Treasury just auctioned $21 billion 10 year notes. Auction demand was healthy thanks to one group of bidders specifically. The bond market has responded favorably in post auction trading.

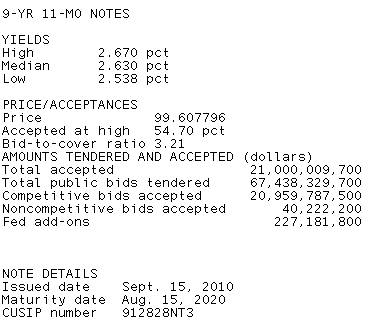

The high yield was 2.67%, which was 1.5 basis points below the 1pm "When Issued" yield, indicating bidding was aggressive, mostly because the market was able build in a big pre-auction concession.

The bid to cover ratio was 3.21 bids submitted for every 1 accepted by Treasury. This is the strongest btc ratio since the June auction.

Primary dealers took down 38.3% of the competitive bid and 18.1% of what they bid on, both metrics are below average. This implies someone else was standing at the ready to support supply offerings. That someone else was indirect bidders!

Indirects took home a whopping 54.7% of the issue!!! This is WAY ABOVE AVERAGE, signaling very strong demand for duration from overseas accounts, who likely viewed this auction as an opportunity to "buy in the dips".

Directs were awarded 6.9% of the issuance. Direct account participation has been fading lately and continued to do so today...but it didnt matter because indirects showed up in size.

Plain and Simple: the lack of trading flows ahead of issuance implied investors were willing to wait until the auction to "buy on the dips" (cover short positions). That they did, specifically indirect accounts. Although it is worrisome that direct participation fell again, alarm bells are not going off yet because indirects have been big buyers in the last five auctions, stealing the spotlight from directs. Demand for US debt from foreign central bankers remains strong, especially for higher yielding, longer maturity notes. I'm very curious to see how the long bond is treated tomorrow.

Market Reactions.....

Stocks have fully recovered from yesterday's sell off.

After consolidating Friday's gains during yesterday's trading session, the S&P has continued higher toward a test of post-NFP highs. The S&P is currently +10.25 at 1101.50. Trading volume and price action are reflective of short covering. Since touching and breaching the 1,100 pivot, flows have slowed considerably. 1106 is the next level of resistance for S&P futures.

The long end of the yield curve was getting beat up before the auction and still is but the pain has subsided a bit thanks to short covering during the auction. Both the 2s/10s and 2s/30s curves were 4bps steeper before issuance, they both flattened 2bps afterward. The long bond yield is up 5.1bps, the 10-year note is 4.7bps higher at 2.645%, and the 3-year note (that was just issued yesterday) is getting whacked (+6.6bps) as dealers attempt to distribute excess auction inventory.

10s are following my Fibonacci Fan lower. This pivot also happens to be the exact center of the PANIC ZONE....see charts HERE. Expect to see some chopatility in after auction trading as dealers attempt to cover their shorts as supply was stolen by indirects.

This is supportive of a post-auction rally! 2.636% is the first level of resistance...

Following a large uptick in prepay speeds on recent vintage MBS coupons in August, embedded call investors are now fully focused on protecting their portfolio from the unexpected return of principal investment. Negative convexity is no longer an illusion and traders must start treating duration with a little more respect!

Plain and Simple: prepayment speeds on 30 year 4.5 and 5.0 coupons were faster than forecast in August. This means cash flows on those coupons are not lasting as long as anticipated (because the borrower who backs the MBS coupon refinanced!). Thus interest earned on the investment is less than previously expected (yields are lower) and yield assumptions must be corrected. Consequently, production MBS coupon valuations (yield spreads) are moving wider vs. benchmarks as traders realize a certain portion of homeowners (qualified) are actually able to pull the trigger on their "in the money" refinance option. READ MORE.

READ MORE ABOUT PREPAY SPEEDS: It's all about how long coupon cash-flows last. Folks who refinanced in the last 20 months are finding themselves in the positions to refinance again. This cuts down the amount of time 30 year 4.5 and 5.0 MBS coupon are paying interest...which reduces investment return.

October FNCL 4.0s found support at a key level of support and have since reversed course, rate sheet influential prices are now heading higher. The October delivery FNCL 4.0 is -0-05 at 102-26. MBS need TSYs to extend their post-auction rally if today's price weakness is to be totally recouped before the end of the session.

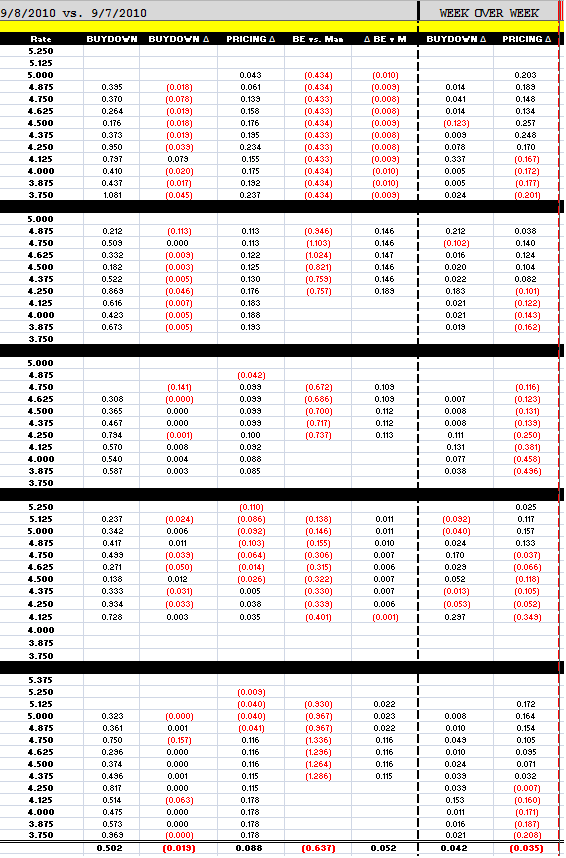

Loan pricing is 8.8bps better vs. offers yesterday morning. The pricing below is from yesterday morning so it does not reflect reprices for the better, most of which were awarded by the mid-majors, not the lenders I watch who improved rebate signficantly on first released and did not need to reprice for the better.

Lenders are not likely to recall rate sheets at the moment but I will alert if the post-auction rally intensifies.

The Federal Reserve will release the Beige Book at 2pm. This event will determine our fate for the rest of the day.