Good Morning. I hope everyone had a safe and sound Labor Day weekend. I for one feel re-energized following a three day stay in State College, PA (PSU). The weather was perfect, we blew out Youngstown State, and I escaped the bike trails unscathed. Mission accomplished! Welcome back to reality...

The bond market ended last week in a panic after a better than expected Employment Situation Report added enthusiasm to a two-day S&P rally. With the econ calendar essentially empty and Treasury (and Corporate) debt supply on the chopping block in the week ahead, the stage was set for stocks to extend optimism and push rates higher.

That isn't happening today...

Instead, short covering combined with a modest "flight to safety" bid in a thinly traded marketplace has helped the long end of the yield curve recover a large portion of the post-NFP sell off. After falling 24 ticks (24/32) on Friday, the 10-year note is currently +0-19 at 99-26 yielding 2.645%.

10s made an aggressive move toward 2.645% in the overnight session, where yields have since stalled. The formation on the chart below is a Continuation Pattern. This formation implies yield levels will eventually release stored energy and move sharply higher, away from resistance, which failed to be broken on several attempts by the market. Again, this rally has occurred in VERY light trading volume.

This makes me laugh because 2.645% is directly in the center of the "PANIC ZONE" range. This is exactly where 10s traveled on August 27...the last big sell-off we experienced.

The benchmark yield curve's retracement has been a positive event for mortgage-backed securities prices and mortgage rates.

Led by the production coupon side of the stack, MBS price levels are higher. The October FNCL 4.0 is +0-11 at 102-25 and the FNCL 4.5 is +0-07 at 104-15. MBS are however being outperformed by benchmark guidance givers. Using my CPR assumptions, the FNCL 4.0 trading +95.3bps/10yrTSYs, +99.4bps/10yrIRS, and +216bps/5yrTSY. I am running 4.0s at a 6 CPR and 4.5s at 11. We find out later today if those assumptions were accurate...

The FNCL 4.0 is banging its head against the first wave of internal trendline resistance at 102-25.

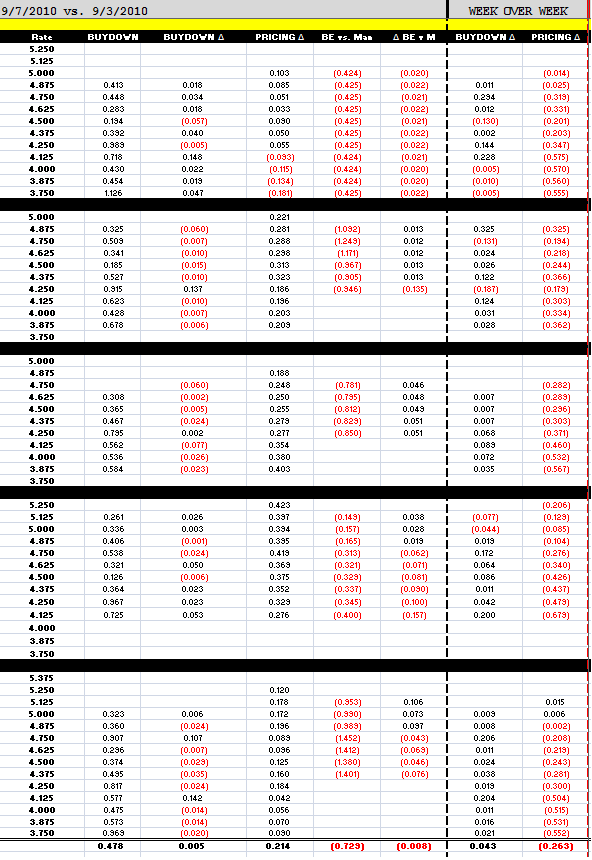

Loan pricing is 21.4bps better on average vs. Friday but still 26.3bps worse on a week over week basis.

This interest rate relief rally was made possible by two bearish headlines on the banking sector.

- Stress Tests Missed Debt at EU Lenders (WSJ): Europe's recent "stress tests" of the strength of major banks understated some lenders' holdings of potentially risky government debt, a Wall Street Journal analysis shows.

- Citi under Fire Over Deferred Tax Assets (FT): Citigroup is at the centre of a dispute among analysts and accounting experts over whether it should set aside funds to cover $50bn of deferred taxes, a move that would reduce its capital buffer and weaken its balance sheet

Although inaccurate EU Stress Test results are a surprise to no one, these headlines explain why S&P Financials are the weakest link. S&P futures are just above their session lows, -9.00 at 1094.25.

You've earned back much of what you lost on Friday, but with Treasury supply in the long end of the curve still ahead, I would remain defensive of rebate improvements until 10s break 2.645% resistance and stocks confirm the move with a sizable retracement and uptick in volume.

Treasury will release the results of the 3-year note auction at 1pm.