The Commerce Department today released January New Construction Spending data.

Previous Release: December New Construction Spending

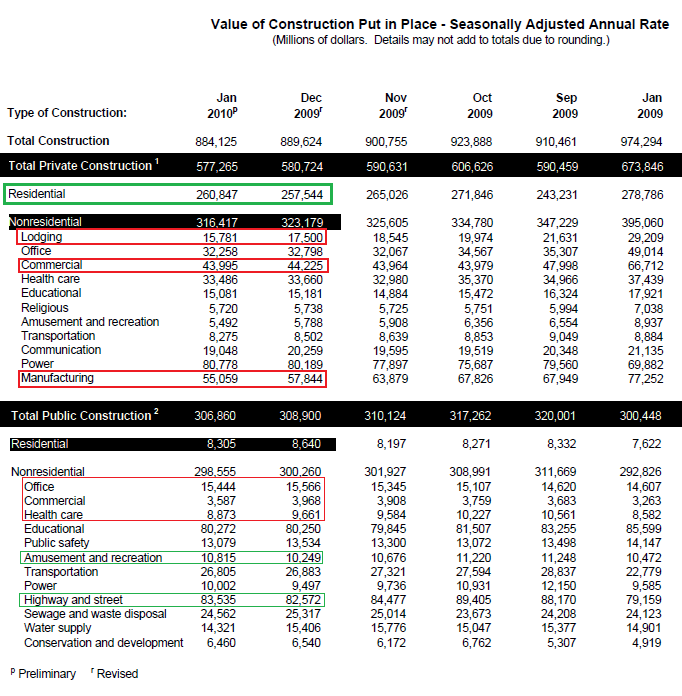

Total New Construction Spending fell 1.2 percent to $889.6 billion in December. This was worse than estimates which called for a 0.5 percent fall. Private spending fell 1.7 percent led by a 2.8 percent decline in residential building and a 5.6 percent decline in lodging.

Current Release: January New Construction Spending

Consensus Forecast: -0.7 percent

Actual Result: -0.6 percent to $884.1 billion.

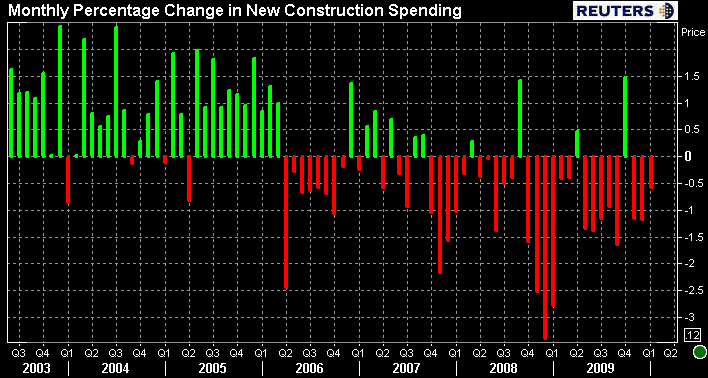

Total Construction spending during January 2010 was estimated at a seasonally adjusted annual rate of $884.1 billion, 0.6 percent below the revised December estimate of $889.6 billion. The January figure is 9.3 percent below the January 2009 estimate of $974.3 billion. Spending has declined in 21 of the last 25 months. This is the third straight month of contraction and the lowest level since June 2003.

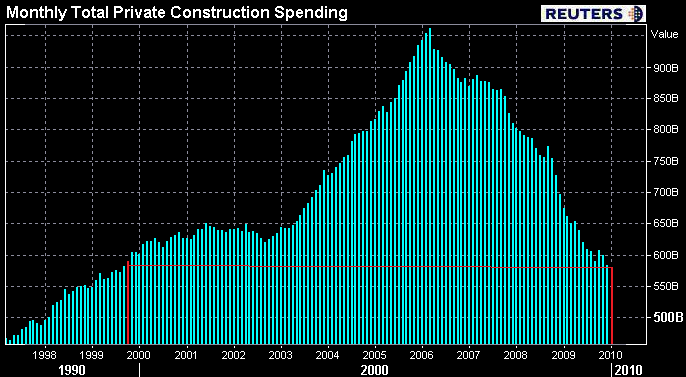

Spending on private construction was at a seasonally adjusted annual rate of $577.3 billion, 0.6 percent below the revised December estimate of $580.7 billion. This is the lowest rate since 1999.

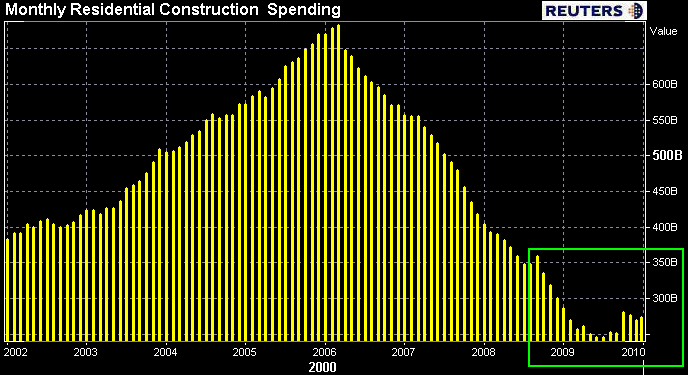

Private Residential construction was at a seasonally adjusted annual rate of $260.8 billion in January, 1.3 percent above the revised December estimate of $257.5 billion.

Here is a chart of residential spending. Bouncing around at low levels.

Here is a table summarizing the results. After two months of contraction, private residential spending was a positive in January. Nonresidential private spending continues to decline as a reduction in consumer spending has contributed to high vacancy rate and less need for new investments. This was a major source of weakness in January data.

The chart below is a geographic breakdown of existing home sales. Notice that housing has lost much of the momentum provided by government stimulus in the spring and summer of 2009. On Friday we learned that the inventory of existing homes on the market increased from 7.2 months in December to 7.8 months in January. We do not expect residential construction spending to gain much traction until the inventory of existing homes declines and stabilizes near lower levels.

Lawrence Yun, Chief Economist at the National Association of Realtors says:

“Most of the completed deals in January were based on contracts in November and December. People who got into the market after the home buyer tax credit was extended in November have only recently started to offer contracts, so it will take a couple months to close those sales...“Still, the latest monthly sales decline is not encouraging, and raises concern about the strength of a recovery....Activity should be picking up strongly in late spring as buyers take advantage of the tax credit, which is critical to absorb distressed properties reaching the market and to continually chip away at inventory,"

“With a downtrend in the number of homes on the market, especially in the lower price ranges, values are beginning to firm but with great variance around the country.”