AHHHHHHH ALERT ALERT!!!

MBS PRICES ARE TANKING!!!!

HAHAHAHAAHA...sorry but I've been trying to squeeze that in for a long time now. The currently crappy rate environment seemed like the perfect time to remind you how mortgages trade. Too soon?

Today is Class A Notification Day in the Secondary Mortgage Market. Class A MBS coupons consist of Fannie Mae and Freddie Mac 30 year loan notes.

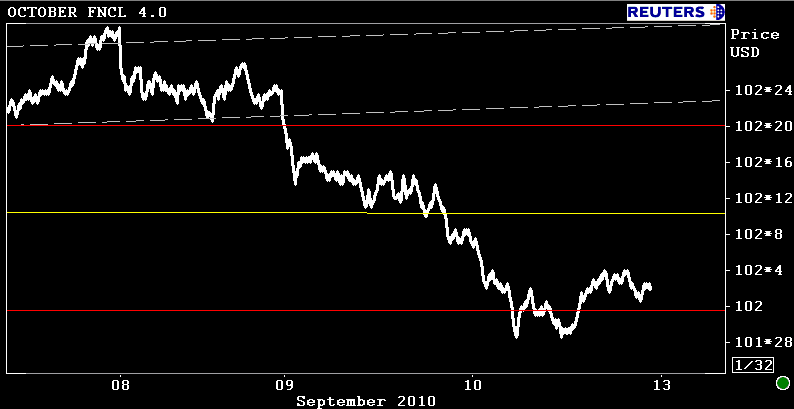

The September FN 4.0 MBS coupon has begun the settlement process and it looks like prices just plummeted.

WHY???

The MBS coupons that determine rate sheet

pricing are traded in the TBA MBS market. TBA = To be Announced

In the TBA MBS market, at the

time a trade is made, buyers and sellers agree to a few specific terms

like what coupon, the issuing agency (Fannie, Freddie, Ginnie), size of

trade, and a buy/sell price....the actual pools of loans are NOT

exchanged at the time of this commitment. Instead, the MBS buyer and the

seller make an agreement to complete the transaction at a later date.

In the MBS market this date is pre-determined; it is called SETTLEMENT

DAY (clever name huh?).

Agency MBS trading settles once a

month. Two

days before the pre-scheduled settlement date, the MBS seller

"notifies" the MBS buyer of the specific pools that they will deliver to

satisfy the previously agreed upon terms of the trade.

This

is Fannie Mae's guidance:

Forty-eight hours prior to

settlement, pool information must be communicated to the Capital Markets

Sales Desk's back office by phone (202-752-5384), facsimile

(202-752-3439), or via EPN transmission. Delivery of pool information

must take place by 3:00 p.m. eastern time. It is advisable that pool

information is communicated early as phone lines, fax machines, and the

EPN queues are extremely taxed as the 3:00 p.m. deadline approaches. If

the transmission does not occur by 3:00 p.m., one day's fail will be

incurred, despite the fact the information is residing in queue.

Then

the MBS buyer reviews the pool information to ensure the seller has

delivered loans that meet the agreed upon terms. 48 hours later, after

being deemed to within "Good Delivery" guidelines, pool purchase funds

are wired and the trade is complete (it goes deeper...this is the

outline).

BUT WHY DO PRICES SEEM TO FALL WHEN WE ROLL FROM

THE FRONT MONTH TO BACK MONTH COUPON?

Today the front month

is

the September delivery coupon and the back month is the October delivery coupon. On Monday, the front month delivery coupon will be the October coupons and

back month will be November delivery.

Prices

don't really "fall". We just start watching the back month MBS

coupon because the front month coupon has just begun the

settlement process. The back month coupon price remains the same!

Below

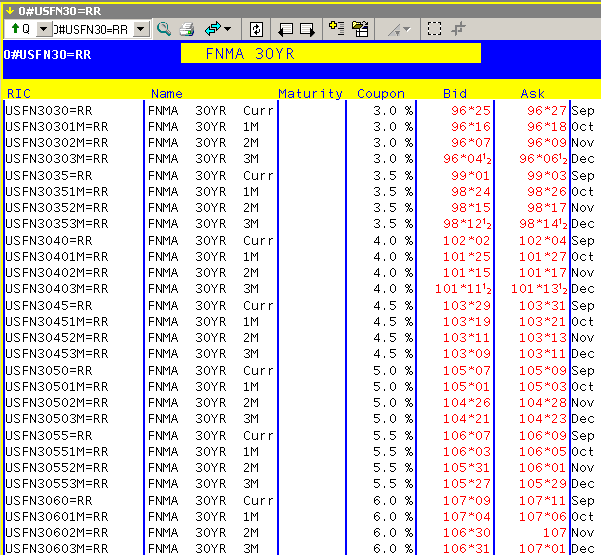

is the current October settlement FN 4.0 MBS coupon. It's bid at 102-02.

This is where prices seem to have fallen in the chart above...

(THIS IS THE COUPON WE'VE BEEN WATCHING ANYWAY. SEE WHY BELOW)

We can actually watch forward pricing as much as three months ahead. See.....

