Think back to October 17th. MBS opened slightly weaker and ended the day down about an eighth of a point. That was the last time we had a weaker start, and there are some parallels to today. In both cases, the weakness was modest. In both cases, the previous session closed at the best levels in at least a month. In fact, yesterday's 5.0 MBS prices matched their best close in over a year. We can definitely forgive (and possibly even expect) a small pull-back after such a consistent rally. As discussed in yesterday's video, it was beginning to seem like a good moment for broader consolidation.

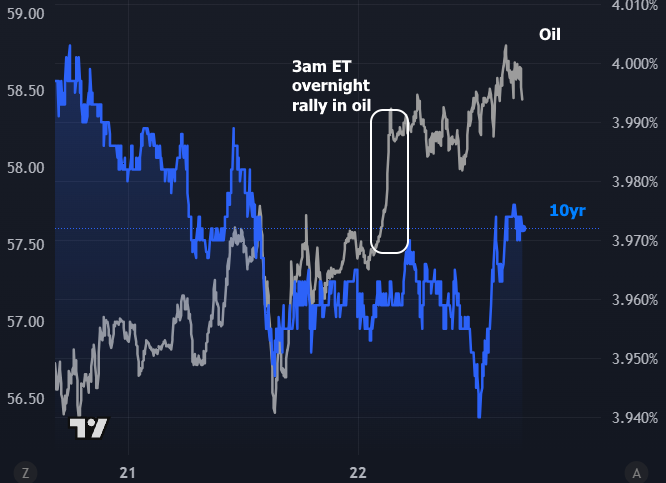

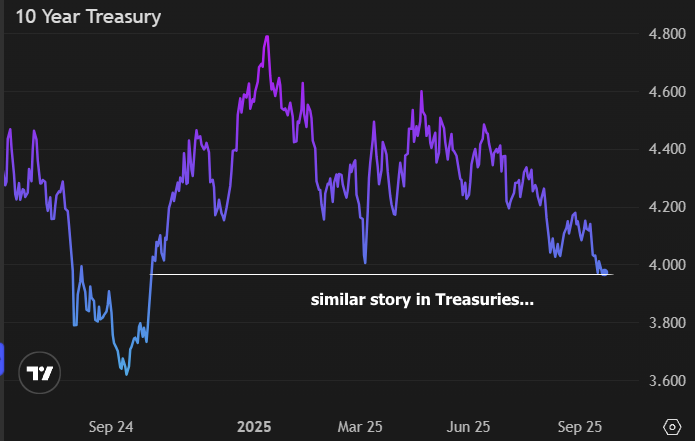

And a bonus chart in light of yesterday's discussion of oil prices... Clearly not a 1:1 correlation, but fans of the oil/Treasury connection could at least say the rebound is not doing us any favors.