The November Mortgage Monitor from Black Knight focused largely on the shifting of the mortgage market toward purchase originations and the unexpected expansion of the refinancing pool due to recent interest rate drops, but it also had an interesting analysis of the current mortgage prepayment rate (also known as single month mortality or SSM). Mortgage prepayments typically slide along with refinancing, and right on schedule the SSM rate for fixed-rate mortgages hit a 10-year low in November, down 34 percent year-over-year. But this time there are some anomalies in the decline.

First, it is concentrated in fixed-rate mortgages. Prepayments of older adjustable rate mortgages (ARMs), those in the 2004-2007 vintages, are up 3 percent on an annual basis, because short term interest rates are rising, driving up rates on those ARMs due for adjustment. This has increased both refinancing pressure and housing turnover among affected homeowners. For similar reasons, prepayment speeds among legacy private labeled securities (PLS) have also been strong, running more than 50 percent above the market average in November and higher than conforming, FHA, VA, and portfolio loans in each of the past 23 months.

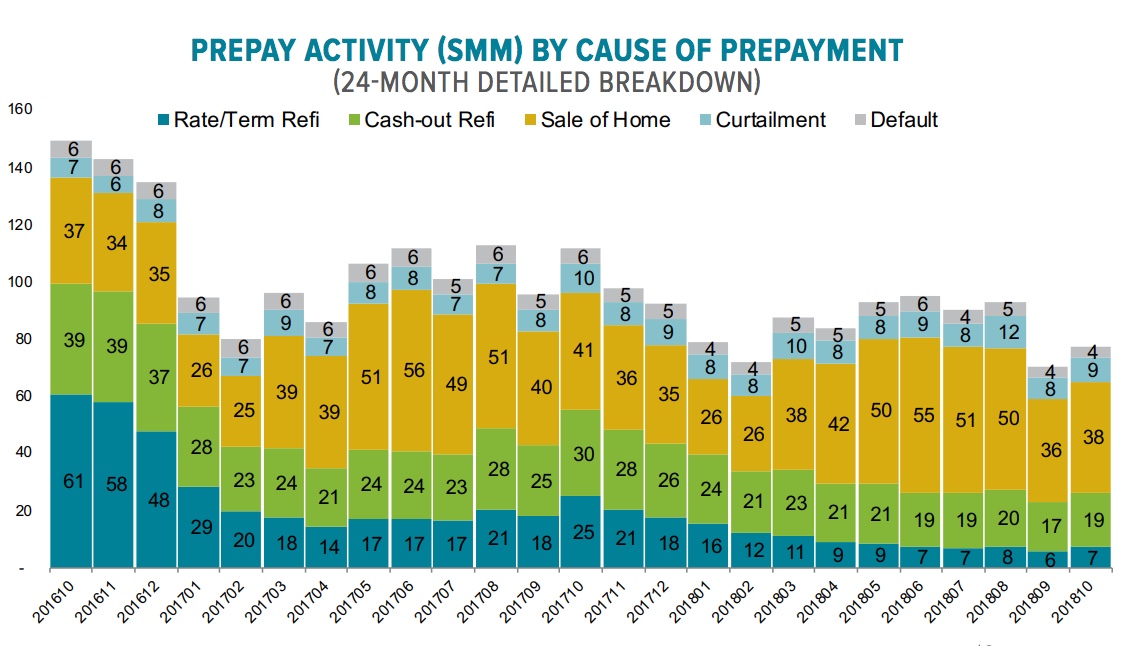

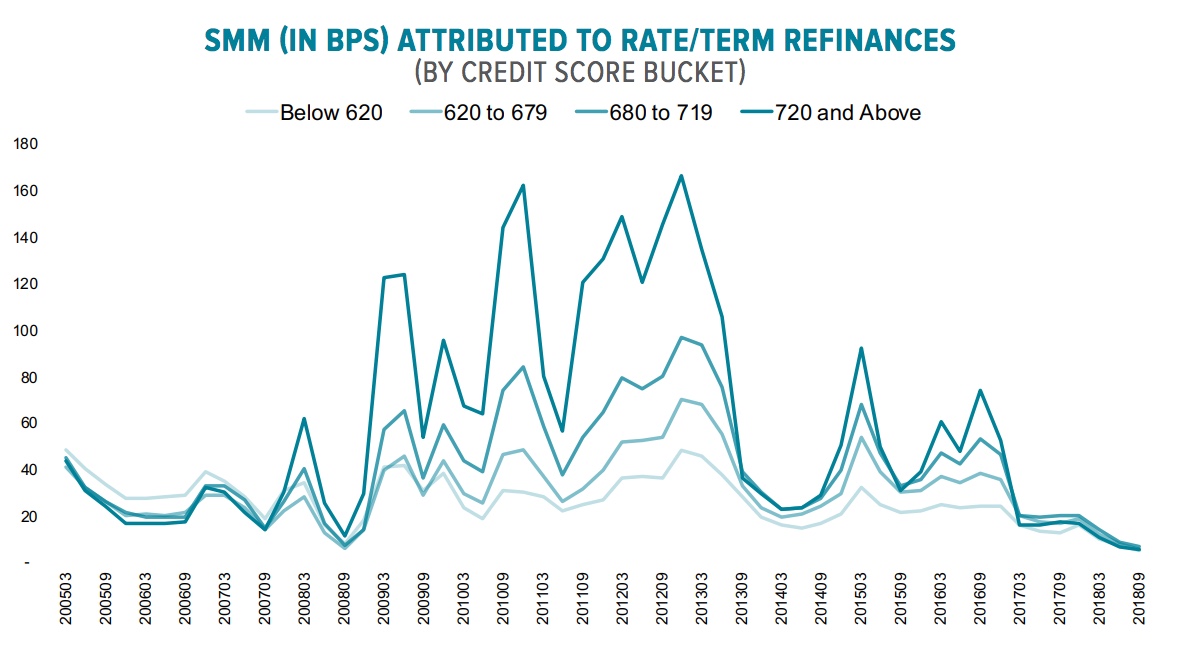

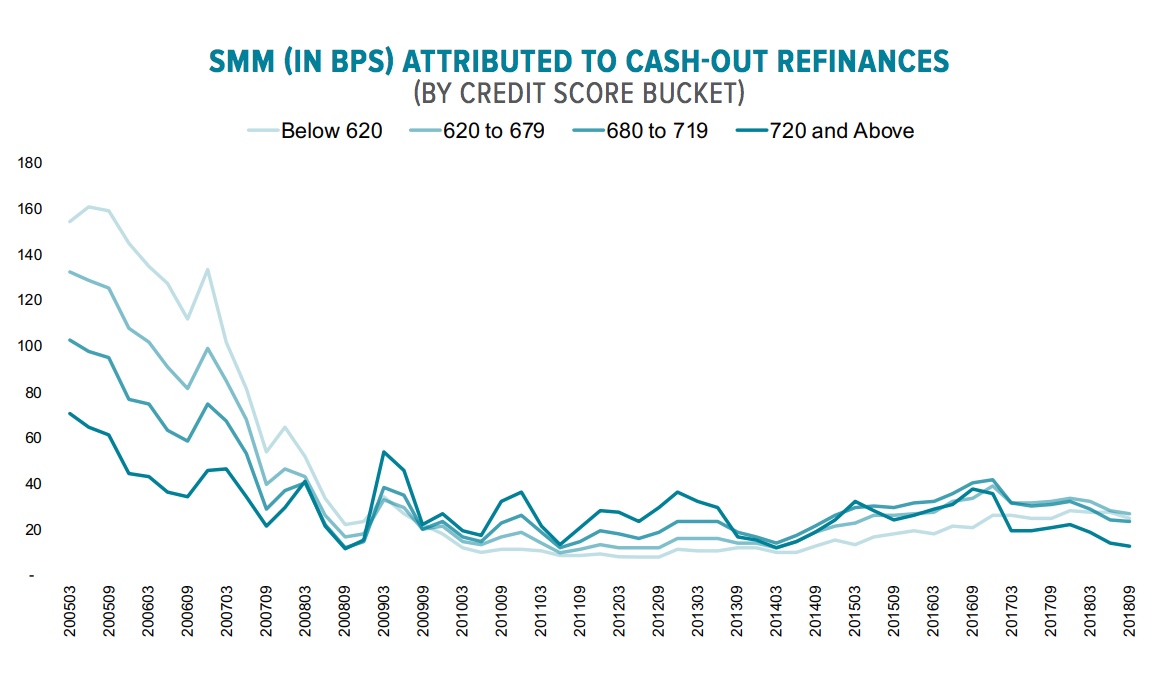

Prepayments are primarily driven by home sales, refinancing, and mortgage defaults. Some homeowners also make larger than required payments on principal to hasten amortization, but these are not included in the Monitor analysis. As might be expected, prepayments by way of refinancing, whether rate/term or cash out, have declined. Rate/term refinancing accounted for only 6 basis points (bps) of SMM in September, the lowest single-month volume since Black Knight began tracking it in 2005, and down more than 90 percent in less than two years. Cash-out driven prepays are down by 30 percent in each of the past three months, accounting for only 17 bps of the total.

But the housing turnover driver has also shrunk. While still accounting for more than half of all prepayment activity, the annual rate of turnover has fallen by an average of 3 percent over the past six months and September's rate was more than 10 percent lower year-over-year. Black Knight says this may be due to an unusually high number of mortgage holders, who should be in their peak selling years, staying put due to rising home prices and mortgage rates.

