Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

Awesome Bounce Back But Still a Cautionary Tale

Bonds started the day quite a bit weaker after several pieces of EU econ data came in much stronger than expected. GDP had no impact, but yields spiked shortly thereafter as one gigantic seller hit the Treasury complex, prompting copycat trades. A slump in stocks may or may not have helped bonds find their footing. Either way, yields drifted lower throughout the afternoon, ultimately hitting the 3pm close less than 3bps higher on the day after being more than 8bps higher this morning. MBS outperformed, and are currently + 2 ticks (+0.06) with just over an hour to go. That's a stellar recovery, but with yields ending the day higher, this week's underlying message remains cautionary. Treasuries were in a rally trend all month and this week is clearly a push back against that.

Econ Data / Events

Fed MBS Buying 10am, 1130am, 1pm

Jobless Claims 553k vs 549k f'cast, 566k prev

GDP 6.4 vs 6.1 f'cast, 4.3 prev

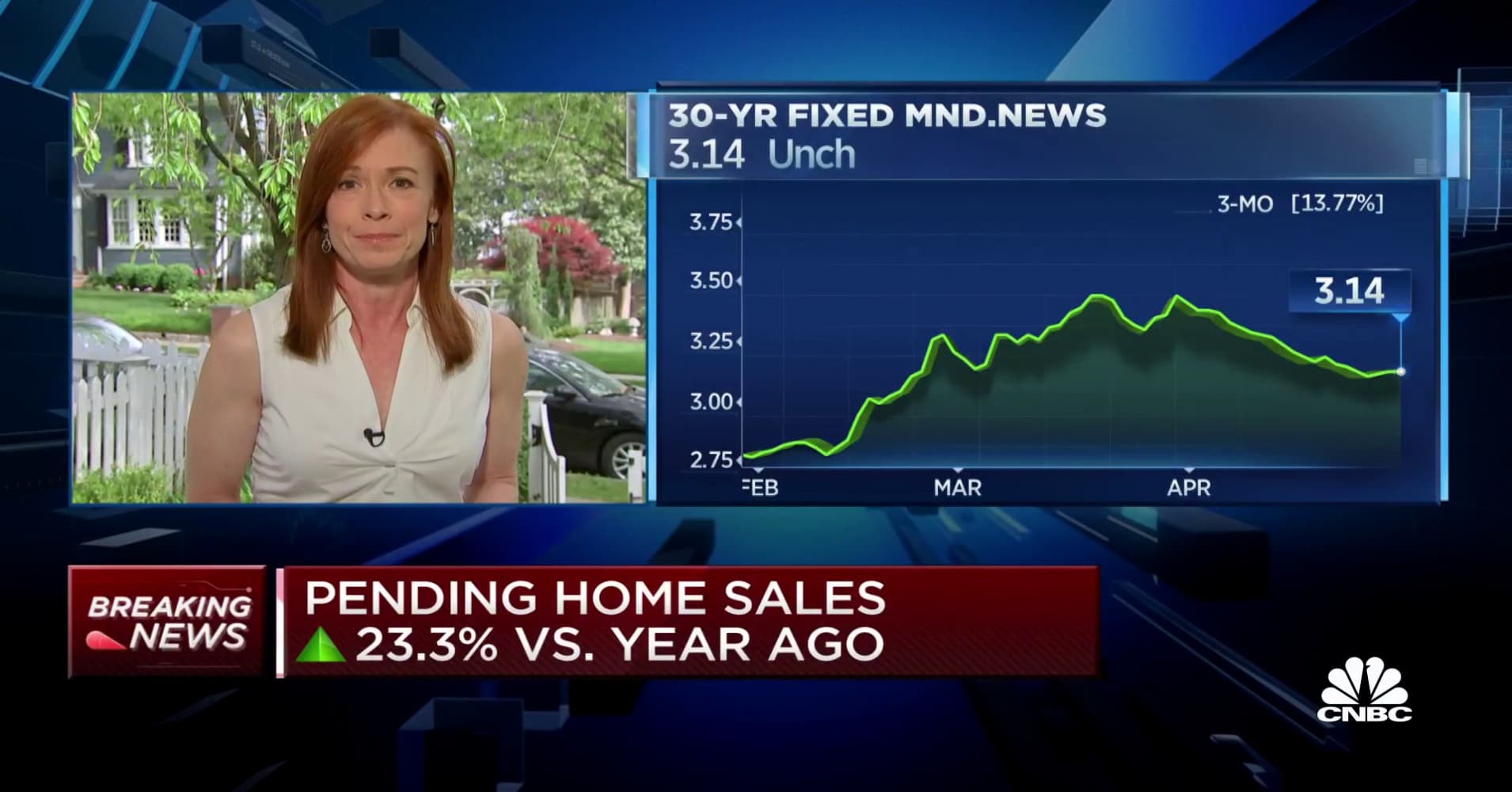

Pending Home Sales +1.9 vs +5.0 f'cast, -11.5 prev

Market Movement Recap

08:17 AM Significantly stronger EU econ data put obvious and immediate upward pressure on yields overnight. 10yr starting out up 5+ bps at 1.663. UMBS 2.5 coupons are down 5 ticks (.16) at 103-11 (103.34).

09:24 AM Tremendous volatility in MBS by the time we consider bid vs ask prices (only bid prices are visible on MBS Live). Bonds weakened quickly just after 9am with 10yr yields hitting 1.681% before bouncing slightly lower (1.675 currently). 2.5 UMBS hit 103-07 (103.22) before bouncing up to 103-11 (103.34) in the blink of an eye. This is still 6 ticks lower on the day (-.19).

12:27 PM Very decent bounce back for bonds, drawing some inspiration from stock market weakness and a technical ceiling at 1.68% in 10yr yields (now down to 1.65%). MBS are outperforming with 2.5 coupons within 2 ticks (.06) of unchanged.

03:50 PM Solid recovery is now fairly stellar as 10yr yields claw back more than 5bps of weakness (still 3bps weaker on the day). MBS, however, are GREEN now, with 2.5 coupons up 2 ticks (+0.06). Credit light supply, heavy Fed buying, friendly Powell y'day, and month-end positioning (favorable index extension for MBS).

|

|