The National Association of Home Builders today released their monthly Housing Market Index.

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

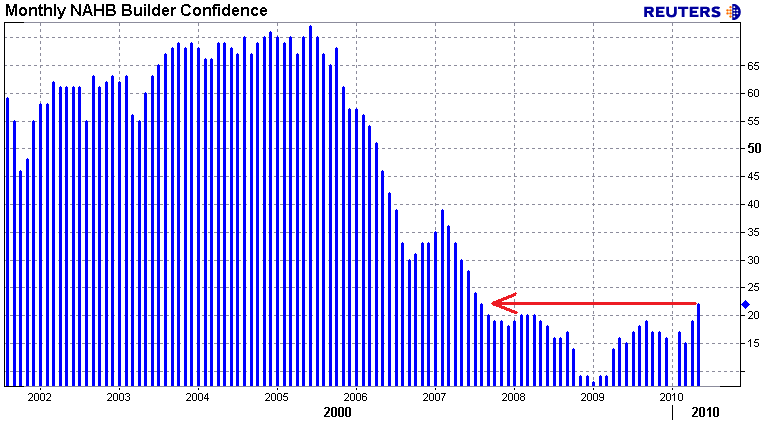

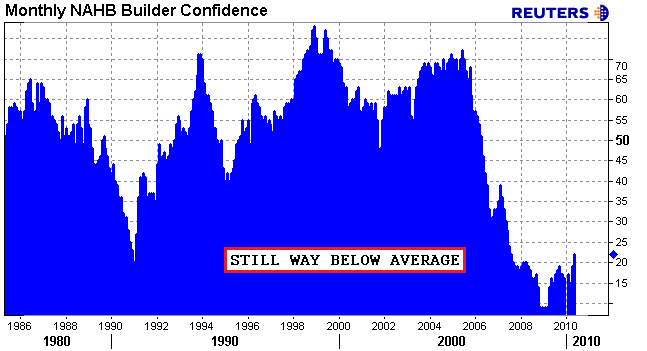

Builder confidence in the market for newly built, single-family homes rose for a second consecutive month in May to its highest point since August 2007. The Housing Market Index (HMI) gained three points to 22 in May....

While this was the best read in more than two years, it's hard to overlook how weak builder confidence is relative to historical standards. To be clear, the HPI is not far from record low levels. (gotta start somewhere?)

NAHB Chief Economist David Crowe says:

"The really encouraging part of today’s HMI is that sales expectations for the next six months continued to gain, despite the expiration of the home buyer tax credits at the end of April....This means builders are more comfortable that the market is truly beginning to recover, and that positive factors for buying a new home – low interest rates, great selection, stabilizing prices, and a recovering job market – are taking the place of tax incentives to generate buyer demand.”

From the Release...

Each of the HMI’s three component indexes posted three-point gains in May. The component gauging current sales conditions climbed to 23, its highest level since July of 2007. The component gauging sales expectations in the next six months rose to 28, its highest point since November 2009, and the component gauging traffic of prospective buyers improved to 16, its best showing since September 2009.

The HMI also posted gains in every region in May. The Northeast, which has the smallest survey sample and is therefore subject to greater month-to-month volatility, rose 14 points to 35, its highest point since June of 2007. The Midwest posted a two-point gain to 17, while the South registered a one-point gain to 22, and the West posted a seven-point gain to 20.

Bob Jones, Chairman of the National Association of Home Builders adds:

“Builders surveyed for the HMI at the beginning of May were undoubtedly reacting to the heightened consumer interest they had just witnessed as the deadline for home buyer tax credits arrived at the end of April... “Builders are also hopeful that the solid momentum that the tax credits initiated will continue even now that those incentives are gone.”