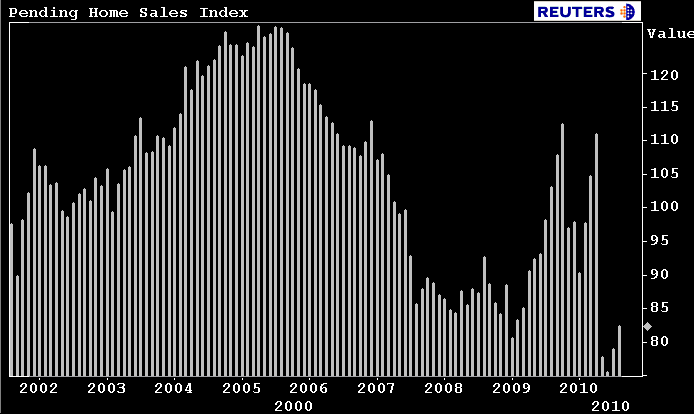

The National Association of Realtors released the Pending Home Sales Index for August today.

NAR's

Pending Home Sales Index measures the number of home purchase contracts

that were signed in the monthly reporting period. Once "pending" sales

contracts are closed, they are considered an Existing Home Sale.

Because the Pending Home Sales index tells us how many contracts were

signed, it is considered a forward indicator of Existing Home Sales. A

signed contract is not counted as an Existing Home Sale until the

transaction actually closes.

The data reflects contracts and not closings, which normally occur

with a lag time of one or two months. However, many closings have been

delayed recently from a rush of buyers into the system and slow

processing of short sales, in addition to the heavy volume and a

more

thorough loan underwriting process.

Excerpts from the Release...

Pending home sales have increased for the second consecutive month, according to the National Association of Realtors®.

The Pending Home Sales Index, a forward-looking indicator, rose 4.3 percent to 82.3 based on contracts signed in August from a downwardly revised 78.9 in July, but is 20.1 percent below August 2009 when it was 103.0. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.

Lawrence Yun, NAR chief economist, said the latest data is consistent with a gradual improvement in home sales in upcoming months. “Attractive affordability conditions from very low mortgage interest rates appear to be bringing buyers back to the market,” he said. “However, the pace of a home sales recovery still depends more on job creation and an accompanying rise in consumer confidence.”

CONSUMER CONFIDENCE HIT A 7-MONTH LOW IN SEPTEMBER....this implies we shouldn't be expecting another rise in Pending Home Sales when that data is released on November 5. It also means we should be expecting an uptick in Existing Home Sales. Get 'em to the table loan originators!

The PHSI in the Northeast declined 2.9 percent to 60.6 in August

and remains 28.8 percent below August 2009. In the Midwest the index

rose 2.1 percent in August to 68.0 but is 26.5 percent below a year ago.

Pending home sales in the South increased 6.7 percent to an index of

90.8 but are 13.1 percent below August 2009. In the West the index rose

6.4 percent to 101.1 but remains 19.6 percent below a year ago.

Although Yun expects a continuing steady rise in home sales from favorable affordability conditions and some job creation, he cautioned any sudden rise in mortgage rates could slow the recovery. “Current low consumer price inflation has helped keep mortgage interest rates very attractive this year. However, recent rising trends in producer prices at the intermediate and early stages of production, along with very high commodity prices, are raising concerns about future inflation and future mortgage interest rates,” he said. “Higher inflation would mean higher mortgage interest rates. In the meantime, housing affordability is hovering near record highs.”