Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

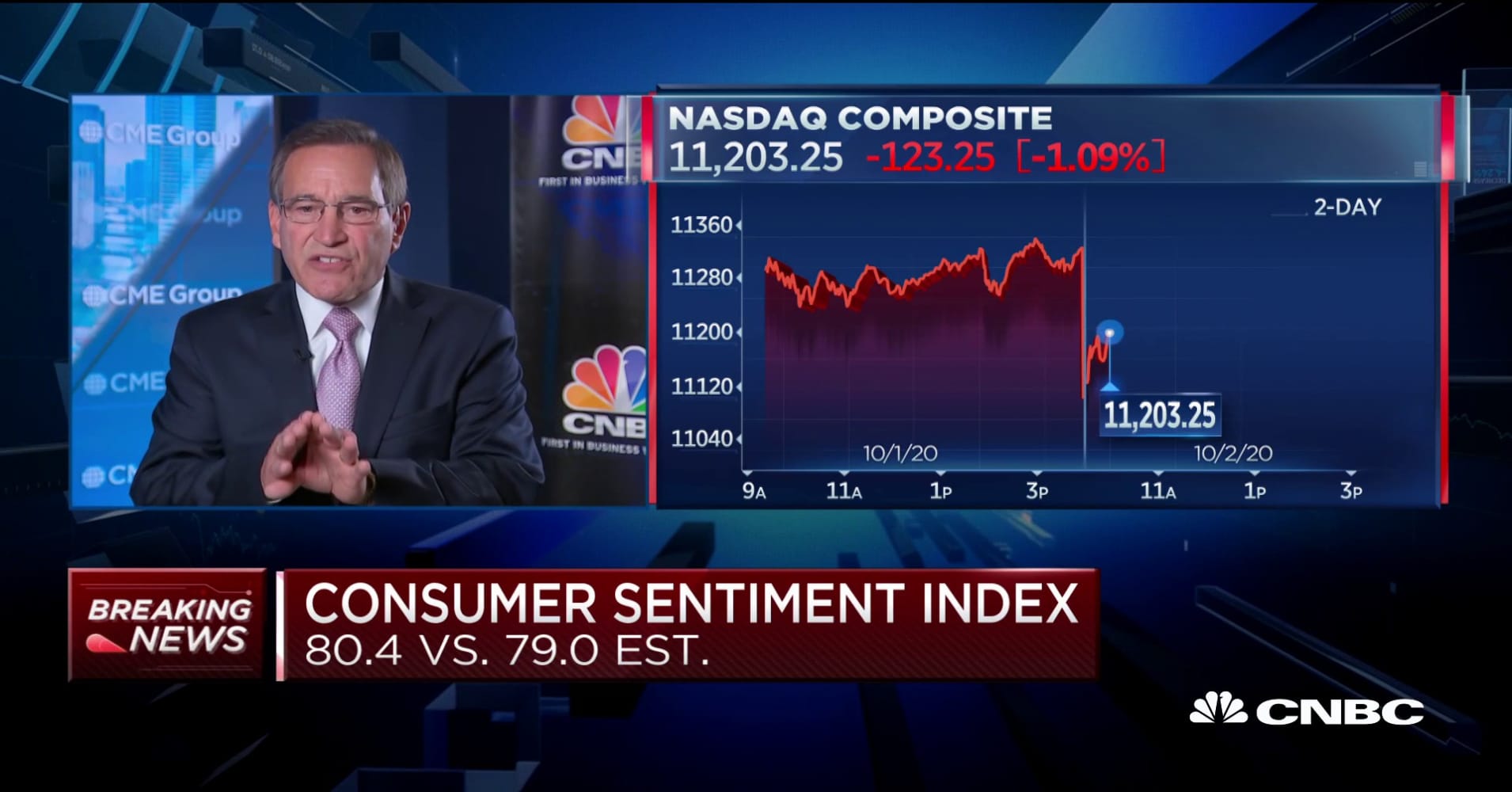

Mortgage rates were mixed today, depending on the lender. The underlying bond market (which dictates day to day changes in rates) has been more volatile in the past 48 hours compared to the past 4 weeks. Mortgage lenders respond to this volatility in different ways. It's those differences that account for higher rates for some lenders and lower rates for others. But those differences are only in day-over-day terms. In other words, one lender might be higher in rate compared to yesterday only because they didn't respond to yesterday's market volatility in a timely way. Specifically, lenders have a choice as to whether or not they will adjust their mortgage rate offerings based on market conditions. Some are jumpier than others. Quite a few lenders increased rates in the middle of the day (yesterday

|

|