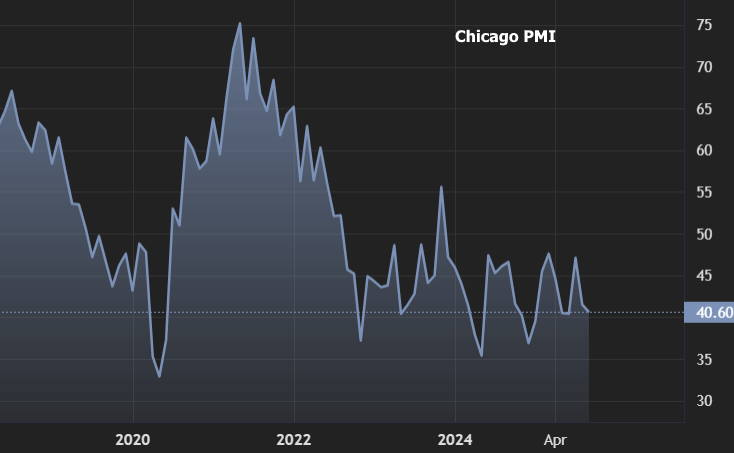

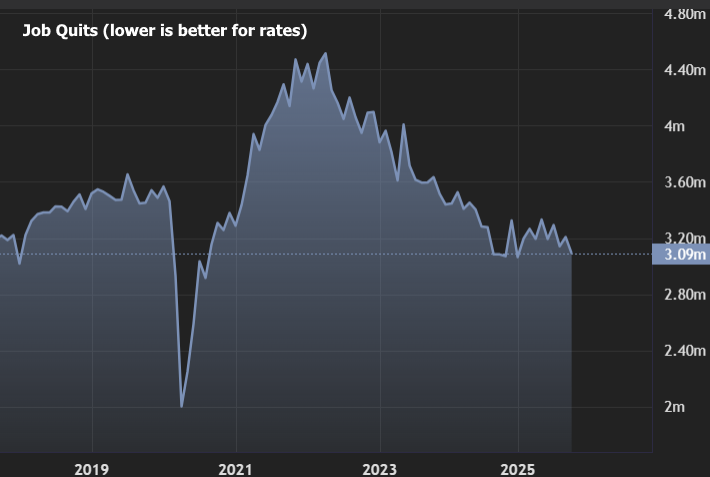

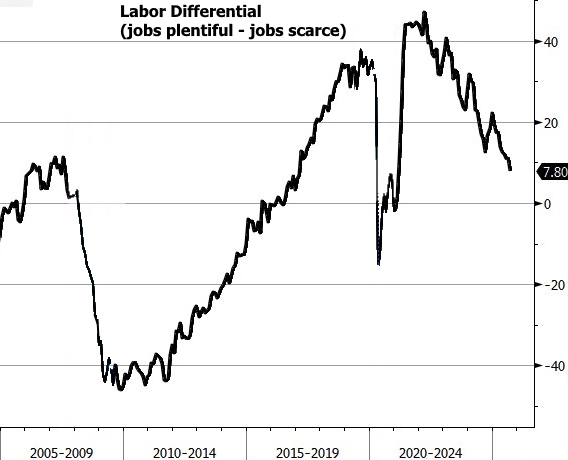

No new news on the probably government shutdown, but betting markets show increased odds, for whatever that's worth. The only reason to watch or care about the shutdown (for bond watching purposes, anyway) is to know what this week's menu of econ data looks like. A shutdown likely means no jobs report. But there are other reports capable of moving the needle, even if to a much lesser degree. This morning's examples included Chicago PMI in line with 2025 lows, the weakest labor differential (part of the Consumer Confidence report that measures the gap between those who say jobs are plentiful vs scarce) of this cycle, and job openings/quits both near cycle lows. Bonds were already slightly stronger this morning, but gained more ground after the data.