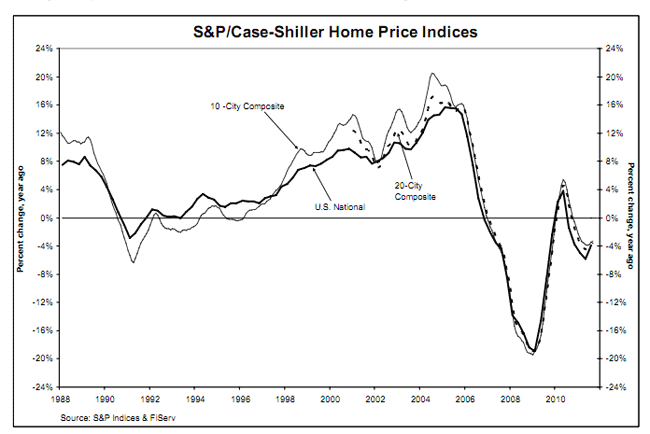

The S&P/Case-Shiller Home Price Indices for the third quarter of 2010 indicate that nationally home prices were flat relative to the second quarter. The national index was up a mere 0.1 percent on a non-seasonally adjusted basis from its second quarter level while narrowing the year-over-year decline to 3.9 percent. Prices had dropped 5.8 percent from the second quarter of 2010 to the second quarter of 2011.

August to September figures improved for 14 of the MSAs and both the 10- and 20-City Composites but both composites declined on an annual basis; the 10-City by 3.3 percent and the 20-City by 3.6 percent. Detroit and Washington, DC posted the only positive annual rates, 3.7 percent and 1.0 percent respectively. September was the third straight month that Detroit posted a positive annual change.

David M. Blitzer, chairman of the Index Committee at S&P Indices said, "Three cities posted new index lows in September 2011 - Atlanta, Las Vegas and Phoenix. Seventeen of the 20 cities and both Composites were down for the month. Over the last year home prices in most cities drifted lower. The plunging collapse of prices seen in 2007-2009 seems to be behind us. Any chance for a sustained recovery will probably need a stronger economy.

As of the third quarter, average home prices in the U.S. have retreated to their early 2003 levels. The National Index has recovered by 3.9 percent from its index low reached in the first quarter but is 3.9 percent below the level during the third quarter last year.

Atlanta, Las Vegas, and Phoenix had new index lows in September. Phoenix is now back to its January 2000 level (the base year for the Case-Shiller Index) but the other two cities have fallen even below that.

Blitzer said, "It is a bit disturbing that we saw three cities post new crisis lows. For the prior three or four months, only Las Vegas was weakening each month. Now Atlanta and Phoenix have fallen to new lows too. On a monthly basis, Atlanta actually posted a record low rate of -5.9 percent in September over August. The markets are fairly thin, and the relative lack of closed transactions might be exacerbating the downside. The relative good news is that 14 cities saw improvements in their annual rates of change, versus the six that weakened."

Three cities posted gains between August and September; Washington, DC (+1.2 percent), Portland, Oregon and New York (0.1 percent each). The 10-City Composite lost 0.4 percent and the 20-City was down 0.6 percent.

S&P/Case-Shiller recommends use of the data they supply on a non-seasonally adjusted basis however they also publish adjusted data. On an SA basis the third quarter prices for the National Index were down 1.2 percent from the second quarter compared to +0.1 on an unadjusted basis. The SA 10-City and 20-City indices were -0.4 percent and -0.6 percent respectively, identical to the unadjusted figures.

The S&P/Case-Shiller Indices are weighted averages of the metro area indices for the component MSAs. The indices' base value of 100 was set in January 2000. Thus an index value of 150 indicates that prices have appreciated 50 percent since the January 2000 date.