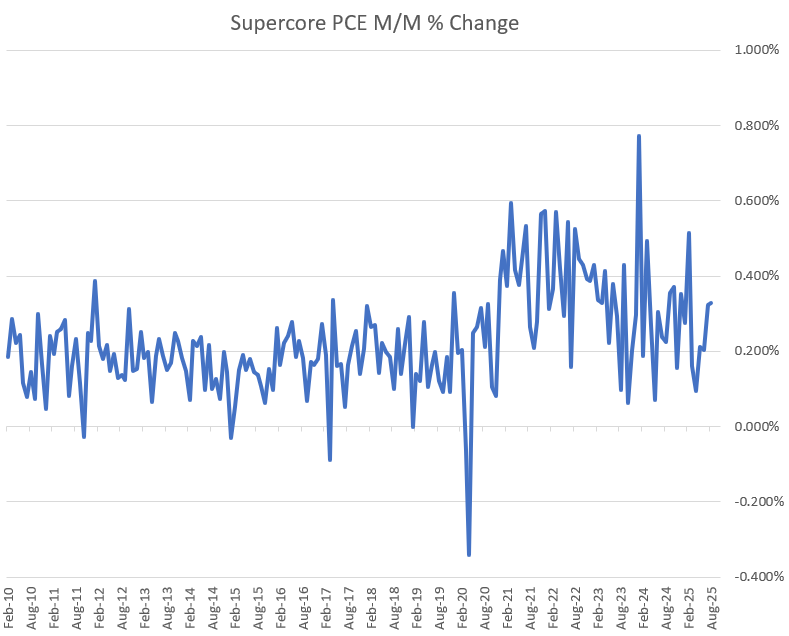

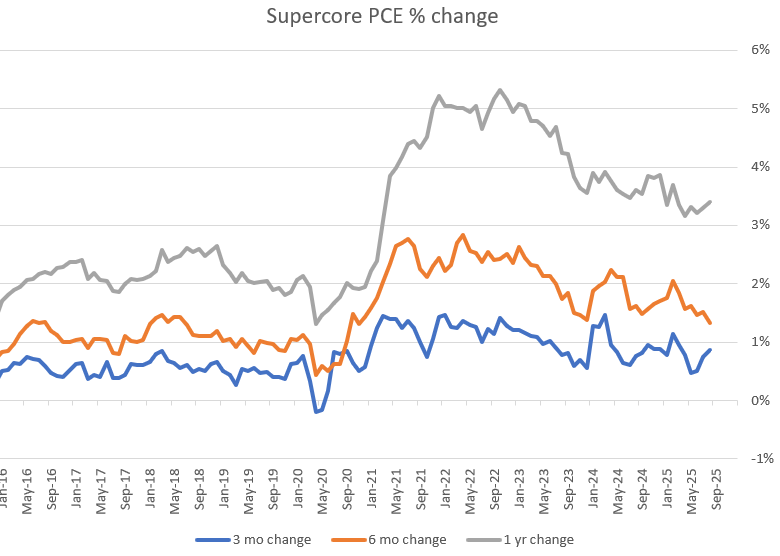

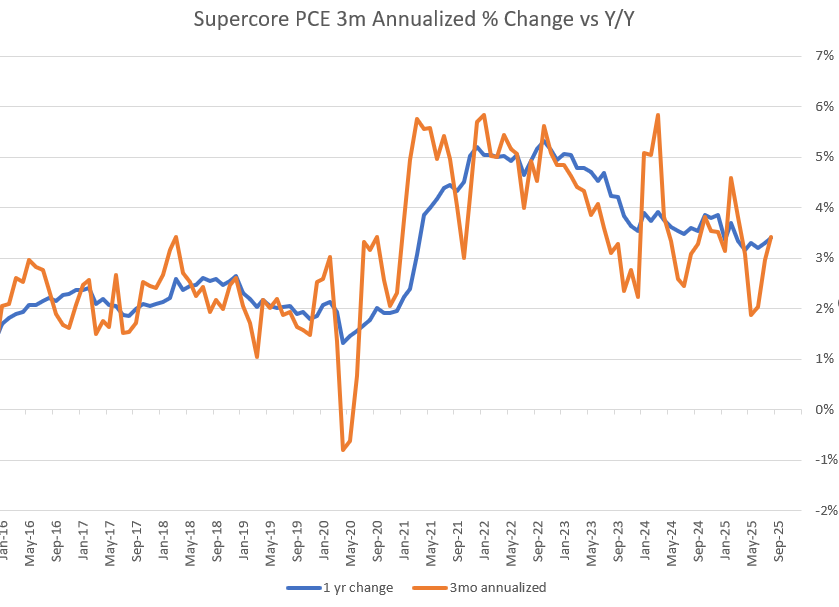

PCE may be the most relevant inflation report when it comes to assessing progress toward the Fed's 2% target, but it is not the most relevant report to the bond market. The reporting lag is the key issue. Today's report is for the ancient past (August), and we already got CPI/PPI 2 weeks ago. Additionally, CPI/PPI help forecasters hone in on likely PCE results, so surprises are less likely. Case in point, in both monthly and annual terms, core PCE was right on target. The increasingly popular "supercore" PCE (core services excluding housing) was a hair than last month (.33 vs .32), and it remains elevated in annual terms as a result. If there's a reason that bonds didn't rally on the as-expected headlines, this is it.