Normally we'd expect lenders to pass along better loan pricing when production MBS coupon prices rally up 8 ticks (+0-08 or 8/32). Not 8/32 from the open, +0-08 from the price indications recorded by secondary before they built pricing for the day. This varies between lenders. Some strive to be out early, others like to let the market show some direction before publishing.

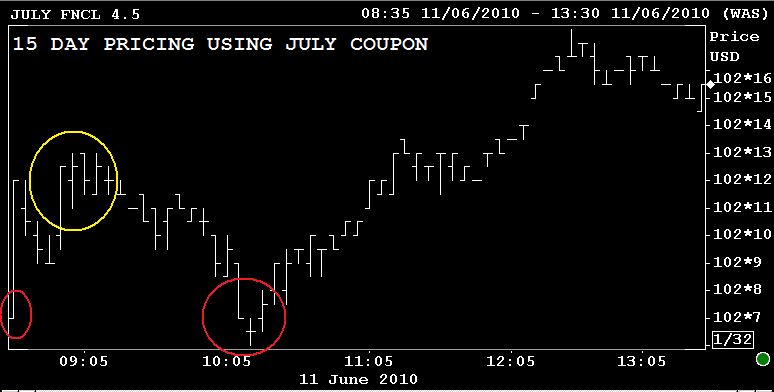

If you're looking for a reprice for the better on a 15 day lock, you should be watching the July coupon, but not for much longer because the investor deadline for "standard delivery" into July MBS coupons is already fast approaching. Most lenders are probably between 6/18 and 6/22.

Anyway...reprices for the better depend on whether or not your lender based rebate at RED or YELLOW. RED is due a reprice for the better as the FN4.5 is now 8 ticks above 102-07. YELLOW lenders need the FN 4.5 to reach 102-20.

The July FNCL 4.0 is currently +0-14 at 99-22. The July FNCL 4.5 is +0-13 at 102-17.

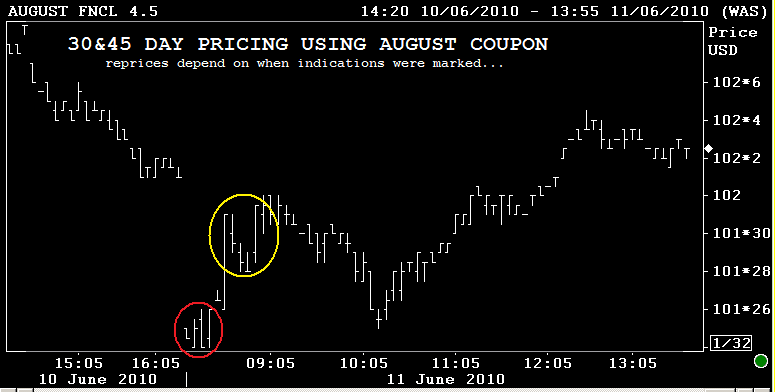

If you're watching 30 or 45 day pricing and your lender released at RED, you are due a reprice for the better as price levels are 8 ticks higher. If your lender posted at YELLOW, you need to see the FN4.5 hit and hold 102-04.

So you should see some reprices for the better come through, but they probably won't be widespread unless MBS prices hit higher prices. It is a Friday after all...

ps...lenders generally "pull the plug" when production MBS coupon prices fall 6 ticks (-0-06 or -6/32)