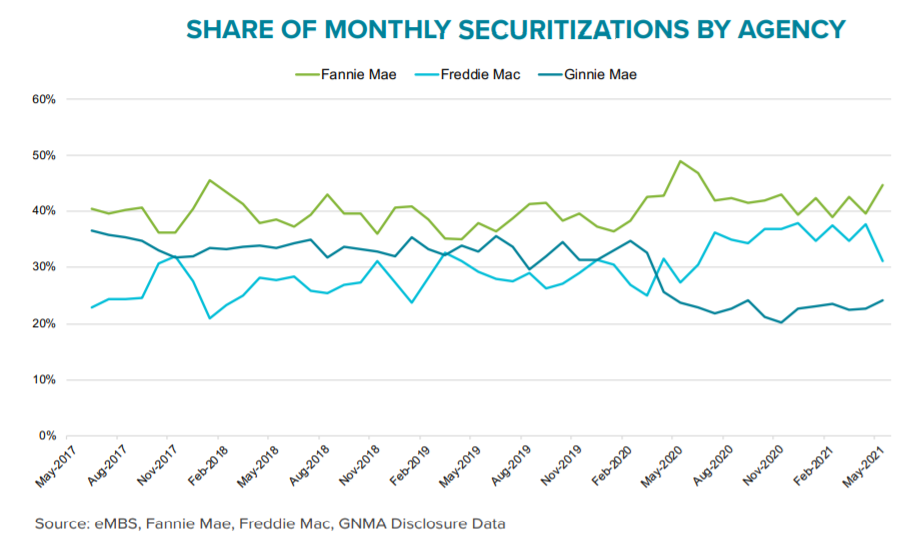

We recently summarized a report from the Urban Institute (UI) about the apparent reluctance of sellers to entertain offers from prospective buyers intending to use FHA or VA financing. UI based its conclusion on both a survey of real estate agents conducted by the National Association of Realtors and the recent decline in the FHA and VA share of originations. Black Knight, in its new Mortgage Monitor covering loan performance data for May, validates, to an extent, UI's suggestion, using recent issuances of mortgage-backed securities (MBS).

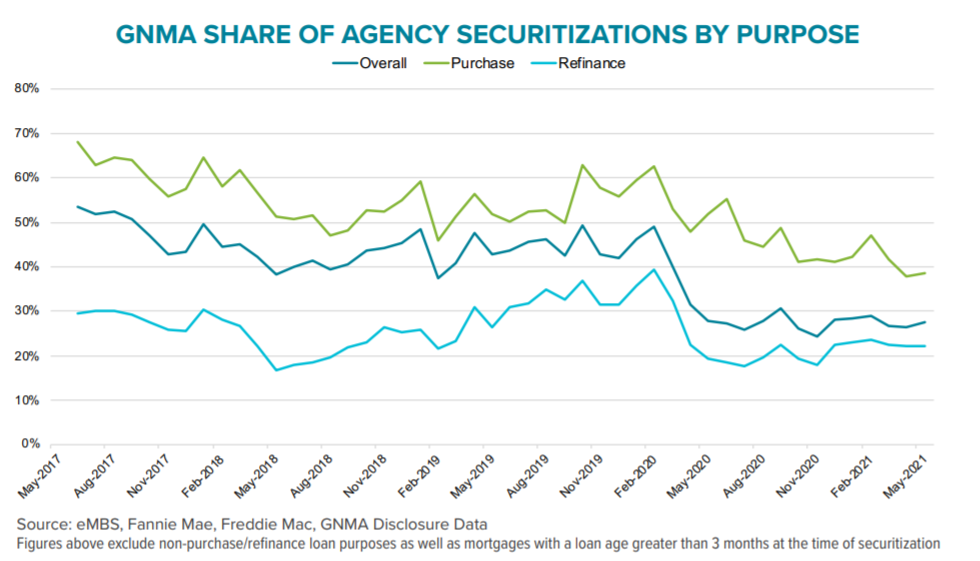

The company says that Ginnie Mac's securities, composed primarily of FHA and VA loans, represented about one third of the agency market before the pandemic. It has dropped to less than 25 percent in recent months. The loss has been driven in part by borrowers with higher balances, more equity, and better credit scores reacting to the opportunity offered by low rates and refinancing. Those borrowers are typically able to obtain GSE (Fannie Mae and Freddie Mac) mortgages. There has also been a trend of FHA borrowers, with increased equity, being able to refinance out of FHA mortgages and its lifetime requirement of paying into the mortgage insurance fund.

But Ginnie Mae's share of purchase lending has also fallen, dropping below 40 percent in April and May for the first time in recent history. Like UI, Black Knight attributes this to the more rigid inspection standards required of FHA borrowers and the unwillingness of sellers to bet on a successful closing in the hypercompetitive market.

