is still well below the six-month supply that is usually the mark of a balanced market. The number of new homes for sale rose 15.1 percent over the year ending in November and the months' supply rose from 4.9 months last November to 6.0 months this November.

As expected, the Fed kept the federal funds rate at a range of 2.25 to 2.50 percent at its January meeting, but also shifted unexpectedly to a more dovish tone. Its after meeting statement said it would be patient in determining future fund moves and gave no guidance about future rate hikes. Fannie Mae says, given the strong labor market, it continues to project the Fed will raise rates in June and then pause for a while.

While the government shutdown has delayed the December residential construction report, single-family construction is expected to end the year on a soft note. Single-family starts fell 4.6 percent to 824,000 in November and single-family permits, which typically lag starts by approximately one month, rose only 0.1 percent to a seasonally adjusted annual rate of 848,000.