Ginnie Mae has issued a formal request for input regarding changes to its II Multi-Issuer Program (GII MIP). That program represents almost a third of the mortgage-backed securities (MBS) issued by the agency. The program uses an aggregation of loans from a wide variety of lender/servicer issuers and contains loans with a broad base of loan characteristics.

The agency says it is vigilant about any trend that might affect investor confidence in the program, and this was noted in the recent attention paid to what was termed "churning" of loans originated through the Department of Veterans Affairs (VA) that were being rapidly prepaid through the streamlined loan process. (That issue was reported on by MND in February 2018.) Counterparty risk arose when issuers specialized in such products and constructed overly concentrated servicing portfolios.

The actual and projected levels of loan prepayments is a primary concern to MBS investors and analysts, especially when the security was sold at an above-par price. While prepayments are a well understood feature of this type of investment, concerns arise when investment losses because of refinancing appear out of sync with economic fundamentals.

When trading of the GII MIP securities were compared to securities issued by Fannie Mae it appeared that the former appeared susceptible to refinance activity out of proportion to what should be expected under prevailing conditions, i.e. uncorrelated refinance spikes. This raises concerns over whether such a discrepancy will negatively impact investor confidence in the securities and thus the relative price they achieve in the market. Any deterioration in price translates directly into higher borrowing costs for the homeowners Ginnie Mae is intended to service.

Policymakers have noted the consumer protection aspects. Congress, Ginnie Mae, and the VA have taken several actions to curb the rapid refinancing in the VA program including a six-month seasoning requirement for streamline refinance loans and cash-out refinances before they are eligible for pooling. Ginnie Mae also identified security performance as being subject to standards of acceptable risk and began reviewing it at the issuer level and restricting issuers whose performance deviated substantial from that of others.

The agency says it believes that these policy initiatives have probably had moderate success in reducing uncorrelated spikes but is not convinced that the current safeguards are sufficient. Non-correlated VA refinancing continues to be evident and, to the extent it is the focus of investors and analysts, not healthy for Ginnie Mae's mission.

