Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

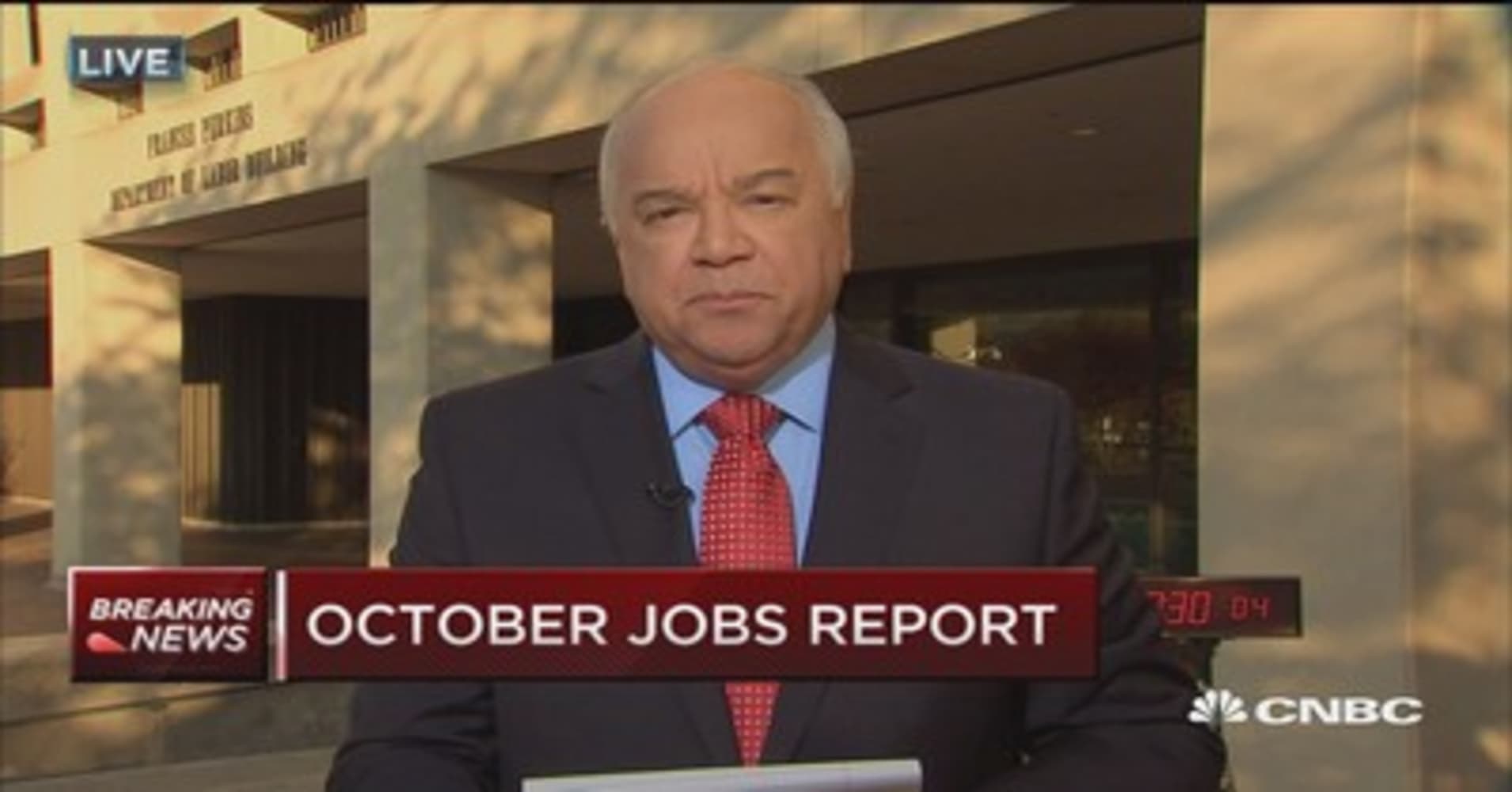

Mortgage Rates were slightly lower today--a counterintuitive move considering the big jobs report was slightly stronger that expected. To be clear, the headline of the jobs report (nonfarm payroll growth) was actually a bit lower than expected, but positive revisions to the previous 2 months more than made up it. The broadest unemployment metric (U-6) fell from 9.7 to 9.5%. And wage growth not only beat expectations, but was also revised higher for the previous month. All in all, it was definitely a better-than-average report, despite the weakness in headline job growth. Rates typically move higher when the jobs report is strong . At first, it looked like today would be no exception, but US bond markets (which dictate interest rate movements) increasingly benefited from a strong day in European

|

|