Bonds found a bid along with stocks yesterday afternoon after Trump announced a "framework of a deal" on Greenland. Markets were much less interested in U.S. access and more concerned with pausing the more immediate market-related implications (new tariffs and changes in foreign demand for Treasuries). This notion was reinforced this morning as there was no reaction at all to new comments saying the U.S. would have "total access" to Greenland with "no time limit."

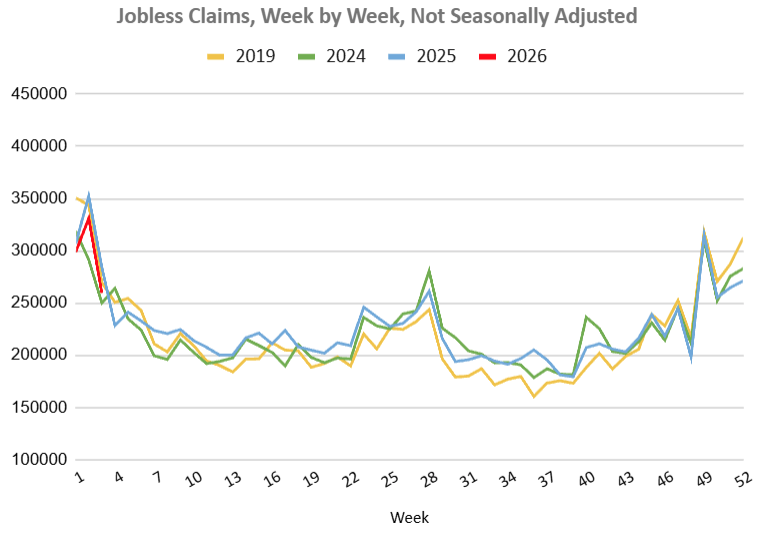

The early round of econ data also failed to inspire, although that's no surprise given the stale nature of GDP and generally limited impact of weekly jobless claims (in addition to the fact that jobless claims are sticking to the same script seen in the past 2 years).

All that remains is the PCE inflation data at 10am ET, but it should be noted this is for the months of Oct/Nov and that we've already received CPI/PPI inflation reports for December. Data aside, yields have been trending gradually higher in concert with European markets, but Treasuries still retain a majority of yesterday's gains.