Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

The past few months have seen several troubling, but not unexpected developments for the long-term rate outlook. While they're not the type of threats that will make for drastic overnight changes, we should increasingly consider them as a part of the bigger picture.

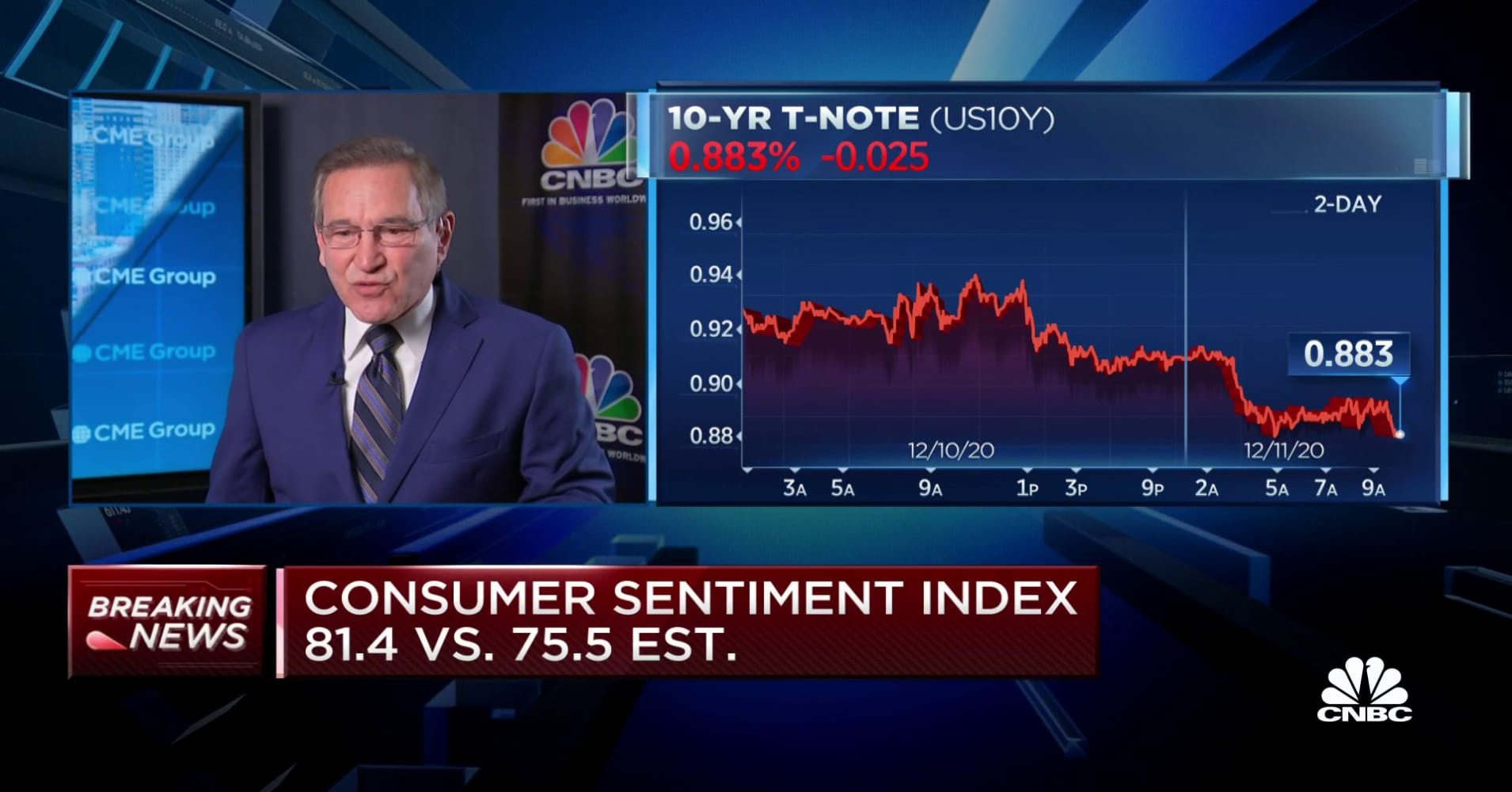

The most basic and most easily-observed threat is as simple as old school bond market calculus. OK, it's not really calculus. It's the longstanding tradition of observing trends in 10yr yields and extrapolating their impact on MBS. It has always made good sense to do that for these reasons, but times of unprecedented crisis tend to put that thesis to the test-- none more so than 2020 .

In 2020's case, the typical 10yr vs MBS vs mortgage rate equation was put to the test by the mortgage market's inability to keep pace with the initial rally in Treasuries. This was only an issue for MBS for a week or two though! Once the Fed ramped up its buying in late March 2020, MBS got back in line with Treasuries quite nicely. At that point, the disconnect was all about where lenders were setting mortgage rates relative to MBS.

You may already know this story: lender margins are wide (i.e. the bond market says rates can be much lower than what's currently being quoted to consumers), and those wide margins have allowed mortgage rates room to improve in the past few months even though 10yr Treasury yields have been moving in the opposite direction.

It's not just margins that have helped during that time. MBS were also outperforming Treasuries.

If the chart above makes it seem like MBS outperformance may have found its limit, that's because it probably has! I'm actually surprised it went as far as it did considering the chart implies a mere 20bp premium over 10yr Treasuries. In actuality, the premium is quite a bit higher than that, but yield calculations don't capture it due to some rather complex distortions underlying TBA MBS valuations (long story, but a true one... will elaborate more in MBS Live Huddle videos).

If outperformance has indeed run its course that means we must turn our attention to mortgage rate spreads versus MBS. We must also hope MBS don't have a full change of heart (i.e. if the blue line in the chart above starts rising very much, it would be a really big double whammy if the red line in the chart below continues to fall).

If these words and charts hurt your head or induce some other level of confusion, THAT'S PERFECTLY NORMAL (and if they don't, congratulations! You're smarter than 99% of the industry). I will try to translate as simply as I can.

mortgage rates are still primarily a factor of mbs prices

mortgage rates have been doing better than treasuries because mbs have have been doing better than treasuries

mortgage rates have ALSO been doing better than treasuries because mortgage rates have been much higher than mbs say they need to be

when rates are higher than mbs yields suggest (i.e. wide margins), they're at liberty to fall according to lender capacity rather than bond market movement

once margins have fallen back to a normal range, rates would be more readily influenced by MBS movement, and bullet point #2 above suggests MBS will have a hard time improving unless Treasuries are improving (the "lowness" of the blue line is like a rubber band pulled lower than ever before--one that's likely to rebound, and may already be starting to rebound)

Bottom line: there's still some insulation left from wide lender margins, but perhaps not as much as the "old normal" would suggest. Once we hit new normal, mortgage rate outperformance vs Treasuries is over and if Treasury yields are rising, so are mortgage rates.

So how long do we have left to bask in the glory? Who knows! If the Fed says the wrong thing next week, then you have less than a week! But again, that refers to mortgage rate OUTPERFORMANCE and NOT outright rate levels. In other words, the Fed could second guess its MBS buying aggression and MBS spreads would widen and lender margins would compress, but rates wouldn't necessarily be moving higher unless Treasuries were also moving higher in yield.

More than anything, this is just a reminder that although mortgage rates have been unbelievably steady-to-strong relative to the broader bond market, that seemingly bottomless well actually has a bottom, and it's starting to come into focus.

|

|