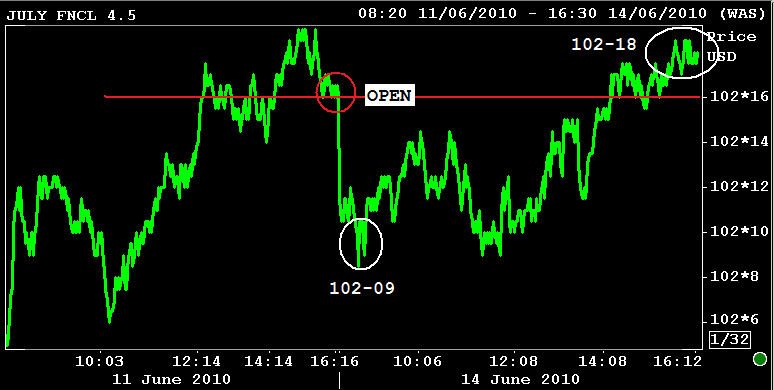

- FN4.5: +0-02 at 102-18 (102.563)

- Secondary Market Current Coupon: 4.052%

- CC Yield Spreads:+79bps/10yTSY. +70.6/10yIRS. Tighter vs. Friday 5pm marks.

- UST10YR: +2.9bps at 3.262%. 2s performed the best, +0.004bps at 0.738%

- S&P CLOSE: -0.18% at 1089.63. HIGH: 1105.65 LOW: 1089.22 WORST SECTOR: Materials -0.99%

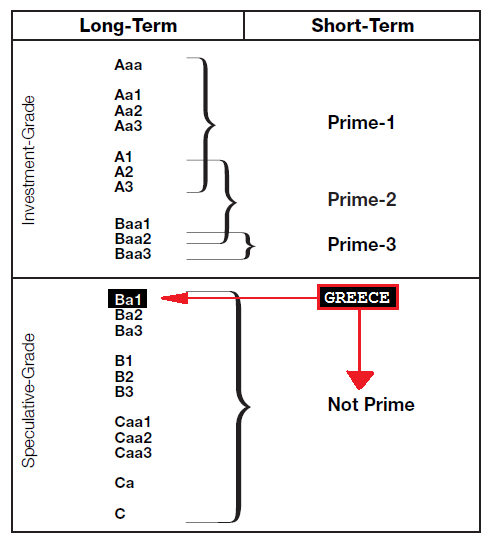

- Moody's Downgrades Greece to Junk Status

Interest rates continued to trend higher overnight into the early lunch hours but reversed course after a Moody's downgrade sent stocks to the lows of the session. The 3.50% coupon bearing 10-year Treasury note closed -0-08 at 102-00, +2.9bps in yield to 3.262%. Those red lines are the Fibonacci Fans I overlaid on Friday. The short term trend favors higher 10yr note yields...

Production MBS coupon prices benefited (directionally) from the recovery of benchmark Treasury yields, closing 9 ticks (0-09 or 9/32) above the the low print of the session. This allowed a few lenders to reprice for the better (including Fells Wargo). HOW MUCH MBS RALLY DOES IT TAKE TO REPRICE FOR THE BETTER?

The news that sparked the recovery of interest rates....

From Reuters:

13:07 14Jun10 RTRS-MOODY'S DOWNGRADES GREECE TO BA1 FROM A3, STABLE OUTLOOK

13:10 14Jun10 RTRS-RPT-MOODY'S CUTS GREECE TO JUNK REFLECTING RISKS ASSOCIATED WITH THE EUROZONE/IMF SUPPORT PACKAGE

13:11 14Jun10 RTRS-MOODY'S SAYS GREECE PACKAGE ELIMINATES ANY NEAR-TERM RISK OF A LIQUIDITY-DRIVEN DEFAULT

13:12 14Jun10 RTRS-MOODY'S SAYS GREECE'S RISKS ARE SUBSTANTIAL AND MORE CONSISTENT WITH A BA1 RATING

13:14 14Jun10 RTRS-MOODY'S BASE CASE SCENARIO SEES GREECE IMPLEMENTING POLICY CHANGES NEEDED TO STABILISE ITS DEBT-TO-GDP RATIO AT AROUND 150 PCT BY 2013

13:17 14Jun10 RTRS-Moody's cuts Greece govt ratings to junk

This downgrade makes Greece "king turd" on "poo hill". Below is a table of the Moody's rating system. READ MORE

You would expect this to cause chaos in equity markets, but it didn't. The S&P closed -1.97 (0.18%) at 1089.63, just below 1090 support. Price action was whippy and participation was low.

The Greek credit rating downgrade hit news wires around 1pm, when the S&P was just off the highs of the day and only a few handles from breaking the 200 day moving average.

Although the short term behavior of both stock and bond markets has been indicative of a looming long-term trend reversal, neither market was able to confirm that theory today. These mixed technical signals are reflective of a broad-based defensive bias/range trade. However, we cannot overlook the fact that stocks have the upper hand at the moment and appear poised to test the S&P's 200 day moving average. This implies we should see short term momentum carry the S&P back over 1100 toward 1108...a move that would reduce rate sheet rebate in the short term. Plan accordingly.