The pain trade continued to play itself out in bonds as the week got started in overseas markets last night. General slowness and a "buyers wanted" environment ended up pushing the benchmark 10 year TSY note all the way up to our 2.85% sell-off target. However, after poking and prodding at the outer limits of our "SOUND THE ALARM BELLS" support level, yields have reversed course thanks to modest real money bargain buying.

HERE are my technical target

10s are now attempting to re-enter the originator friendly confines of the PANIC ZONE. The 2.625% coupon bearing 10 year TSY note is +0-09 at 98-26 yielding 2.763% (-3.3bps). It should be noted that volume is paltry and buyers are not being met with much resistance, therefore this modest recovery must be deemed as FRAGILE, at least until some volume gets behind the rebound.

2.75% will probably slow further positive progress...

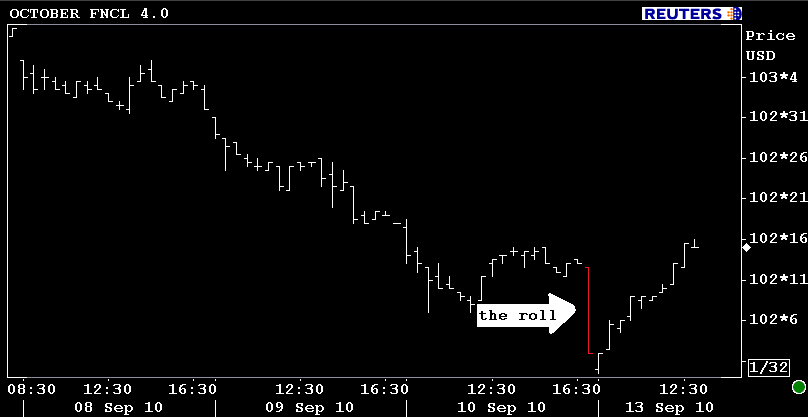

REMEMBER: The settlement calendar flipped forward on Friday. October delivery is now cash, we will likely roll forward to November in the next couple days. READ MORE

Rate sheet influential MBS coupon prices are playing follow the leader with Treasuries and trading higher. The October delivery FNCL 4.0 is +0-14 at 102-16 and the FNCL 4.5 is +0-10 at 104-07. Phew for now!

Loan pricing was mixed this morning. Reprices for the better have been reported in the last 20 minutes...

Again, don't get too comfy with this turnaround yet. The range has contained further loan pricing weakness but we've received no confirmation that it will last.