The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today revealed that home builders are more optimistic about home buying conditions now than they were one month ago and slightly more optimistic about market conditions over the next six months. Overall, however, builder's confidence levels remain near historic lows.

The survey asks residential builders about their perceptions of market conditions at present, what their expectations are for sales over the next six months, and to rate the current traffic of prospective buyers. Builders are asked to rate their dual perceptions of marketing conditions as "good," "fair," or "poor," and current traffic as "high to very high," "average," or "low to very low." Each component is scored separately and then the three scores are combined to create the HMI. A score of 50 or more on the index or any of its components indicates that more respondents view conditions as favorable rather than unfavorable. Survey results are seasonally adjusted.

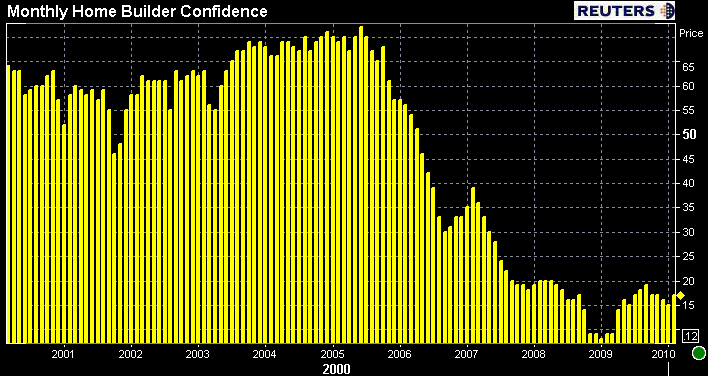

The HMI rose two points to 17, the highest level since November 2009. Two of three components also were higher; current sales conditions also rose from 15 to 17 and sales expectations over the next six months rose one point to 27. The component assessing current buyer traffic was unchanged at 12.

Regionally results were mixed. While the Midwest and South each registered two-point gains, to 13 and 19, respectively, the Northeast and West each registered one-point declines, to 19 and 14, respectively.

NAHB and Wells Fargo have conducted the survey for 20 years. The HMI was near 70 in early 2006 before beginning a precipitous decline that brought it below ten in mid 2009.

NAHB Chief Economist David Crowe said that builders are beginning to see effects of the home buyer tax credit and are encouraged by recent improvements in the employment market. But he said that several factors including the number of foreclosures on the market along with resulting low appraisals based on distressed property comparables, as well as a lack of available construction financing are still weighing down builder expectations.

NAHB Chairman Bob Jones said that, "Continued low interest rates, very attractive home prices that appear to have stabilized in many markets, and the availability of the home buyer tax credit make this an opportune time for potential purchasers. As a result, builders are slightly more optimistic that the housing recovery is finally beginning to take root."