Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

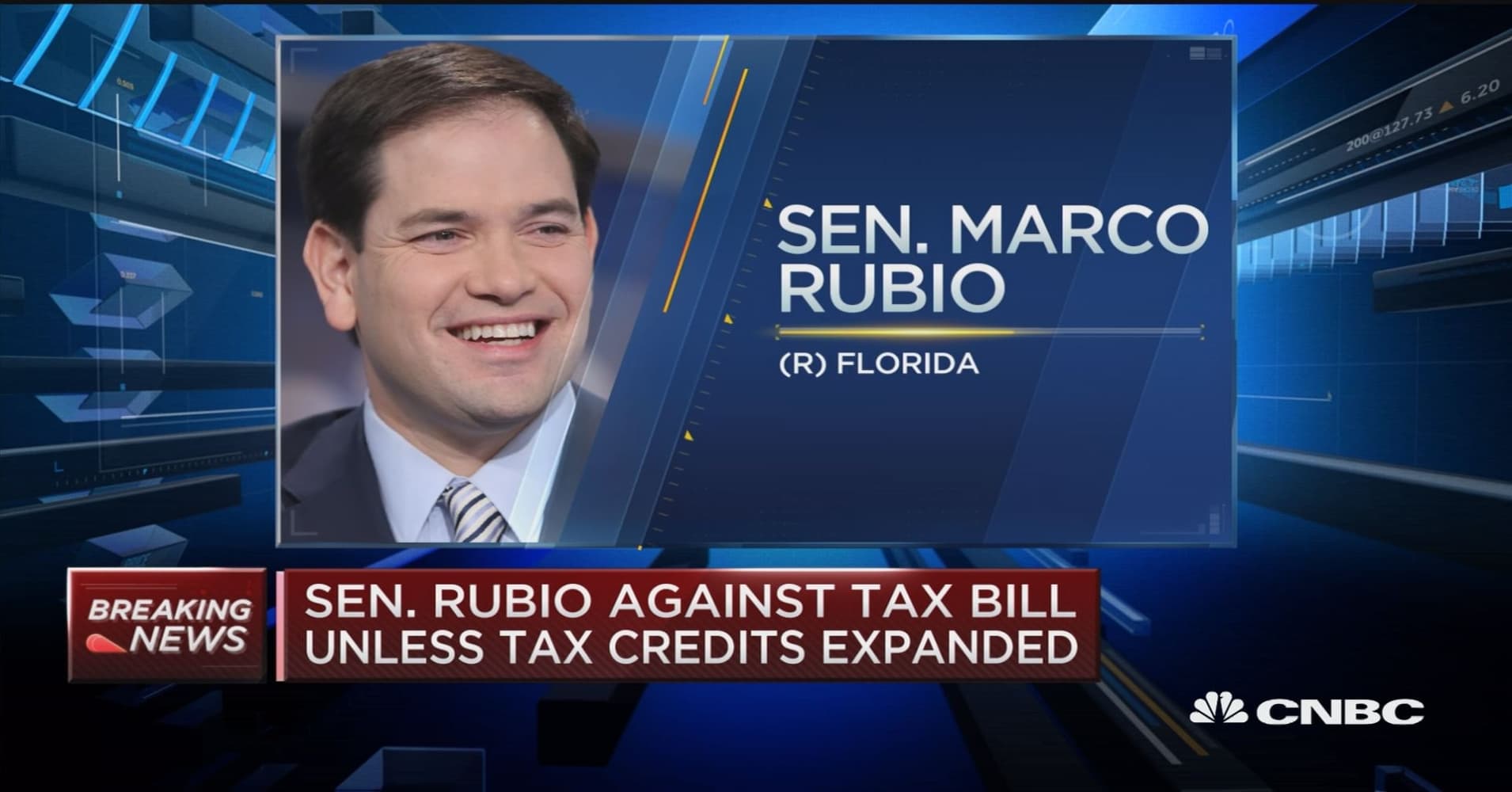

Mortgage rates held on to yesterday's gains in most cases. Some lenders were even in slightly better shape today, but not enough to have an effect on anything beyond the upfront costs associated with any given rate quote. Rates themselves would be right in line with yesterday's. That's not a bad thing considering yesterday afternoon brought effective rates near their lowest levels of the month. In this case, lower "effective rates" refer to lower upfront closing costs (or higher lender credits) for the prevailing top tier conventional 30yr fixed rates of 4.0%. Bond markets (which underlie interest rate movement) continued to pay more attention to policy developments than the economic data that traditionally has an impact. In today's case, it was news that a few Republican senators may not vote

|

|