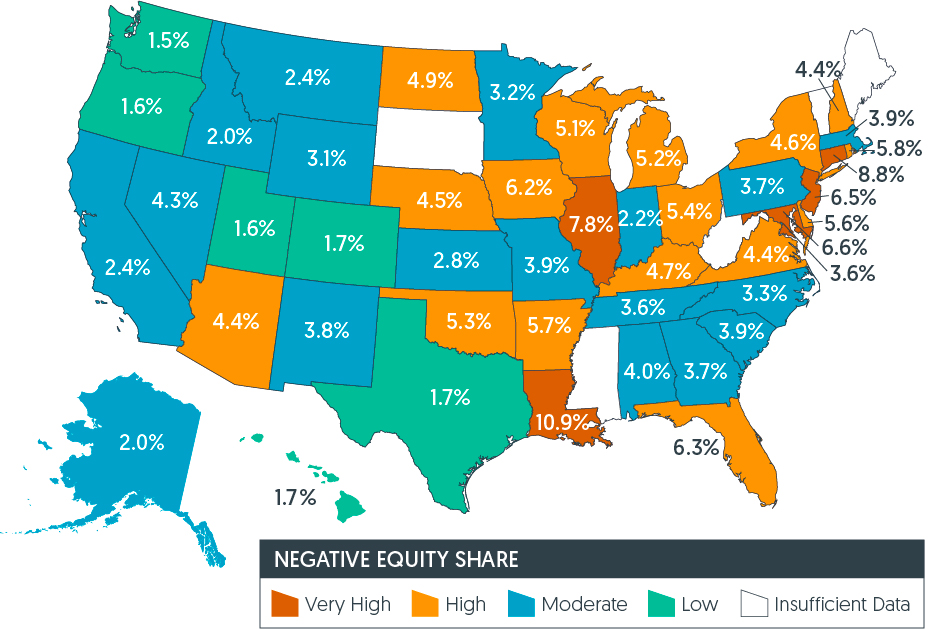

While homeowner equity increased overall during the fourth quarter of 2018, the number of homeowners with negative equity rose for the first time in 12 quarters. Homeowners who were underwater, owing more on their mortgage than the value of their home, rose by 35,000 although it declined year-over-year by 350,000 or 14 percent.

The fourth quarter increase raised negative equity by 1.6 percent from the previous quarter to 2.2 million homes. Those homes represent 4.2 percent of mortgaged properties. That too was an annual decline from a national negative rate of 4.9 percent one year earlier.

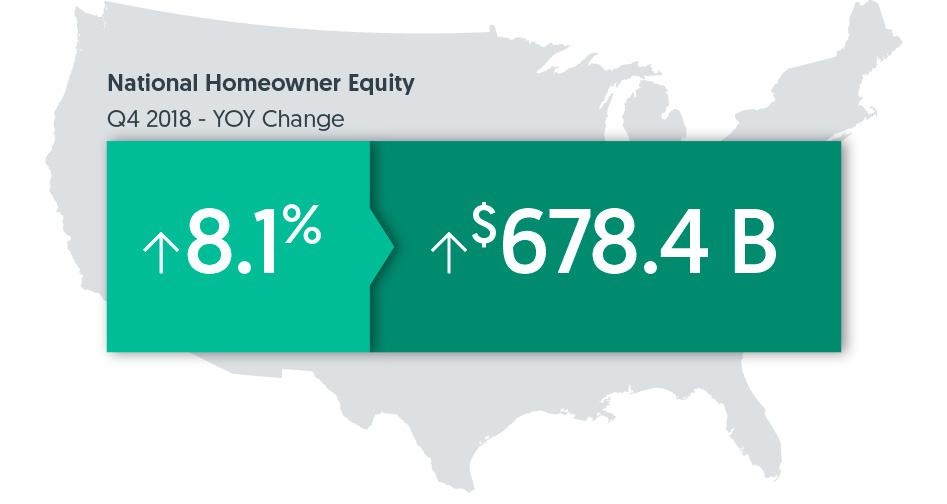

Despite that blip, homeowners with a mortgage, accounting for roughly 63 percent of total residential properties, saw their equity increase by 8.1 percent or $678.3 billion since the fourth quarter of 2017. This is an average gain of $9,700 for each homeowner. Nevada, where home prices are rising faster than in any other state, had the highest year-over-year average increase at $29,400. Three states, North Dakota, Connecticut, and Louisiana saw average homeowner equity decline over the year.

Frank Martell, president and CEO of CoreLogic, points out that rising home prices are leading homeowners to invest in their homes. "As home prices rise, significantly more people are choosing to remodel, repair or upgrade their existing homes," he said. The increase in home equity over the past several years provides homeowners with the means to finance home remodels and repairs. With rates still ultra-low by historical standards, home-equity loans provide a low-cost method to finance home-improvement spending. These expenditures are expected to rise 5 percent in 2019."

The national aggregate value of negative equity was approximately $300.3 billion at the end of the fourth quarter of 2018. This is up quarter over quarter by approximately $17.4 billion, from $ 282.9 billion in the third quarter of 2018.

Negative equity peaked at 26 percent of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

Frank Nothaft, CoreLogic Chief economist offered the following forecast. "The CoreLogic Home Price Index predicts there will be a 5 percent increase in our national index from December 2018 to the end of 2019. If all homes experience this gain, this would lift about 350,000 homeowners from being underwater and restore positive equity."