Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

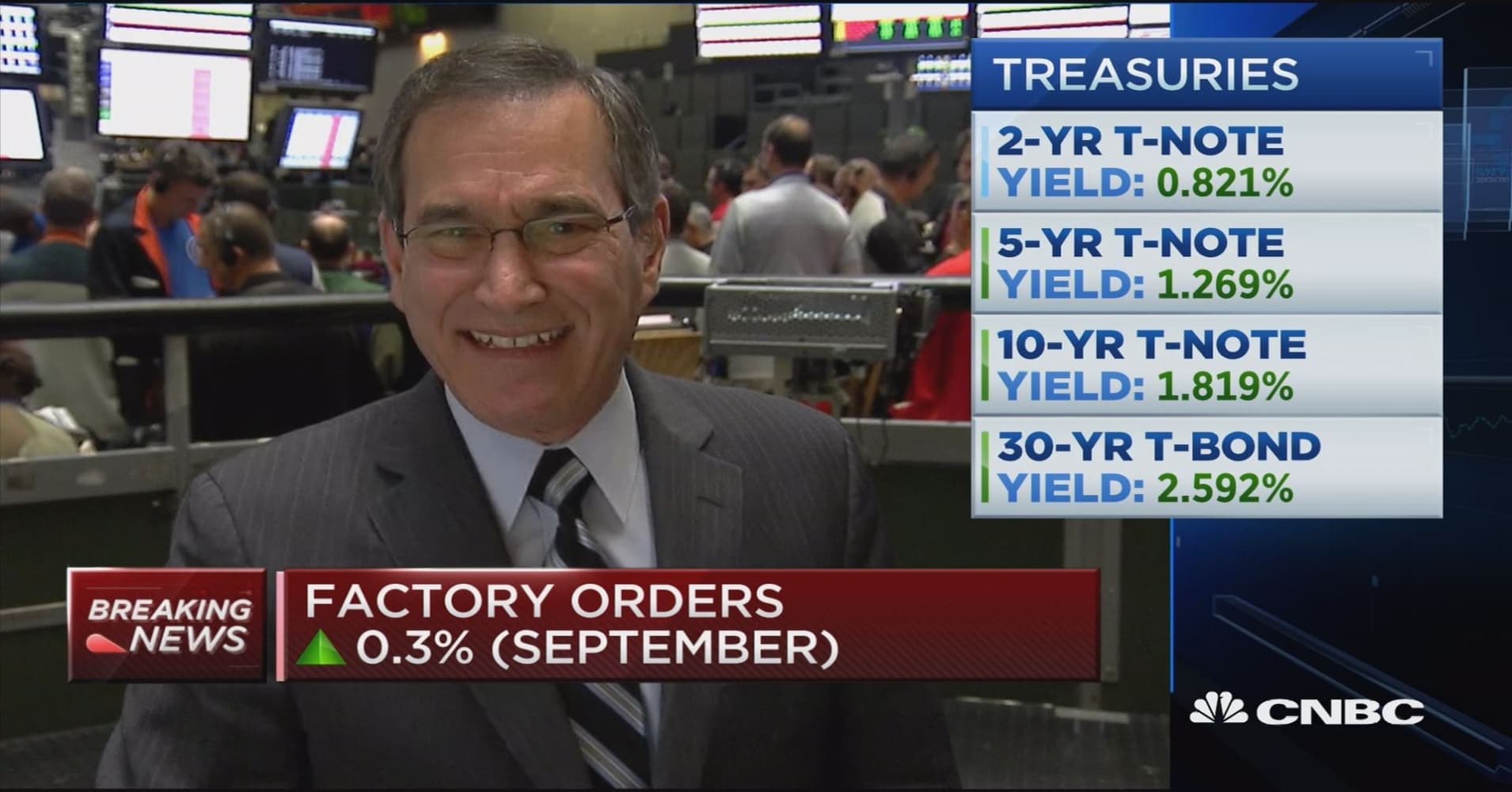

Mortgage Rates were slightly higher today, keeping them in line with the weakest levels in just over 5 months. "Weakness" is relative, however. Apart from the past 5 months, and a few months in 2012, today's rates would rank among all-time lows. Day-to-day movement hasn't been extreme for the past few days, with most lenders continuing to quote 3.625% on top tier conventional 30yr fixed scenarios, and merely making small adjustments to the upfront costs depending on market movement. Volatility could increase tomorrow, following the Employment Situation. This "jobs report" is the biggest piece of economic data that comes out on any given month in terms of its market-moving track record. Its typical potency is likely limited by the election and broader global concerns that will be addressed in

|

|