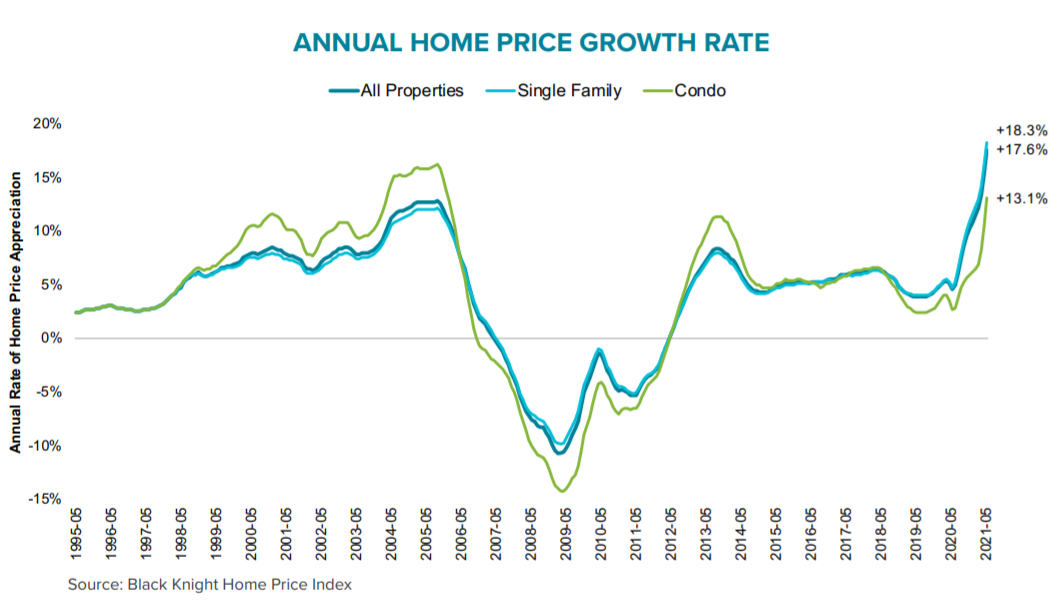

May was another month of record home price growth, the third in a row. May's 18 percent year-over-year increase dwarfed April's record 14.8 percent gain. Black Knight Data & Analytics President Ben Graboske says, "Frankly, home values are appreciating at rates we've simply never seen before, as low interest rates, ultra-scarce inventory and increasingly competitive homebuyers combine to create a truly unprecedented market."

The average home price is now up more than 10 percent ($33K) through the first five months of 2021 alone and nearly $63K (+20.3 percent) since the onset of the pandemic.

The rate of growth is still accelerating, increasing by more than 2 percent in both April and May. Single month growth of 2 percent had never been observed in any single month prior to the start of 2021 and May's growth of 2.1 percent was the sharpest increase in Black Knight's records that date back to the mid-1990s. The company's Collateral Analytics group says its sales data for the first three months of June suggests that the acceleration may continue. Median sales prices of single-family homes rose 25 percent on an annual basis over that period.

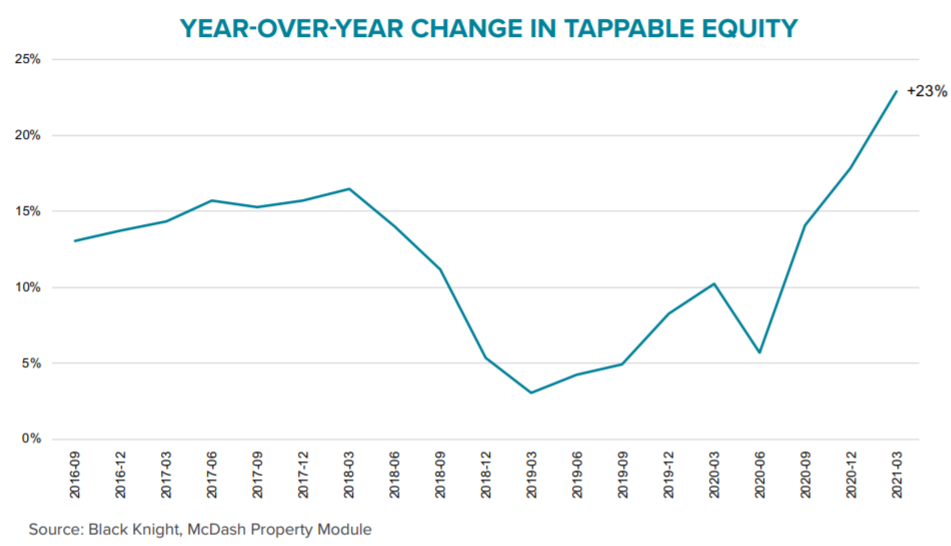

The appreciation has pushed tappable equity to another record high, an aggregate of $81 trillion at the end of Quarter One. Homeowners with a mortgage saw tappable equity (the amount available to take as cash out while maintaining a loan-to-value (LTV) ratio of 80 percent or less) increase by 11 percent during the quarter to an aggregate gain of $800 billion and growth of 23 percent on an annual basis.

The average homeowner could now tap $153,000 in equity, up $16,000 from the end of 2020's Q4. Overall mortgage debt is now only 48 percent of associated home values nationwide, the lowest percentage since at least 2005.