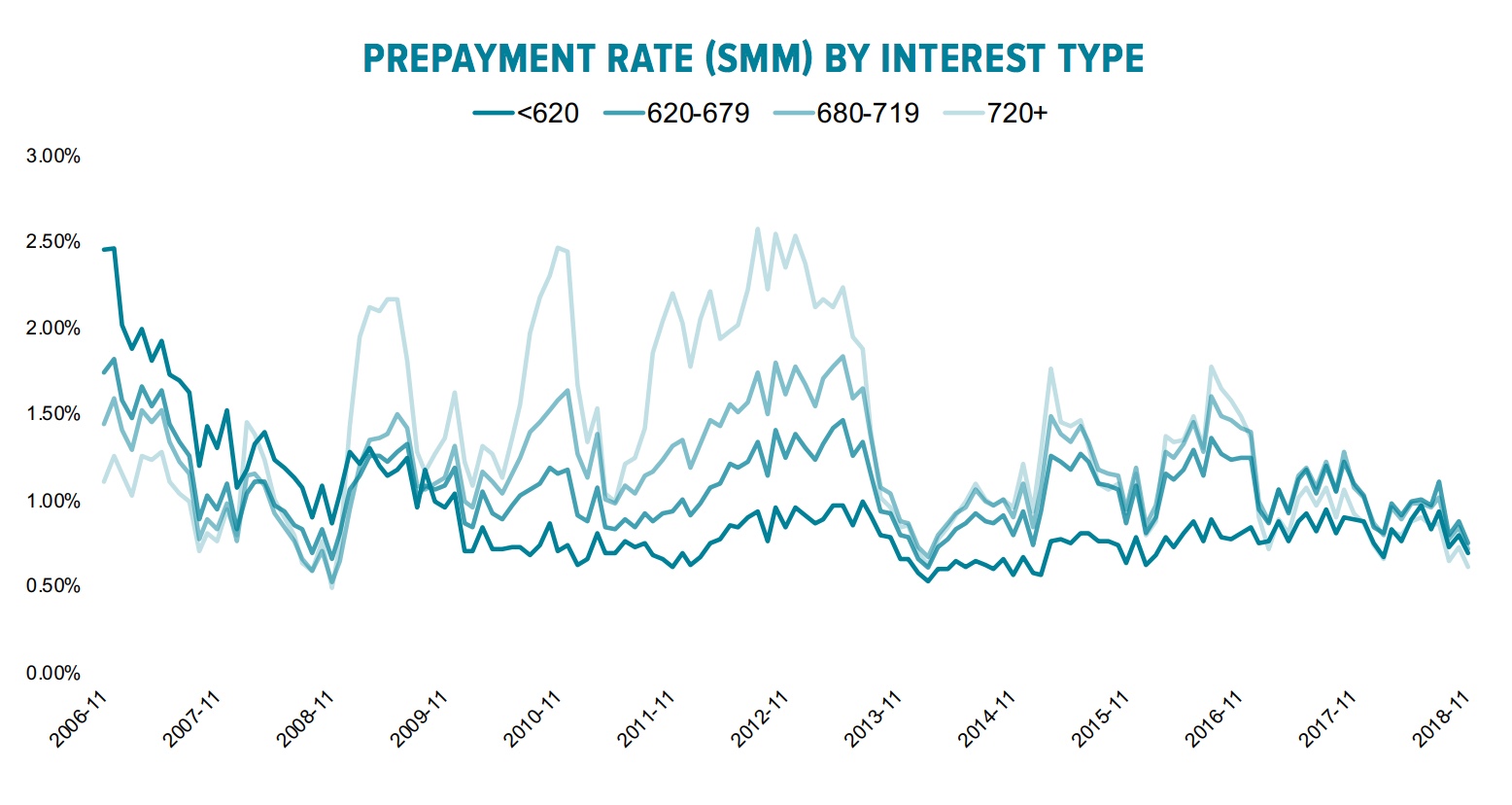

Another change is in the prepayments accounted for by various credit score buckets. Borrowers with higher scores (720+) have led the market in their rate of prepayments for each of the last four years. Black Knight points out elsewhere in the Monitor that higher credit score borrowers are usually the quickest to refinance when rates move lower and the earliest to abandon refinancing as rates rise. That appears to be the case here as the high score group has now had the lowest rate of SSM for ten of the last 12 months, declining by 58 percent from two years ago while the rate is down only 14 percent among those with the lowest credit scores.

Those borrowers trail the rest of the market in both types of refi. Rate/term refinances among this cohort were once more than 40 percent above the market average but have fallen below it in six of the last seven months. They are also refinancing to pull out cash less per capita despite holding the majority of tappable equity (equity above 20 percent). The high score cohort has trailed the market in cash-out refinancing for the last 16 months.

The high score group has lost its dominance with the other prepay drivers as well. It has gone from leading the market average for housing turnover by more than 10 percent 18 months ago to just over a 1 percent edge in the third quarter of this year. As might be expected, their prepayments due to default are usually lower than the market average, but have now fallen to 0.01 percent, the lowest since 2006. This cause has also fallen among the other credit buckets, further increasing the SSM deficit.

Black Knight concludes that these among credit score buckets can be attributed to the rising rate environment, but it is also worth a closer look at how prepay drivers have changed overall.