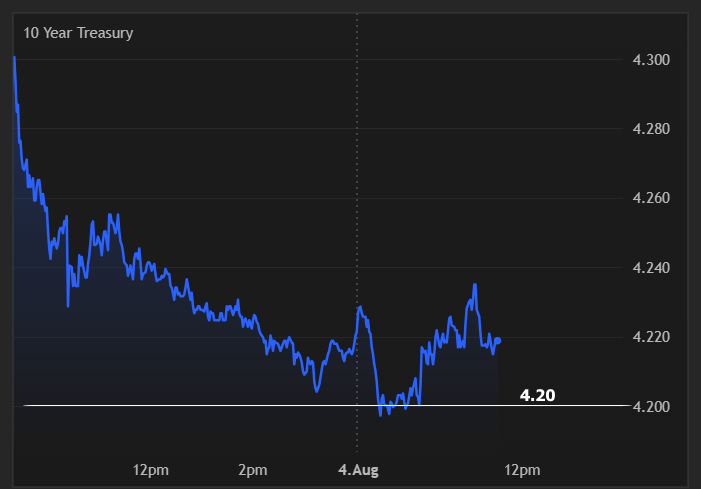

The new week is less interesting than the previous week in terms of scheduled events with the only top tier data being Tuesday's ISM Non Manufacturing PMI. In addition, the Treasury auction cycle may be a bit more interesting than normal in light of the recent rally and last week's quarterly refunding details (not because the details were surprising, but because they eliminated uncertainty). After a big post-NFP rally, the following Monday is always a bit of a barometer as to the market's level of comfort in the newfound range. In that sense, we're learning one--possibly two things this morning. On a positive note, the ground holding in bonds tells us there are no major regrets. On a cautious note, the absence of additional gains means we need to keep an eye on the 4.20 technical level (July 1st lows) for potential resistance.