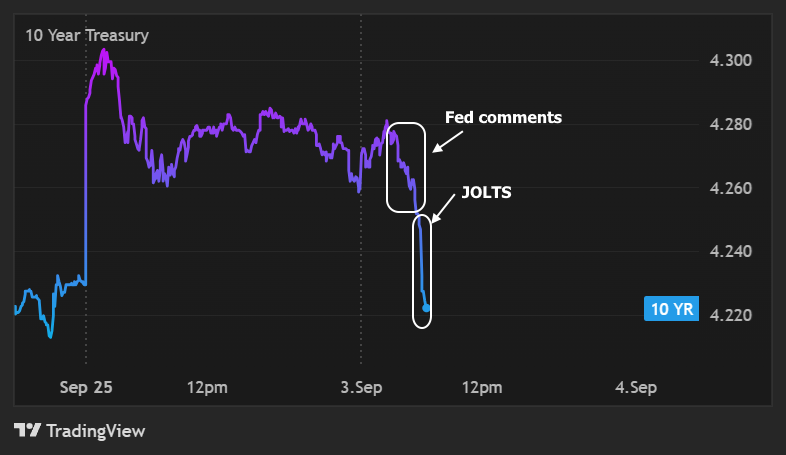

Bonds were flat to just slightly stronger in the overnight session but a noticeable rally is underway following the JOLTS data (job openings and labor turnover survey). This is a new cycle low for job openings, just barely dropping below the level reported in April 2025 (for March). MBS have gained about an eighth of a point since the data came out and 10yr yields dropped about 3 bps to 4.226. Before the data, friendly Fed comments were already starting to help bonds push the best levels of the morning.

Here are the comments from Fed's Waller that started at 8:42AM ET:

FED'S WALLER TELLS CNBC: WE SHOULD CUT AT NEXT MEETING

FED'S WALLER: DONT NEED TO GO IN LOCK-SEQUENCE OF RATE CUTS

FED'S WALLER: COULD SEE MULTIPLE CUTS, WHETHER IT'S EVERY MEETING OR EVERY OTHER WILL NEED TO SEE WHAT DATA SAYS

WALLER: WE KNOW WE'LL HAVE A BLIP OF INFLATION BUT IT WON'T BE PERMANENT, 6 MONTHS OUT WILL BE CLOSER TO 2%

WALLER: WE CAN ALWAYS ADJUST RATE-CUT PACE