The housing inventory, or lack of it, dominates Freddie Mac's Outlook for April. The company's Economic and Housing Research team says the supply of for-sale houses, especially starter homes, is at its lowest level in over ten years. This has real implications for home sales in 2017 and, unless inventories improve, they see a decline from last year when sales were the best in a decade.

Between December 2016 and February of this year homes available for sale averaged an estimated 3.6-month supply, based on the current rate of absorption. This was the lowest supply since 2000. Last year there were 1.17 million housing starts and Freddie Mac estimates there will be 1.36 million this year. However, they also project a need for 1.7 million additional units just to meet the demand created by new household formation, second home demand, and to replace existing housing stock.

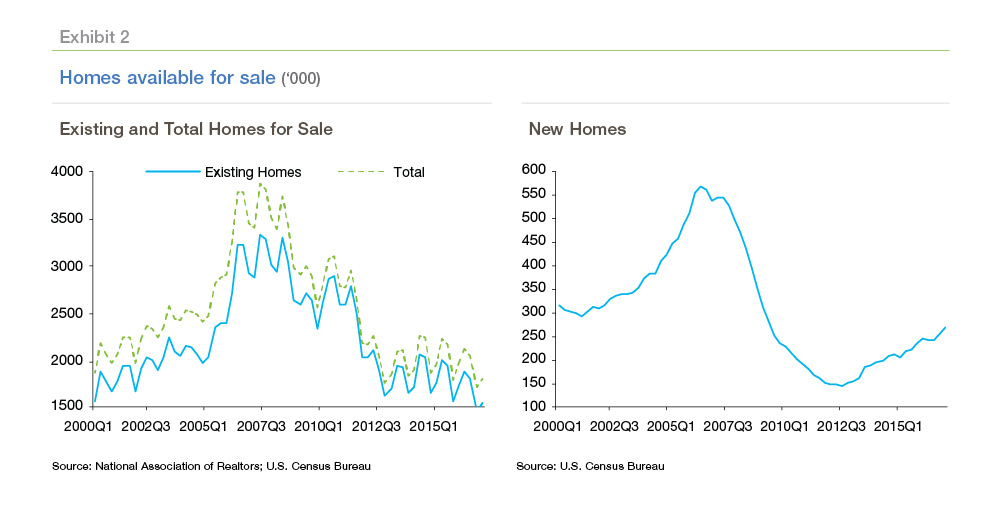

Average marketing time in February was 3.0 months, compared to a historical average of 5.3 months. This alone, the economists say, is not a cause for concern if it can be explained by an efficient market. However, the number of homes for sale, both new and existing is significantly below pre-crisis years. The historic average for combined inventory is 2.527 million units; in February, the number was 1.801 million.

Freddie Mac sees the inventory problem as circular. Many existing homeowners who might like to move to a better location or to a larger home are not doing so out of fear they won't find a home they want or need and can afford. That situation is aggravated by both interest rates and rising prices. In some cases, homeowners who bought at the pre-crisis peak have not fully recovered their equity to an extent that they have a downpayment on a new home. Because of these factors, homeowners are staying in their homes for longer periods than before the housing crisis.

Existing homeowners who are not selling their homes add to a problem already created by pent-up demand following the housing crisis and growing numbers of Millennials who are forming households. This problem is not unique, Freddie Mac says, to the strongest housing markets. Tight inventories are common in most areas across the country.

Decisions by existing homeowners will impact the housing inventory but also will affect home sales this year. Freddie Mac projects sales to decrease to 5.90 million in 2017. The spring homebuying season depends on whether those willing to list their homes do, and those looking to buy get lucky, find a home, and buy. That will be key to understanding how the market performs over the rest of the year.

Mortgage rates, which are an important factor in home buying, could also come into play. If inflation reaches its target rate and labor markets tighten further, mortgage rates will rise as projected. This will make it difficult for some homebuyers, who might not be able to afford the higher mortgage payments and therefore might be sidelined.

Freddie Mac sees other economic news falling in line with their projections. The labor market is continuing to strengthen, as the unemployment rate dropped to 4.5 percent in March-the lowest rate in nearly a decade, and inflation has gradually been ticking up since the start of the year. The Consumer Price Index (CPI) increased 0.1 percent in February and was at 2.7 percent year over year. Core-CPI (exclusive of food and energy components) increased 2.2 percent annually.

While full employment and rising inflation are signs of a strong economy, they also have the potential to push mortgage rates and house prices up. The higher rates and higher home prices (up 5.8 percent on an annual basis in January) create significant affordability concerns, which may continue to characterize the housing market for the rest of 2017.