Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

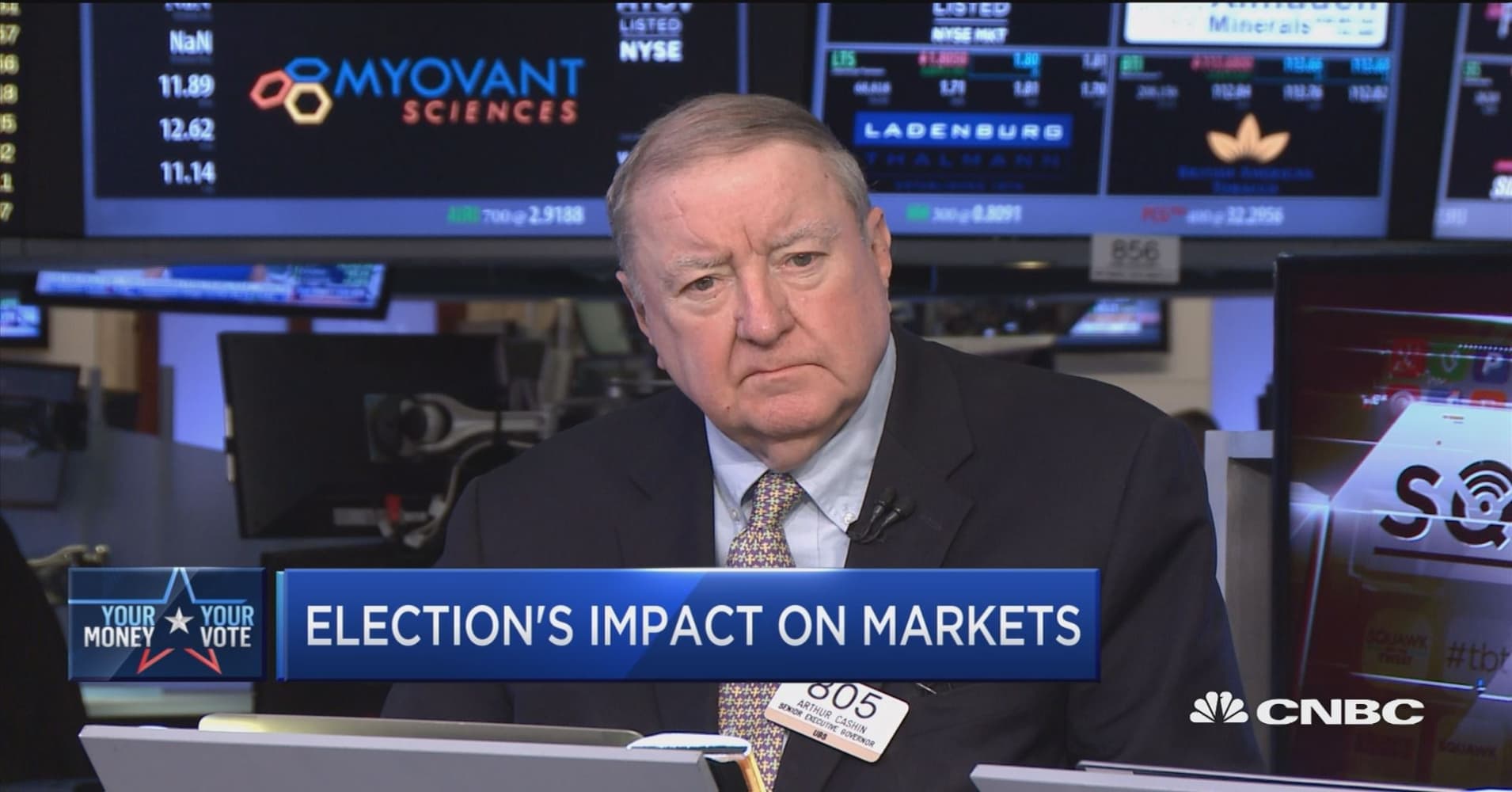

Mortgage Rates rose today as early presidential polls showed Clinton leading in several battleground states. At least when it comes to the most immediate future, rates have done better when Trump's numbers have been better. Some analysis suggests that although a Trump presidency could ultimately be worse for rates in the long run, the near-term uncertainty prompts investors to sell stocks and buy bonds. When demand for bonds increases, rates move lower, all other things being equal. Mortgage rates didn't have to move too much higher in order to make it to new 5-month highs . If we're talking about the actual "note rate," that hasn't changed for most prospective borrowers at all this week. Rather, the changes must be measured in the form of upfront closing costs/credits. Higher upfront costs

|

|