A second housing price index is showing an uptick in the rate of appreciation, possibly because interest rates declines have begun to mitigate affordability issues. CoreLogic says its Home Price Index for July was up 3.6 percent in July, the annual increase in June, was 3.4 percent. On a month over month basis the gain was 0.5 percent compared to an increase of 0.4 percent the previous month. Last week Black Knight noted that the rate of increase in its index had risen for the first time in 16 months.

CoreLogic Chief Economist Frank Nothaft said, "Sales of new and existing homes this July were up from a year ago, supported by low mortgage rates and rising family income. With the for-sale inventory remaining low in many markets, the pick-up in buying has nudged price growth up. If low interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year."

Annual price gains were experienced in all states but Connecticut and South Dakota. The highest increases were posted in Idaho (11.5 percent) Utah (8.4 percent) and Maine (7.7 percent).

The company's forecast is for home prices to increase by 5.4 percent on a year over year basis from July to this year to the corresponding month in 2020. On a month-over-month basis, home prices are expected to increase by 0.4 percent from July 2019 to August 2019.

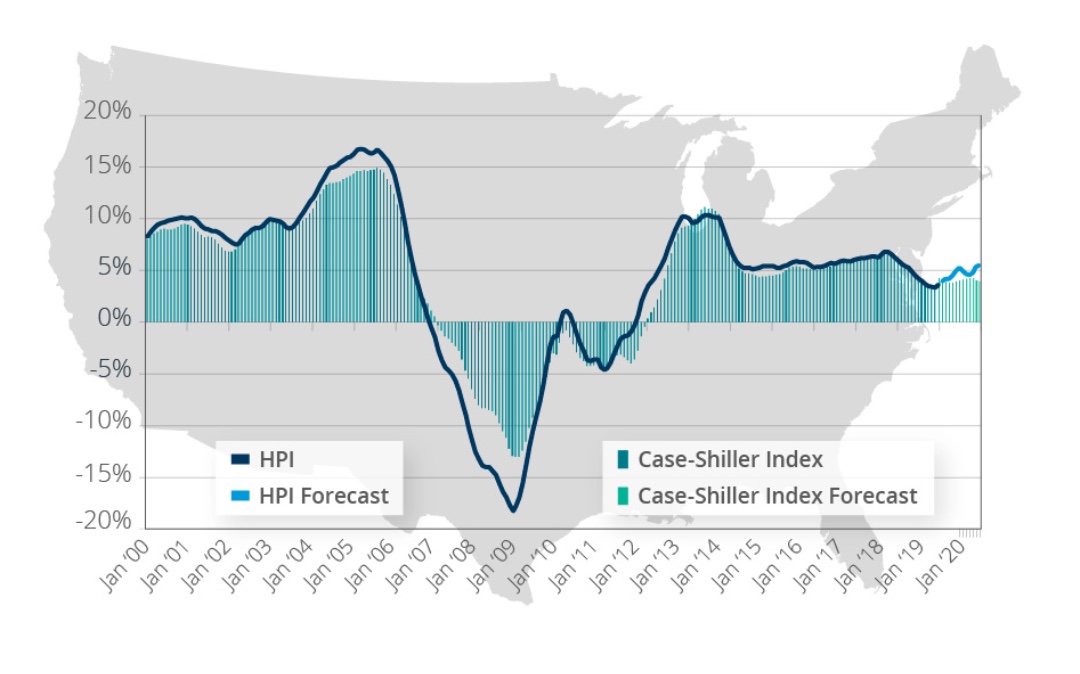

The graph below shows a comparison of the national year-over-year percent change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to present month with forecasts one year into the future. Both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive, but moderating year-over-year percent changes, and forecasting gains for the next year.

"Although the rise in home prices has slowed over the past several months, we see a reacceleration over the next year to just over 5 percent on an annualized basis," CEO President and CEO Frank Martell commented. "Lower rates are certainly making it more affordable to buy homes and millennial buyers are entering the market with increasing force. These positive demand drivers, which are occurring against a backdrop of persistent shortages in housing stock, are the major drivers for higher home prices, which will likely continue to rise for the foreseeable future."

During the second quarter of 2019, CoreLogic and RTi Research conducted a survey of Millennial generation consumer-housing sentiment. They found that approximately 26 percent of that age group expressed an interest in buying a home in the next 12 months, but only 8 percent indicated a desire to sell their home within the same time frame. This means that new housing starts, or sellers from other age cohorts, will need to make up the necessary available supply to meet the demand. This desire to buy while housing stock is limited will continue to force prices up as buyers search for a home to purchase.

CoreLogic considers 37 percent of large metropolitan areas to have an overvalued housing stock as of July. Their analysis categorizes home prices in individual markets as undervalued, at value or overvalued by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals such as disposable income. Twenty-three percent were undervalued, and 40 percent were at value. When the analysis is done on only the top 50 markets 40 percent were overvalued, 16 percent were undervalued, and 44 percent were at value.