Good Morning

S&Ps opened lower then traded higher before closing near the same levels it they started the session yesterday. This tells us the stock market is indecisive after S&Ps broke 200 day moving average.

In the chart below I have called attention to a potential "evening doji star" sighting. If the S&P closes below the mid-point of Tuesday's rally (yellow line = 1102.43), it would be a sign that S&Ps have topped out. By the way, the indicator on the bottom is volume. Not so much lately eh? I still feel the primary reason behind the stock rally has been forced buying/short covering ahead of expiry tomorrow.

S&P futures are currently +5.25 at 1114.75.

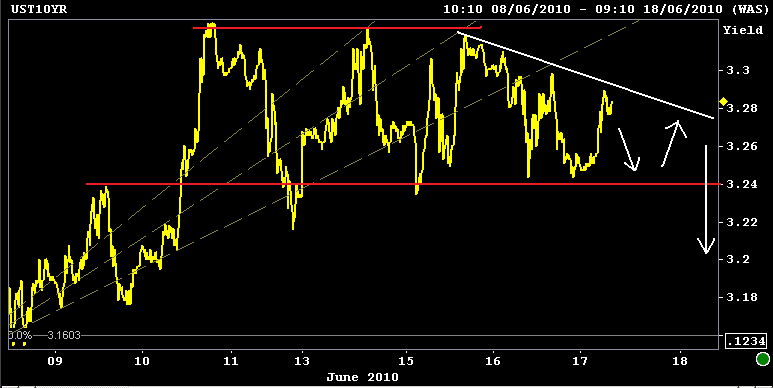

Benchmark yields moved lower across the curve yesterday. The 10yr note was the best performer, falling 4.4bps to 3.264% (+12 at 101-31). The 2 yr note dropped 2.4bps to 0.734% (+01 at 100-01.). Although price action has been choppy lately, interest rates have generally performed well while the pain trade plays out in equity and forex markets.

In the chart below I called attention to a descending triangle. As the trend continues to consolidate around 3.24%, the odds of a Treasury market rally will increase. I should point out that this pattern could play out the other way in an impulsive manner if stocks ride the short squeeze rally into month-end/quarter-end. Friday afternoon and Monday s/be interesting.

The 3.50% coupon bearing 10yr TSY note is currently -0-02 at 101-29 yielding 3.271%.

Mortgages have had a rough go at it over the last two days. Prices moved lower and yield spreads wider, this is not normal behavior for mortgage-backs. Their relative value generally improves (yield spreads tighter) as benchmark yields rise (implies borrowers will have less incentive to refinance). Cheaper valuations were due though, production MBS coupons were a bit overbought.

There is a clear price downtrend in process, but I explained why above. That trend would stall if the evening doji star plays out in stocks. Of course, if that pattern doesn't play out and stocks rally, production MBS coupon prices would breakdown. Although interest rates have resisted the effects of the stock lever this week, that relationship is more likely to link back up after expiry tomorrow.

The FN 4.0 is currently UNCH at 99-23. The FN 4.5 is +0-01 at 102-18 (102.563). The secondary market current coupon is UNCH at 4.0651%.

Jobless Claims and CPI at 830am.

THIS POST has thoughts on what might play out in markets after tomorrow. Energy is being stored for a bigger move.

UPDATED AT 830AM

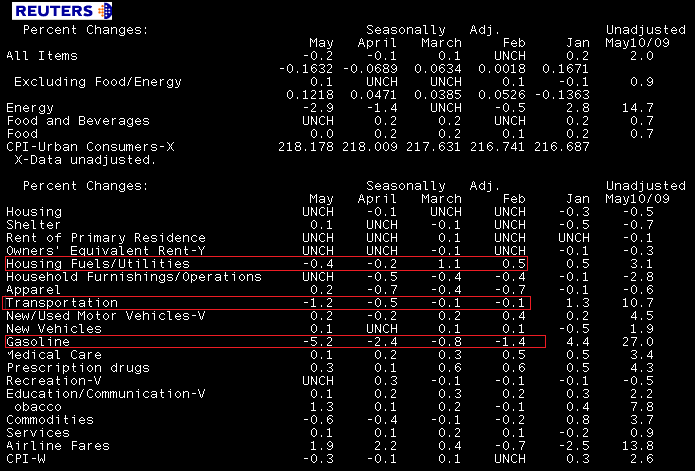

08:30 17Jun10 RTRS-U.S. MAY CPI -0.2 PCT (-0.1632; CONSENSUS -0.2 PCT), EXFOOD/ENERGY +0.1 PCT (+0.1218; CONS +0.1 PCT)

