In your defense, perhaps you're not too bothered or concerned about the market/rate movement since Fed day. But if you are, here's some perspective. With the exception of the past 2 weeks, 10yr yields are the lowest since April and mortgage rates are the lowest since October. Both are lower than they were the day before this month's jobs report and mortgage rates were already at 11-month lows at that time. We won't know if there's true cause for concern until we see the early October economic data. For now, we're seeing a fairly logical reaction to the events at hand, but it feels brisk when compared to bonds/rates that were stretched to the aggressive side amid pre-Fed positioning.

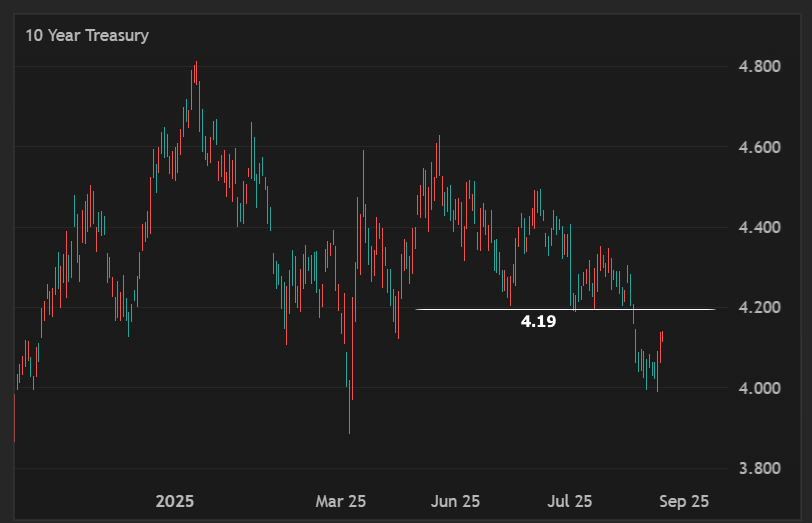

Bottom line, 4.19 had been our bottom line for the past several months. Anything that happens below that level is just noise between now and the next jobs report.