The legend of the bond market's extreme apathy is increasingly making the rounds in financial circles. Bond issuance, inflation, and economic strength are not seen surging enough to put huge upward pressure on longer-term rates. And without a big downturn in 2 of those 3 variables, there's no major impetus for a big drop in rates. So we wait (and wait and wait) while bonds gyrate in micro-ranges. Add today to the list. It might have been more volatile if we had the econ data that was postponed due to the shutdown, but JOLTS wouldn't be enough to singlehandedly change the narrative. Stocks and commodities were volatile in contrast, but with limited correlation to bonds. The government funding bill passed the house and a reopening is assumed for Wednesday, but Friday's jobs report will nonetheless not be coming out on Friday.

-

- ISM Manufacturing Employment (Jan)

- 48.1 vs -- f'cast, 44.9 prev

- ISM Manufacturing PMI (Jan)

- 52.6 vs 48.5 f'cast, 47.9 prev

- ISM Mfg Prices Paid (Jan)

- 59.0 vs 60.5 f'cast, 58.5 prev

- ISM Manufacturing Employment (Jan)

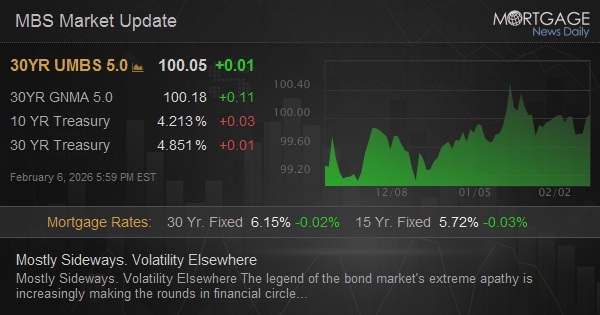

Sideways to slightly weaker overnight in Treasuries with 10yr now up 1bp at 4.285. MBS outperforming, up 1 tick (.03) on the day.

Not much movement. MBS down 1 tick (.03) and 10yr up 1.5 bps at 4.29

off weakest levels. MBS unchanged and 10yr down 0.4bps at 4.271