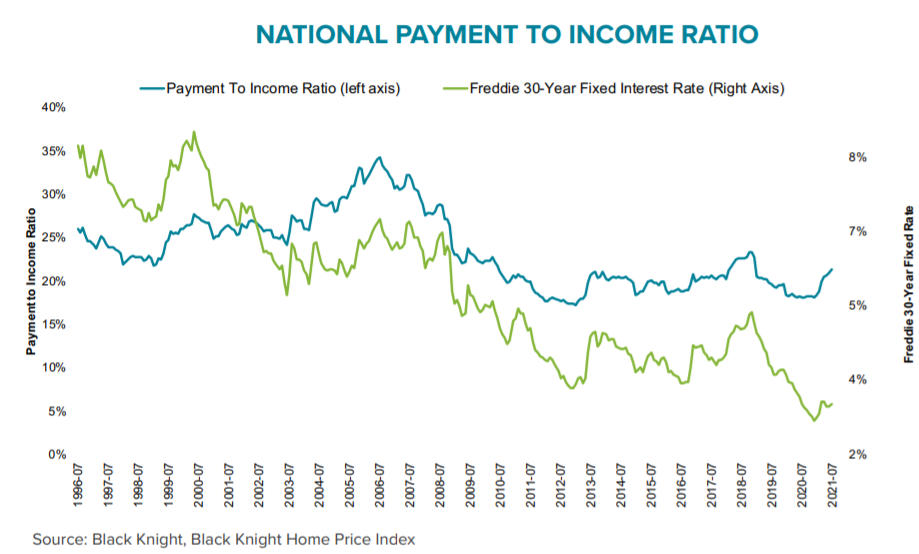

Of course, there is a downside to these price increases. Those huge price gains also contribute to affordability concerns. With prices up $33,000 since the first of the year, it now requires $191 more in monthly principal and interest payments to purchase the average home. Assuming a 20 percent down payment, the mortgage payment on an average home will now consumer 21.3 percent of the median national income. Even though the 30-year fixed-rate mortgage has remained relatively stable around 3.0 percent, this is an 18.1 percent increase in the payment to income ratio since the first of the year.

Black Knight notes that while equity levels have risen, so has the share of cash-out refinancing. Of course, this is partially due to the uptick in mortgage rates which have reduced the number of rate/term refinance candidates from 14.1 million the week before the last Federal Open Market Committee meeting to 12.2 percent the following week. That pool has a potential of $3.4 billion in monthly savings through refinancing, but the company said borrowers have been less reactive to refinance incentives in recent weeks.

On the other hand, nearly half of tappable equity is held by borrowers with current interest rates above 3.75 percent, presenting an opportunity to both reduce rates and pull cash out of their homes. Forty-two percent of refinance rate locks during the first three weeks of June were cash-out loans, the highest share in more than two years. But nearly a quarter of tappable equity is held by homeowners with rates below 3.0 percent which could also create a demand for second mortgages such as home equity lines of credit (HELOCs).

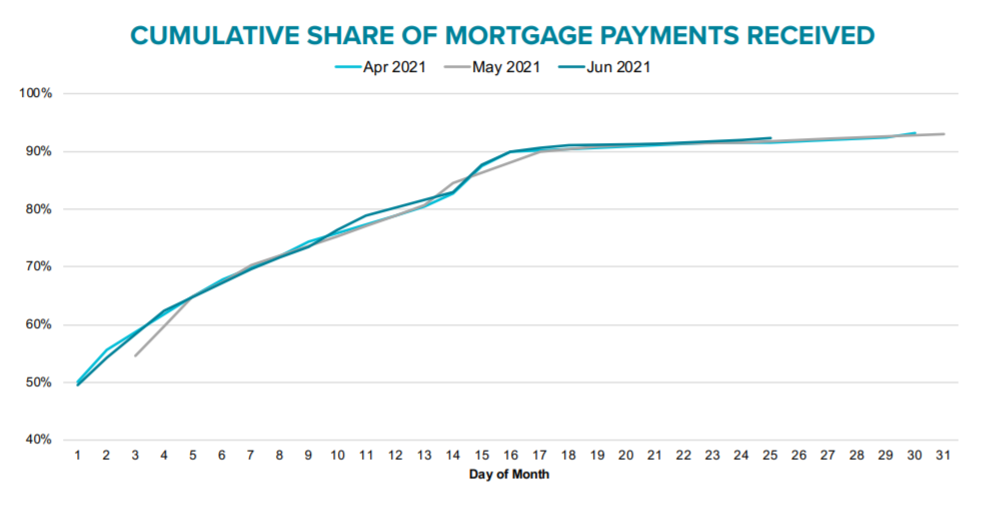

Finally, in its "first look" at May data, Black Knight attributed a 1.5 percent increase in the mortgage delinquency rate to the calendar. The month not only ended on a Sunday, leaving less time to process last minute mortgage payments, but the following Monday was the Memorial Day holiday. The number of past due mortgages rose 11,000 compared to the previous month.

The company updated that information in the Mortgage Monitor. By May 25, 91.8 percent of borrowers had made their May payment, the most since the pandemic started. This suggests that delinquencies would have continued their previous declines had the calendar not intervened. This was more or less validated by the next month's performance through June 25. About 92.3 percent of the month's payments had been received by that date.