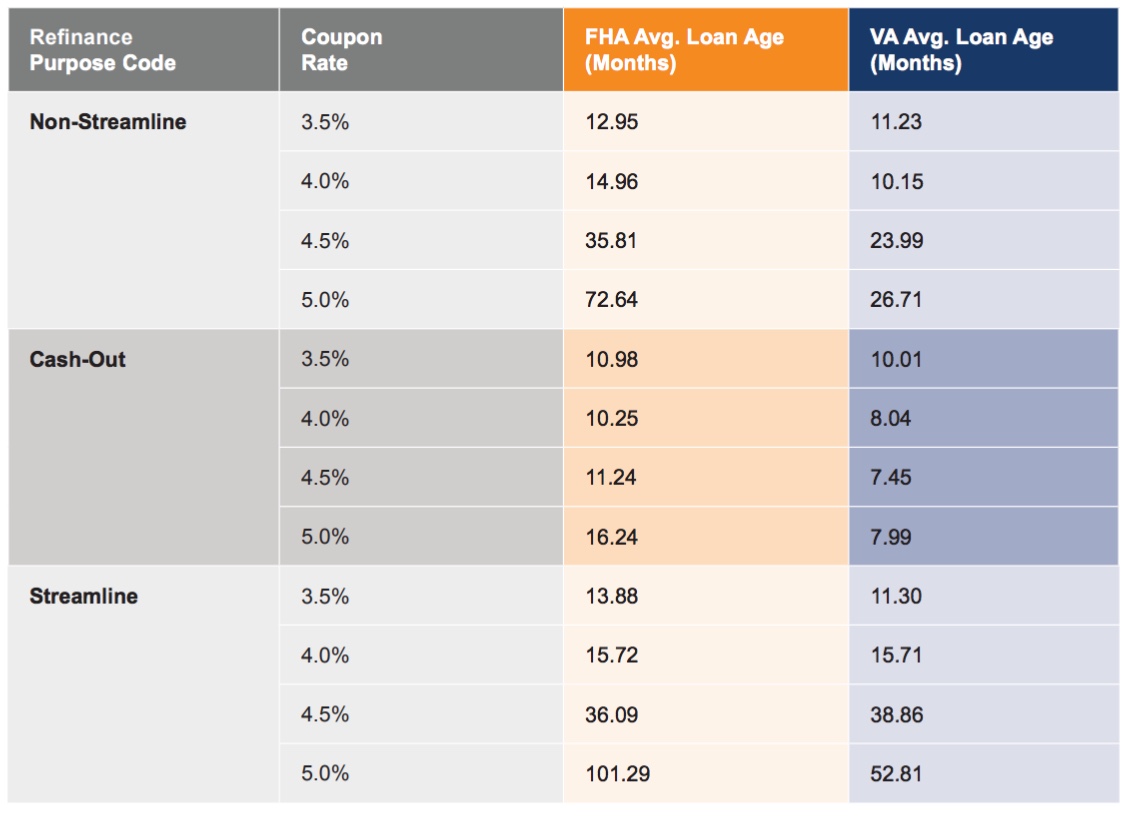

The agency has been reviewing loan data in order to understand the relative performance of different loan categories. Looking at pooling and monthly reporting data from January 2017 to March 2019 they have found that,

- Refinance loans liquidate with greater frequency than purchase loans.

- VA refinance liquidations occur on average earlier than do those of FHA loans.

- VA cash-out refinance loans with higher loan-to-value (LTV) ratios liquidate with greater frequency and with more impact on prepayments than FHA loans with comparable LTVs.

The loans that were analyzed were originated at differing times relative to the policy changes noted above, particularly the VA rule, so it is difficult to determine the impact of the changes. It is also difficult to determine how much the differences in performance of the VA and FHA loans may be attributed to the parameter differences in the two programs, differences which are one of the purposes of the GII MIP. However, despite program requirements, there appear to be other dynamics at play, particularly as it relates to prepayment speeds and the security performance.

Ginnie Mae says it is exploring further actions and the Request for Input is to give program stakeholders and observers a chance to provide analysis and insight to guide the agencies decisions. It sets out two areas for consideration.

The first is the need to ensure that the loans made serve the interest of homeowning veterans. The second is the extent to which the more lenient VA requirements are fostering short-term borrowing patterns at odds with the GII MIP program. Ginnie Mae views the GII MIP products as those where the average lifespan can be expected to align with ownership of the property, adjusted periodically to improve loan terms when interest rate cycles are favorable.

Cash-out refinances serve a role for borrowers, but usually on a smaller scale as both FHA and the GSEs Fannie Mae and Freddie Mac have more stringent LTV requirements for cash-outs than does the VA. Ginnie Mae is concerned that its program, due to the combination of a greater volume of VA loans and current borrowing and lending practices, is serving as a short-term vehicle for consumer finance to a greater degree than previously and this situation may be having an adverse impact on pricing these securities. This would also result in cross-subsidization of the remaining high LTV VA, FHA, and USDA borrowers whose loans are commingled in the security.

One change under consideration is the exclusion from or restricting within the acceptable GI MIP loan type categories those loans than can be expected to prepay at significantly higher rates. Because of their performance history in the securities and the difference in their LTV requirements from FHA and GSE loans, this would mean specifically VA cash-out refinances in excess of 90 percent LTV.

If such an exclusion or restriction is enacted and given its mission, Ginnie Mae would seek to provide an alternative securitization pathway. The logical possibilities for doing this would be single-issuer custom securities, imposition of a de minimis standard restricting inclusion in the MIP, or creation of a new MIP specifically for shorter duration loan types.

Given these issues, Ginnie Mae is inviting comments on four topics:

1. The extent to which the varying prepayment performance of different loan types should be considered acceptable.

2. Further analysis on the propensity of high LTV cash-out refinances to prepay and whether 90 percent LTV is the appropriate threshold for any restriction or exclusion.

3. Further analysis on the impact of the VA high LTV loans' propensity to repay on pricing of the securities.

4. Input on an alternative securitization path should these loans be excluded/restricted, including discussion of marketability, pricing, liquidity and TBA market implications.

Comments must be submitted to Ginnie Mae by 3 p.m. EDT on May 22.