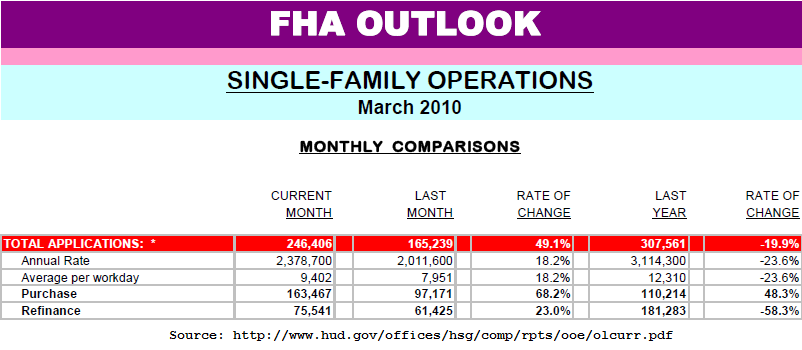

FHA mortgage applications rose dramatically in March to a total of 246,406 compared to 165,239 in February, an increase of 68 percent.

Over two-thirds of the applications, 163,467, were for the purpose of purchasing a home while 75,541 were requests for refinancing. 7,398 were applications for Home Equity Conversion Mortgages (HECMs) or reverse mortgages. In February those numbers were 97,171, 51,425, and 6,643 respectively.

The figures were contained in the monthly FHA Outlook released by the Department of Housing and Urban Development yesterday Morning. The report revised the annualized application rate upward from 2.01 million in the last report to 2.38 million based on the March figures.

The rise in applications was believed to reflect the upcoming expiration of the $8,000 tax credit for first time buyers and $6,500 credit available to "move-up" homebuyers. A sales contract must be in place by the end of April and the entire sale finalized by June 30 for homebuyers to qualify for the credit. The surge in applications, especially during the last week of the month, may also reflect a race to obtain a mortgage before the increase in the FHA up-front premium which took effect on April 5.

FHA endorsed 132,301 mortgages for insurance during March; a total dollar value of 24.1 billion, compared to 131,978 and $24.4 billion in February. March endorsements included 82,879 purchase money mortgages, 43,600 refinanced mortgages, and 5,822 reverse mortgages. Of the refinances, 28,596 were conventional to FHA and 15,003 were prior FHA mortgages. 10,695 of the refinances were cash out, 24.5 percent of the total.

Endorsements for FY2010 to date total 935,349 ($171.1 billion) compared to 867,749 ($158.2 billion) at the same time in FY 2009. Purchases account for 550,885 or 58.9 percent of those endorsements compared to 444,078 or 51.2 percent during the similar period last year. FHA is projecting a total of 1.875 endorsements for the entire year. To date 81.4 percent of FHA endorsements have been for first-time buyers, up from 77.4 percent during the similar period in 2009.

Thus far in FY2010 FHA has refinanced 339,215 properties, down from 365,782 during the same period last year. 164,185 of these were refinanced from other FHA mortgages while 175,028 were conventional to FHA refinances. Cash-out mortgages represent 18.9 percent of refinances thus far in FY2010 compared to 24.6 percent one year earlier.

In March the average processing time for all mortgages from application to endorsement was 11.1 weeks and 88 percent were accepted and endorsed using the FHA scorecard (TOTAL). The weighted average FICO score for FHA mortgages in March was 697.

At the end of March FHA had 6,114,452 mortgages outstanding with an unpaid principal balance of $805.6 billion. One year ago there were 4,904,167 FHA mortgages on the books with an unpaid balance of $577.2 billion. This is an increase of nearly 25 percent in the number of FHA loans and almost a 40 percent increase in the portfolio value.

Delinquencies in FHA loans declined slightly in March from 553,929 to 536,858. The delinquency rate was down from 9.2 percent in February to 8.8 percent at the end of March.