We commented last week how a lot of people didn’t know what HSBC stood for...

If you go back to when they bought a bank in Buffalo, New York to established themselves in the U.S. The joke was that HSBC stood for "Holy ____, Buffalo's Cold.”

City National Bank (Los Angeles) was in the news for paying off all its TARP money last week, but the real story is how they became L.A.’s prestige bank in the first place.

Frank Sinatra’s son was kidnapped on a Friday in 1963, and the singer called up Bank of America, Security Pacific and a few other big banks asking for $240,000 to pay the ransom money. The big banks told him to come in Monday morning and fill out a loan application. When he called City National, Chairman Bram Goldsmith told him “Come down to the bank as fast as you can and we’ll have your cash ready.” Sinatra was so impressed that he told all his Hollywood friends to bank there, and it soon became the bank for the rich and famous of Hollywood and Beverly Hills. Even today, it’s considered a prestigious thing to do your banking with them.

We're conducting a search for a credit manager for large warehouse lending organizations in Dallas and Central New Jersey. Duties would include structuring, underwriting, and managing warehouse relationships and monitoring collateral positions. If you or somebody you know has experience as a credit manager, please send your resume to Mike McAuley at mmcauley@garrettwatts.com

From Henry Wells of Wells Fargo:“There is one very powerful business rule. It is concentrated in the word courtesy.” He said this in 1864, and isn’t it still true?

If you like to follow community bank stocks, there’s no better reading than The Vulture’s Roost (call 615-383-2654). His disclaimer last month was that “Anybody who is still investing in banks doesn’t need a disclaimer. They need a shrink. Besides, we have no credentials, no license and no accreditation of any kind. We aren’t brokers and we don't front run. So believe nothing you read here. Believe only what you research yourself, and if you come up with any good ideas, please call.” His analysis is actually quite good, and he covers small banks that no one else follows.

We were reading a Keefe Bruyette analyst’s report, and at the end was a set of disclaimers. We did a word count, and it came to 2,029 words. At about 350 words per typewritten page, that’s a 5.8 page disclaimer. The disclaimer was longer than the actual report.

Speaking of disclaimers, here’s what should have accompanied every prospectus for subprime mortgage securities: “I, the undersigned, have no clue as to how this security works. I know it is backed by loans to people who are possibly dead-beats and chronic liars. The underwriter does not understand how the borrowers will possibly afford payments when the rates adjust, and I suspect that Moody’s gave it an AA rating because a software program told them to do so. Please also note that the undersigned is 23 years old and a recent college graduate with a degree in 17th century poetry with a minor in PE. Please also note that when the authorities investigate this security, I am 100% willing to rat out my boss in return for immunity.”

And how about little Security California Bank? Didn’t anyone tell them there’s a banking crisis going on, especially in Southern California? A Texas Ratio of only 11%, no brokered deposits, 11% capital, and 32% of their deposits are non-interest bearing. You can even buy their stock, symbol SCAF. What’s even more remarkable is that the bank is in Riverside, which is kind of Ground Zero for the SoCal housing and real estate meltdown. Last we checked, the stock traded below book value.

We spoke to a mortgage company in the Southwest that is owned by a commercial bank that’s in a lot of trouble. Here are a few of the issues we pointed out: (1) If your parent is seized, your new owner will be the FDIC, or (2) The FDIC may flip you to a buyer of the failed bank. In either case, you end up being owned by people and institutions you don’t know and may not enjoy working for. Therefore, we strongly suggested that these guys needed a Contingency Plan which looked at all possibilities and tried to address them in advance of any possible failure and seizure of their parent.

A few that they need to look at: (1) Do a buy-out and take ownership of their company (2) Start looking for warehouse lines should their bank be unable to provide funding and/or if they do a buy-out, (3) Plan to deal with all services they currently obtain from their parent. This particular company gets I.T. and H.R. support from their parent, so they need to plan to take those in-house.

We just noticed that Viewpoint Bank earned 1.02% on assets last quarter on a pre-tax pre-provision basis, and that’s very good in the current environment! Very good.

Regulators don’t like brokered deposits, but what if your cost of funds is 1.5% and you can get brokered CD’s for 0.75%? This is the situation for many banks, but despite the lower costs, we talk to many bank Presidents who won’t accept these deposits for fear of the regulators.

We know of a mortgage banker and specialty servicer who is looking for an equity partner. The originator is a call center operation and has been successful for many years. The specialty servicer focuses on servicing and restructuring distressed mortgages, with a current portfolio of $350 million. Contact any of us for further information. Oh, it’s in the Portland, Oregon area.

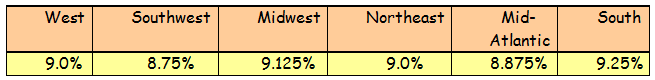

People in Washington are debating the future of Fannie Mae and Freddie Mac, and while we watch with interest, we don’t have strong opinions on this but do remember all the changes these entities brought about. One such change was the end of regional pricing. Newspapers used to regularly show what mortgage rates were in each area of the nation. They typically looked something like this:

There was no national market, and rates were lower in those areas with lots of bank deposits, limited population growth, and limited loan demand. Secondary marketing involved personal relationships and the moving of capital from region to region. California was a rapidly growing state with younger families and less deposits. Parts of the Northeast had older populations, lots of deposits, and limited loan demand. As a result, secondary marketing involved a mortgage banker in California developing a relationship with a Savings & Loan from a Northeast state, say, Connecticut. California had too many loans and not enough deposits, and Connecticut would have too many deposits and not enough loans.

When the California mortgage banker sold loans to a Connecticut bank or thrift, it was always servicing retained. “We don't know California, so we need you to service these loans for us.” This meant that almost every mortgage banker had a servicing portfolio. Smaller companies might service only $25 million, and they’d have just 1-2 people carrying out that function. Next issue we’ll