The main reason behind the price

"DROP" is the lost "time value of money".

Interest rates can be

thought of in three ways..

- Required Rate of Return: this is the minimum amount of return an investor is willing to receive when making an investment.

- Discount Rate: the rate used to determine the present value of future cash flows. When you loan someone money with the intention of being paid back in the future, you must place a value on how much of a premium you are losing by not spending that money right now. The discount rate is essentially how much you are charging to delay repayment until a future date.

- Opportunity Cost: the value an investor passes up when choosing an alternate investment. You must earn enough interest when you loan someone money to compensate for the loss of income that you could have been earning by investing elsewhere.

LET ME POSE A QUESTION: Would you rather have $1.00 today or

$1.00 tomorrow?

You would rather have $1.00 today! If you have

$1.00 today you can invest it today...the fact you are investing

today vs. tomorrow implies you are giving the asset more time to

appreciate, more time to accumulate interest earned (ACCRUE).

To

relate this concept to the MBS market---if you buy the September FN 4.0

coupon, then your returns will begin accruing on September 1. If you buy the October coupon---your returns don't start accruing until October 1. That means

you would have to wait 20 days (from today) for your money to start

working for

you. Investing now, before the roll, puts money to work now, or in

today's case, on September 1.

Starting tomorrow, because the September coupon has already entered into the

settlement process, MBS investors will have to wait until October 1 to see

their funds start working. To compensate for the lost Time Value of

Money, investors demand higher MBS yields. This lost time value of money

is discounted via a lower back month coupo price (in this case the October FN 4.0 coupon).

Note: to be clear, the previous owner

has

rights to the income (accrued interest) earned from while they owned the

coupon. The price you pay to purchase the back month coupon includes

the income the current owner has accrued while they owned the coupon.

The buyer recovers the added premium when the coupon payment is

deposited in their account. This is called the 'clean price'...it's the

same way Treasuries trade.

Plain

and Simple: If you own the September FN 4.0 MBS coupon, then you

are entitled to the coupon clips (income) paid in September. If you decided

to

wait and buy the October MBS coupon...then you have to wait until October for

your investment to start accruing interest. To compensate for the lost

"time value of money", investors demand higher yields, which is why

prices fall when delivery rolls from front month to back month. (not

including any profit earned from price movement)

This

explains why 60 and 90 day locks are more expensive. The longer the

lock commitment period, the more it costs the lender to hedge

interest-rate volatility and fall out risk.

HOW DOES THIS AFFECT LOAN PRICING?

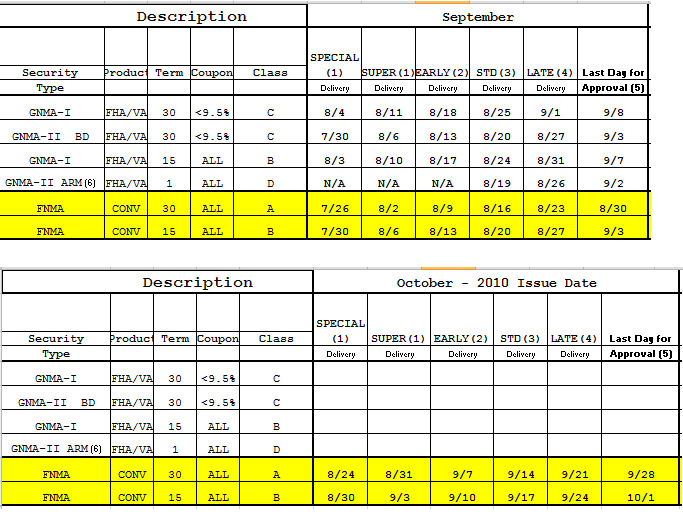

You won't notice the affects tomorrow. Lenders have been building loan pricing based on the October coupon for several weeks already, that's why I've been using the October delivery coupon since this time last month. Lenders must roll earlier because secondary desks are lower in the MBS supply chain and need to deliver their closed loans to investors with enough time to allow for post-closing/pre-purchase review.

Here is an example of a delivery schedule.

I'll probably roll forward to the November delivery Class A MBS coupon in the next few days. If your rate sheets reflect a roll cost on that day, I will let you know.

-------------------------------------

OK SO I GOT A GOOD LAUGH. I HOPE YOU DID TOO!!! NOW FOR SOME SERIOUS BUSINESS...

It was a bad week for mortgage rates and it might not even be over yet.

Although lenders were a bit rougher than needed with rate sheets over the past two days, the potential for rates to rise further is high. My technical targets have not been hit and momentum is shifting toward a rally for riskier assets (stocks). The bigger problem is: once duration starts to sell, it tends to snowball and you know what happens when rates selling snowballs! THINK BLACK WEDNESDAY

Plain and Simple: Floating in the short term is very risky. HERE are the technical targets I laid out last week. They still apply. If those support/resistance pivots are broken (good for stocks, bad for bonds), then we sound the alarm bells.

It's a trader's world...