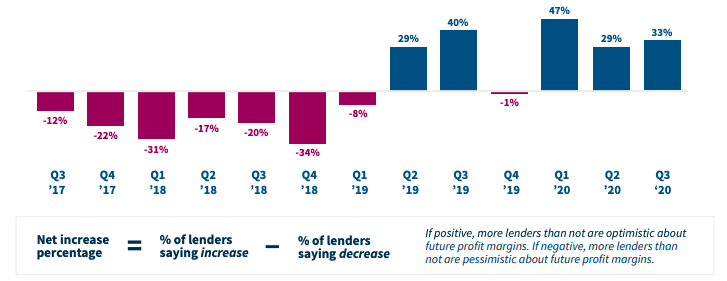

Mortgage lenders had an excellent second quarter in terms of profitability according to the Mortgage Bankers Association, and Fannie Mae's Lender Sentiment Survey for the third quarter indicates they expect that situation to continue. Forty-eight percent of respondents believe their profit margins will increase compared to Q2 while 37 percent say profits will be about the same. Only 15 percent believe there will be a decline.

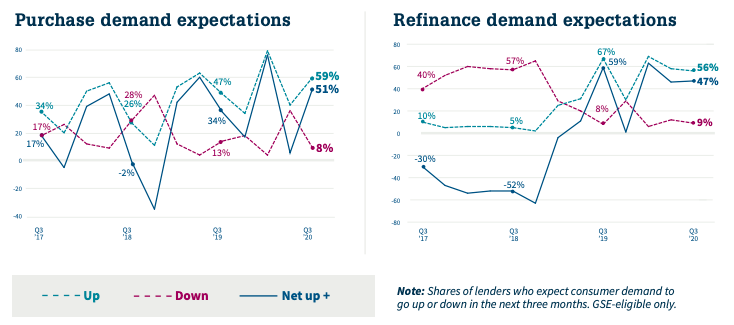

Lenders said consumer demand had remained strong across all loan types, GSE-eligible, non-GSE-eligible, and government, and in some cases hit new highs. More lenders reported that demand for purchase loans grew both for the prior three months and the next three months and refinance mortgage demand remained extremely strong in the third quarter on both a look-back and look-forward basis.

"This quarter's MLSS results align with the strong housing recovery amid the larger economic downturn due to COVID-19," said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. "Lenders' reported purchase mortgage demand for the prior three months across all loan types have returned from sharp drops to the levels seen last year for the same quarter. Purchase demand growth expectations for the next three months reached the highest third-quarter readings since survey inception. For the third consecutive quarter, lenders' profitability outlook has remained a strong positive. Pent-up consumer demand, continued low mortgage rates, and favorable mortgage spreads helped drive lender profitability."

"This quarter, lenders on net continue to report tightening of credit standards for the prior three months, but expected no further tightening next quarter," Duncan continued. "Lenders attributed credit tightening to the uncertainty on the economic recovery and labor markets resulting from COVID-19. Although the housing market is showing remarkable strength amid the economic and health crisis, potential longer-term downside risks remain, including labor market weakness, low inventory, and home price uncertainty."

The Mortgage Lender Sentiment Survey by Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The Fannie Mae third quarter 2020 Mortgage Lender Sentiment Survey was conducted between August 4, 2020 and August 16, 2020.