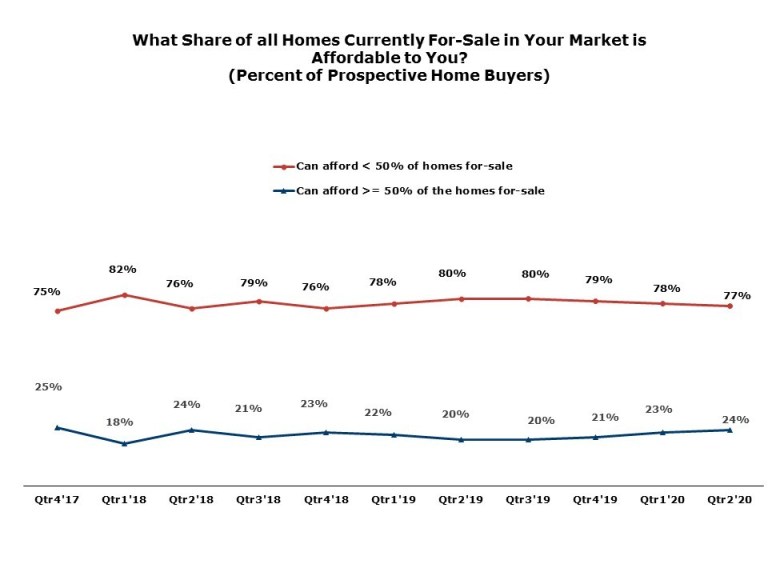

The National Association of Home Builders' (NAHB') Housing Trends Report for the second quarter of 2020 found slightly less than a quarter of prospective home buyers could afford a median-priced home in their local markets, leaving 77 percent shut out. However, Rose Quint, writing in NAHB's Eye on Housing blog, calls that an improvement from a year ago when only 20 percent could buy. She says that lower interest rates are responsible for the change.

There is remarkable similarity across generations. Among Gen Z, Millennials, and Boomers, 76 percent of buyers can afford fewer than half the homes for sale in their markets. Among Gen X buyers the share is even higher, 78 percent. There was also little difference in affordability across regions.

Quint says the data for the report was collected between June 16 and June 28 which is important. The results need to be interpreted in the larger context of the US economy and the trajectory of new cases of the coronavirus. In June, the labor market showed signs of recovery, gaining 4.8 million jobs and a lower unemployment rate. The 30-year fixed mortgage rate continued to fall, reaching 3.13% by the last week of the month and the COVID case rate nationally had been stable through the first half of the month, only beginning to climb around June 15. For these reasons, NAHB assessed the responses as reflecting a period of general improvement.

The data for the quarterly Housing Trends report is derived from national polls of a representative sample of American adults. Because of the short time horizon only year-over-year comparisons are considered valid.