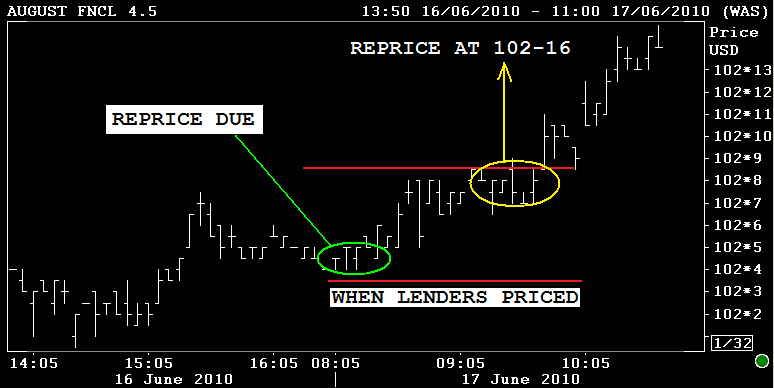

The majors published pricing pretty early this morning...when production coupons were at lower levels. Since then stocks have pulled a complete 180. S&Ps are now down 5 at 1104.50 and benchmark interest rates are approaching face melting status. The flight to safety (yield) has led "rate sheet influential" MBS coupons into REPRICE FOR THE BETTER territory.

HOW MUCH MBS RALLY DOES IT TAKE TO REPRICE FOR THE BETTER?

The AUGUST FNCL 4.5 MBS coupon is +0-11 at 102-15 (102.469)...

That "evening doji star" pattern is playing out in stocks..the day isn't over yet though.