The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending May 14, 2010.

Michael Fratantoni, MBA's Vice President of Research and Economics summed up the survey:

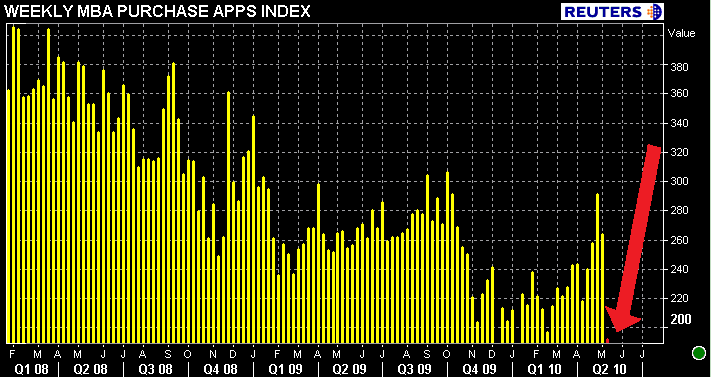

"Purchase applications plummeted 27 percent last week and have declined almost 20 percent over the past month, despite relatively low interest rates. The data continue to suggest that the tax credit pulled sales into April at the expense of the remainder of the spring buying season. In fact, this drop occurred even as rates on 30-year fixed-rate mortgages continued to fall, and at 4.83 percent are at their lowest level since November 2009....However, refinance borrowers did react to these lower rates, with refi applications up almost 15 percent, hitting their highest level in nine weeks."

The Mortgage Banker's application survey covers over 50% of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payments which can result in increased disposable income and consumer spending (or give consumers a chance to pay down other debts like credit cards). A rising trend of purchase applications indicates an increase in home buying interest, a positive for the housing industry and the economy as a whole.

From the Release...

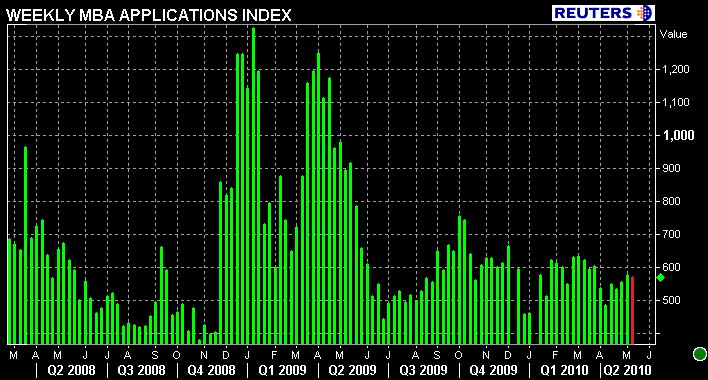

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3.1 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is up 0.8 percent.

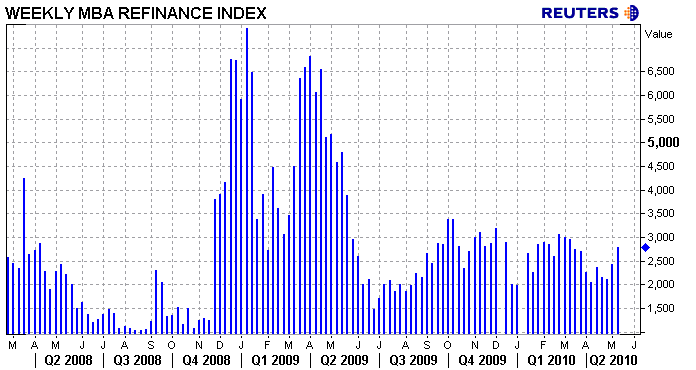

The Refinance Index increased 14.5 percent from the previous week. The four week moving average is up 4.5 percent for the Refinance Index. The refinance share of mortgage activity increased to 68.1 percent of total applications from 57.7 percent the previous week.

The seasonally adjusted Purchase Index decreased 27.1 percent from one week earlier. The unadjusted Purchase Index decreased 27.0 percent compared with the previous week and was 24.1 percent lower than the same week one year ago. The four week moving average is down 4.6 percent for the seasonally adjusted Purchase Index.

This is the lowest Purchase Index observed in the survey since May of 1997.....

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.83 percent from 4.96 percent, with points increasing to 1.08 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.19 percent from 4.32 percent, with points increasing to 1.36 from 0.81 (including the origination fee) for 80 percent LTV loans. This is the lowest 15-year contract interest rate ever recorded in the survey. However, due to the increase in points, the effective rate was essentially unchanged from last week.

The average contract interest rate for one-year ARMs decreased to 6.81 percent from 6.86 percent, with points increasing to 0.37 from 0.35 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity remained constant

at 6.3 percent of total applications from the previous week.

Uh oh. The industry's worst fears might be coming true. Regardless of record levels of affordability (reset home prices and mortgage rates below 5.00%), purchase demand continues to decline after the expiration of the homebuyer tax credit.

THIS HAS LED THE INDUSTRY TO COLLECTIVELY ASK: WHERE WILL NEW BUSINESS BE GENERATED IF HOMEBUYER DEMAND WAS EXHAUSTED BY THE EXPIRATION OF TWO TAX CREDITS?

If this develops into a trend I fear broader economic and financial market consequences could play out. The failure of housing to maintain tax credit momentum would call a great deal of attention to the fact that 6.7 million Americans have been unemployed for longer than 27 weeks. It would remind market participants that the broadest measure of unemployment, which includes discouraged workers and those who are underemployed, rose to 17.1% in April.

This is not a problem the Federal Reserve can fix by purchasing more "rate sheet influential" mortgage-backed securities. This is a structural issue for housing...This is an "I CAN'T QUALIFY" to buy a home problem.

Is this a sign that we should all wave the white flag and find another job? Did the MBA miss more apps than usual this week? You tell me...has new purchase business gone cold?

I am not really sure what else to say here...this is deflating data and hopefully not indicative of things to come this summer. There is always the chance that refinance activity picks up steam as rates move closer to the lows of 2009, but you can bet profit margins will be tight on those loans as everyone left originating is competing for the same loans and willing to earn $1 instead of $0. Plus we can't overlook SHADOW BUYERS who are waiting around for home prices to fall a bit more. FANNIE MAE WARNED US THIS WOULD HAPPEN. Maybe this is just a tax credit hangover?

Tax credit loans have until June 30 to close. Originators who are still busy working those deals should not be placated by the government induced uptick in activity. Keep pushing whatever marketing you utilize (seller concessions) while you work to close those deals (a feat of its own)...the industry looks like it is about to contract a little more, competition for business will be fierce.