Several weeks ago we summarized CoreLogic's first cut at quantifying the potential effects of the planned expiration of the Consumer Financial Protection Bureau's (CFPB's) Qualified Mortgage "GSE Patch." In his blog article, CoreLogic's Pete Carroll found that roughly 16 percent or $260 billion of 2018 mortgage loan origination volume was considered to be a qualified mortgage (QM) due to exemptions granted through the Patch. Roughly three-quarters of that share were estimated to have a safe harbor through that patch - i.e. the lender is assumed to have made a reasonable determination of the borrower's ability to repay and is thus essentially immune from legal action if there is a default. About 4 percent were considered QM Rebuttable Presumption loans, i.e. without that legal protection. The Patch, in simplest terms, grants QM status to credit-worthy borrowers with debt-to-income (DTI) ratios exceeding the QM standard of 43 percent.

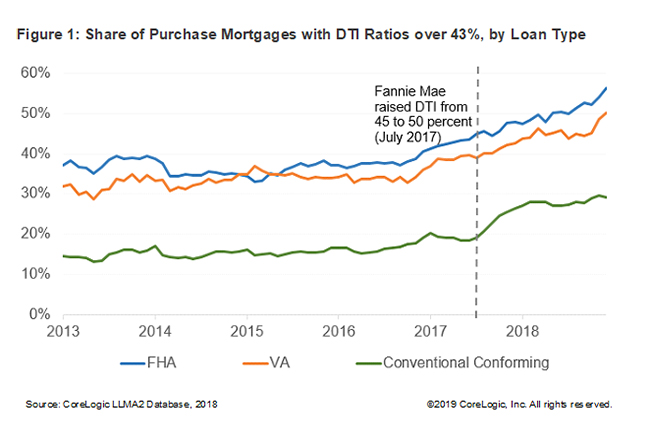

In the second installment of the analysis, Archana Pradhan used the company's loan servicing data to determine the profiles of borrowers likely to be found in the above 43 percent DTI group. About 32 percent of the 2018 vintage of purchase loans had DTI ratios greater than 43 percent, up 12 percentage points compared to 2014 (the year after the QM Rule and the Patch went into effect.) The share of higher DTI loans has increased since 2014 across all lenders, but the share of high DTI conventional purchase mortgages jumped sharply after Fannie Mae increased its DTI ratio level from 45 percent to 50 percent in July 2017, up 13 points to 28 percent.

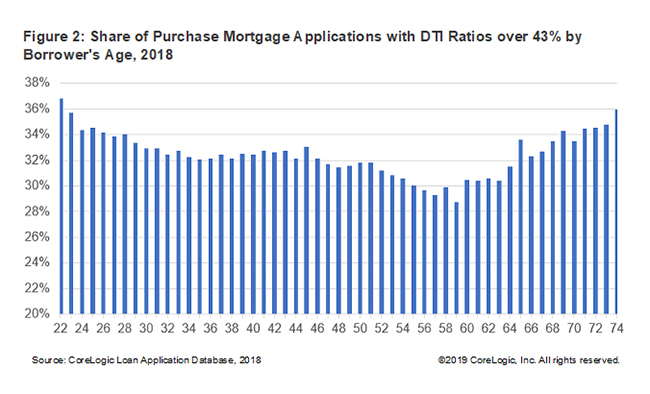

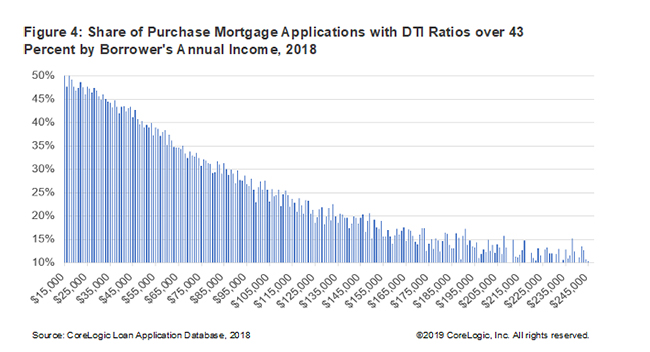

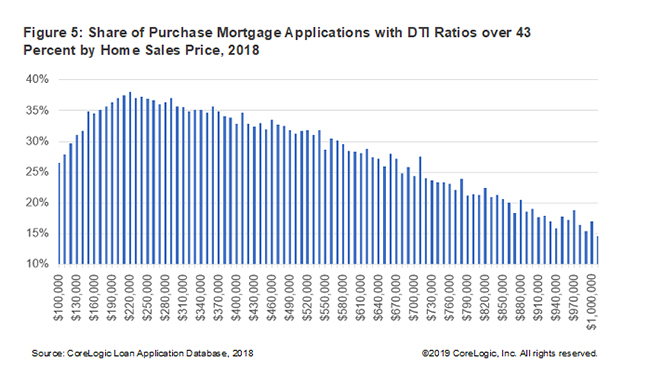

CoreLogic's loan application data illustrates that the current GSE Patch disproportionately benefits younger millennials and retirees, Non-W-2 borrowers, low-income borrowers, and borrowers purchasing low-to-mid-priced homes. Thus, it is assumed these will switch to Non-QM loans if the CFPB holds to its stated policy of allowing the patch to expire in January 2021.

Borrowers below the age of 33 and those over 65 had highest share of high DTI purchase mortgage applications. Younger millennials tend to be first-time buyers, often with student or other debt, are just starting their careers and thus tend to have lower earnings than others. Older borrowers are frequently retired, and their lower incomes tend to increase a DTI even where there is little debt.

Those covered by the Patch are also likely to be Non-W-2 wage earners, often self employed, retired, seasonal workers, or those in the gig economy. About 37 percent of Non-W-2 wage earners had purchase mortgage applications with DTI ratio over 43 percent in 2018 compared to just 32 percent for W-2 borrowers.

The analysis, not surprisingly, found that low-income borrowers are most likely to be affected by expiration of the Patch. The figure below shows that as income declines, the share of high DTI applications increases.

Likewise, the impact is likely to be higher for borrowers purchasing low-to-mid priced homes. They also had the largest shares of high DTI loans.

In a subsequent blog article Pradhan will look at the impact of the expiration by race/ethnicity, income category, and property location.