08:30 17Jun10 RTRS-U.S. MAY CPI YEAR-OVER-YEAR +2.0 PCT (CONS +2.0 PCT), EXFOOD/ENERGY +0.9 PCT (CONS +0.9 PCT)

08:30 17Jun10 RTRS-U.S. MAY UNADJUSTED CPI INDEX 218.178 (CONS 218.08) VS APRIL 218.009

08:30 17Jun10 RTRS-U.S. MAY CPI ENERGY -2.9 PCT, GASOLINE -5.2 PCT, NEW VEHICLES +0.1 PCT

08:30 17Jun10 RTRS-U.S. MAY CPI FOOD UNCH, HOUSING UNCH, OWNERS' EQUIVALENT RENT OF PRIMARY RESIDENCE UNCH

08:30 17Jun10 RTRS-U.S. MAY CORE CPI SEASONALLY ADJUSTED INDEX 221.037 VS APRIL 220.768

08:30 17Jun10 RTRS-U.S. MAY REAL EARNINGS ALL PRIVATE WORKERS +0.8 PCT (CONS +0.3) VS APRIL +0.5 PCT (PREV +0.4 PCT)

08:30 17Jun10 RTRS-TABLE-U.S. May CPI fell 0.2 pct

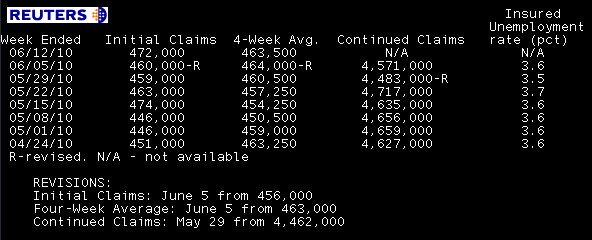

08:30 17Jun10 RTRS-US JOBLESS CLAIMS ROSE TO 472,000 JUNE 12 WEEK (CONSENSUS 450,000) FROM 460,000 PRIOR WEEK (PREVIOUS 456,000)

08:30 17Jun10 RTRS-US JOBLESS CLAIMS 4-WK AVG FELL TO 463,500 JUNE 12 WEEK FROM 464,000 PRIOR WEEK (PREVIOUS 463,000)

08:30 17Jun10 RTRS-US CONTINUED CLAIMS ROSE TO 4.571 MLN (CON. 4.460 MLN) JUNE 5 WEEK FROM 4.483 MLN PRIOR (PREV 4.462 MLN)

08:30 17Jun10 RTRS-US INSURED UNEMPLOYMENT RATE ROSE TO 3.6 PCT JUNE 5 WEEK FROM 3.5 PCT PRIOR WEEK (PREV 3.5 PCT)

08:30 17Jun10 RTRS-US CONTINUED CLAIMS 4-WEEK AVERAGE FELL TO 4.602 MLN IN JUNE 5 WEEK, LOWEST SINCE JAN 2009

08:30 17Jun10 RTRS-TABLE-U.S. jobless claims rose in latest week

CPI was on the screws but Jobless Claims were worse than expected. Stocks traded immediatly lower and interest rates rallied when the data flashed. The S&P is now +1.75 at 1111.25. The 10yr TSY note is 5 ticks higher at 102-05, now 2bps lower in yield at 3.244%. The FN 4.0 is +0-04 at 99-27 (99.844). The FN 4.5 is +0-04 at 102-21 (102.656). The secondary market current coupon is 1.8bps lower at 4.043% and yield spreads are 1bp tighter (after the data. UNCH vs. 5pm yesterday).